Billions of Barrels of Oil Vanish in a Puff of Accounting Smoke

(Bloomberg) In an instant, Chesapeake Energy Corp. will erase the equivalent of 1.1 billion barrels of oil from its books.

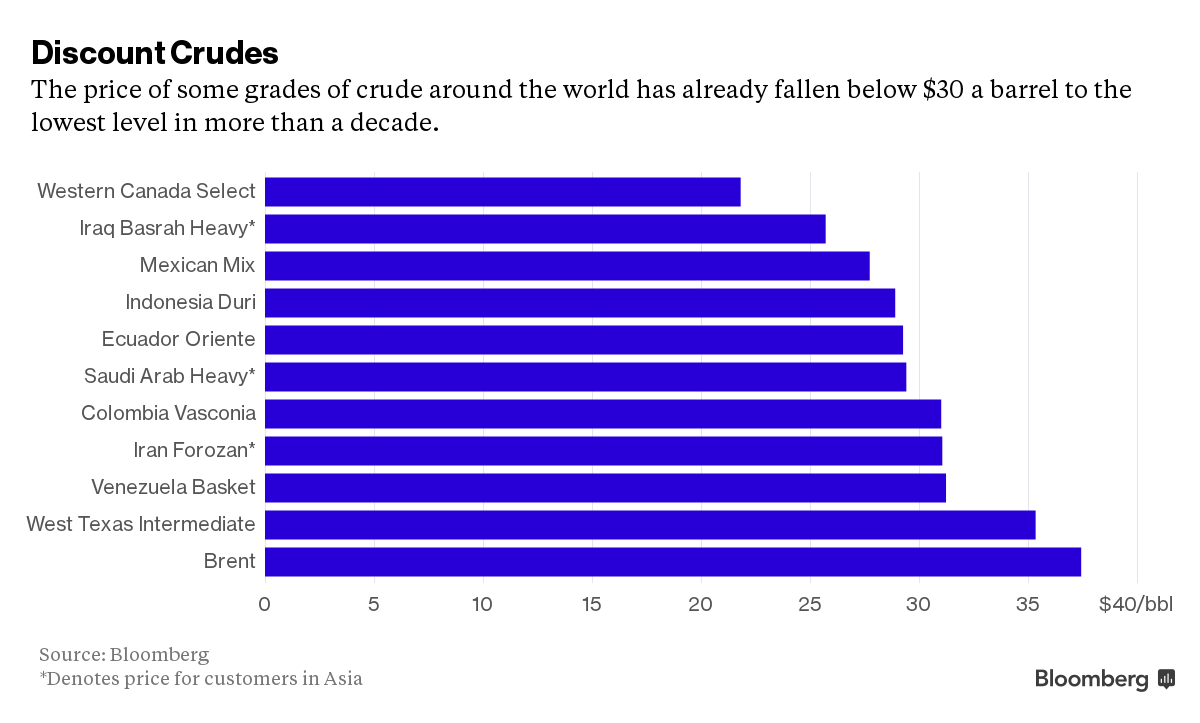

Across the American shale patch, companies are being forced to square their reported oil reserves with hard economic reality. After lobbying for rules that let them claim their vast underground potential at the start of the boom, they must now acknowledge what their investors already know: many prospective wells would lose money with oil hovering below $40 a barrel.