Oil Slump Sets Scene for Mergers

(Wall Street Journal) Here’s how bad things are getting in the oil patch: In some cases it is now cheaper for energy companies to buy one another rather than drill for crude.

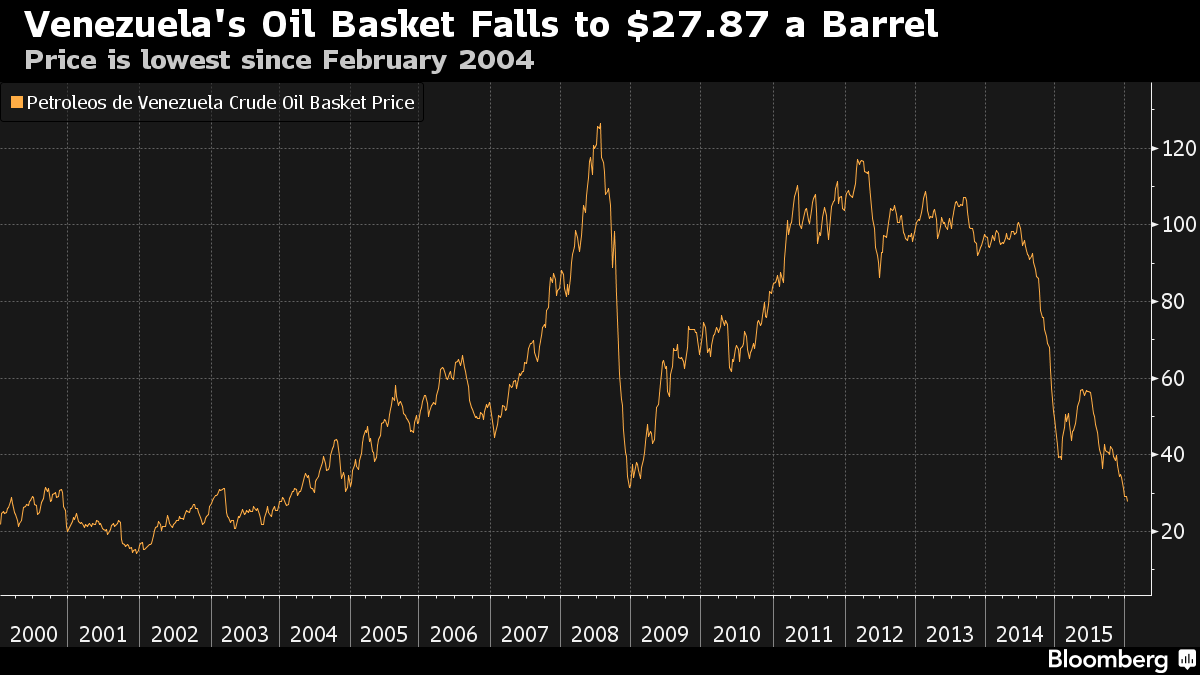

A year-and-a-half on from the start of the worst crude-oil price crash in a generation, the biggest U.S. and European energy companies have delayed projects and made such deep budget cuts that they will soon struggle to replace the oil they pump out of the ground with new reserves.