Editors: Tom Whipple, Steve Andrews

Quotes of the Week

[Shortage of heavy oil due to US sanctions on Venezuela, production declines in Mexico and transportation bottlenecks in Canada:] “That’s a big structural problem that’s not going to go away anytime soon. We’ve got this mismatch in the country. We’ve got refineries that want heavy oil and producers that make light oil.”

Jennifer Rowland, analyst with Edward Jones

“These extreme phenomena [floods and droughts] are here to stay. And with the risk implied by climate change, I think Panama should do more because its economy depends so much on the proper working of the canal.”

Gustavo Alanis, head of Cemda, a Latin American environmental group

Graphic of the Week

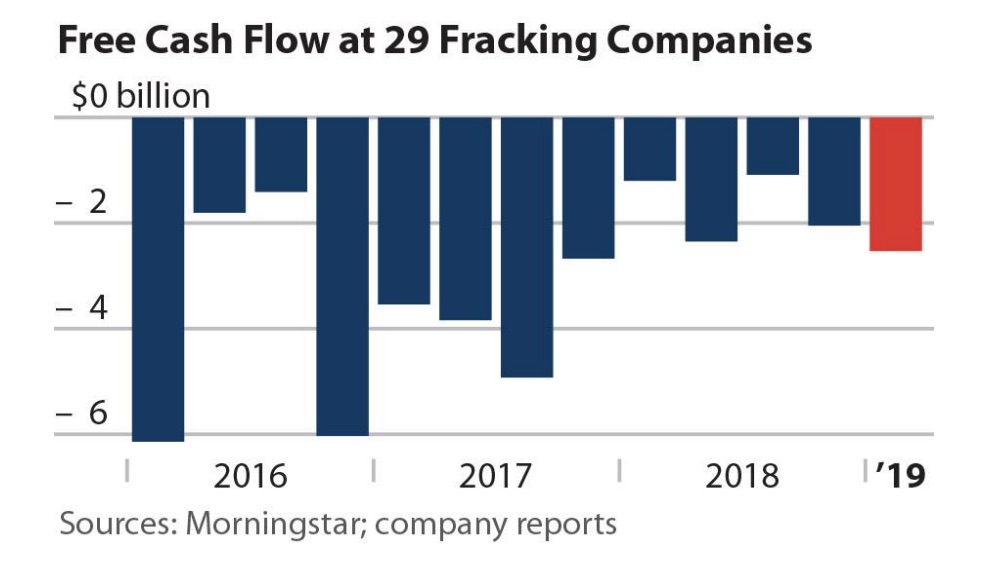

| Contents 1. Oil and the Global Economy 2. The Middle East & North Africa 3. China 4. Russia 5. Venezuela 6. Mexico 7. The Briefs 1. Oil and the Global Economy US oil prices sank into bear market territory on Wednesday, falling more than 20 percent below the April peak. Traders were concerned that a 6.8-million-barrel build in US crude stocks indicated lower prices ahead. The markets rebounded on Thursday and Friday on news that a settlement in the Mexican border dispute was in the offing and that the OPEC+ production cut was likely to be extended for six months. London futures closed at $63.29 and New York at $53.99. London, however, is trading about $10 below where it was in the middle of May. As has been the case for months, the markets are caught between sagging economic growth, which would hurt demand, and production outages in Venezuela, Iran, and potentially in Libya. There are numerous signs that the world economy is moving towards recession. Besides the potential damage of a prolonged US-China trade war, factory output has been slowing in China, the US, and the EU. Long-term interest rates as evidenced by government bond markets and inflation have fallen steeply. US Treasury yields have fallen 50 basis points in the last seven weeks, while German 10-year bond yields are at record lows. In Japan, Britain, Switzerland, and France, borrowing costs are at their lowest since 2016. US job growth slowed sharply in May and wages rose less than expected. Flooding in the US’s corn belt seems likely to do serious harm to US agricultural production this year. The OPEC+ Production Cut: The cartel’s market share in North America fell last year, with shipments declining by 406,000 b/d or 12.6 percent to just over 2.81 million b/d as US shale output replaces grades of imported crude. Saudi Arabia and Russia are in disagreement about how to respond to the recent fall in oil prices. Their energy ministers are set to meet in Russia on June 10th to build a consensus ahead of a meeting of the OPEC members with other OPEC+ coalition members. Arguments seem to be taking place as to whether the meeting date should be moved to July 2nd-4th from the scheduled June 24th-25th. Russia is proposing the move, while Iran is vehemently opposing the change. On Friday, Saudi energy minister Khalid al-Falih said OPEC is ready to commit to an extension of its oil production cuts beyond June. However, non-OPEC partners, led by Russia, could have their quotas increased as part of a compromise. Moscow and OPEC have divergent views on a “fair price” for oil. Russia is comfortable with an oil price in the range of $60-$65 per barrel, given that the Russian budget is built on a $40 per barrel price assumption. Moscow fears that increasing US shale oil production will continue to erode its export markets. However, the IMF says that Saudi Arabia’s fiscal breakeven oil price this year is $85.40 per barrel, with the average for OPEC’s Middle Eastern members at $82.40. With oil trading around $62 barrel, the Gulf Arabs do not want to see prices fall further. US Shale Oil Production: Government and outside energy consultants remain optimistic that US oil production will increase by over 1 million b/d this year. Rystad Energy is raising its forecast for US crude output to 13.4 million b/d by this December. In May 2019, the firm said that US crude oil production will average 12.5 million b/d. The last verified US production number was 11.9 million b/d in March so Rystad is expecting US production to increase by 1.5 million b/d during the last nine months of this year. The head of oil market research at Rystad says preliminary (estimated) US data shows that tight oil production alone reached pre-winter levels of around 8.5 million b/d in May. However, the final production numbers for May, which will not be available until the end of July, have been running behind preliminary estimates lately. Given that oil prices have fallen by circa $20 a barrel in the last two months; the global economy seems to be slowing; the China-US trade war shows no signs of subsiding; and 90 percent of the small and medium shale oil drillers lost money in the first quarter when oil prices were higher; we may not see the increase in shale oil production in the next six months that optimists are predicting. A survey of 29 oil and gas companies that focus on shale oil reported more than $2.5 billion in negative free cash flows (i.e., lost money) in the first quarter of 2019. These results were even worse than in the fourth quarter of 2018 when the same group of fracking-focused firms suffered $2.1 billion in negative cash flows. This dismal cash flow performance came despite a 16 percent quarter-over-quarter decline in capital expenditures. From 2010 through early 2019, the companies booked aggregate negative cash flows of $184 billion. Since 2015, 174 North American oil and gas producers have filed for bankruptcy protection, restructuring nearly $100 billion in debt, mostly through write-offs. Oil and gas bankruptcies have continued in 2019. At least eight oil and gas producers have filed for bankruptcy since January, restructuring more than $3 billion of debt. The oilfield services sector, which relies heavily on the fracking industry for revenues, has gone through nearly 180 bankruptcies involving more than $64 billion in debt since 2015. The oil-field services sector is in the tough position of being the first to get hurt when oil prices plunge and the last to profit when a recovery finally happens. Last week Weatherford International announced that it plans to file for Chapter 11 bankruptcy protection. Weatherford is a diversified company with customers in nearly every significant business sector across the oil and gas industry. It plans to restructure its $7.6 billion in long-term debt. As financing from Wall Street dries up, shale oil drillers are turning to asset sales, drilling partnerships and alternative funding to supplement their cash flow. These forms of funding often come with higher interest rates or carry other downsides, such as giving outside investors a hefty share of future oil and gas production. EIA data last week showed a crude supply adjustment factor — the difference between reported stockpiles and those implied by production, refinery demand, imports, and exports — of more than 800,000 b/d. These adjustments now have added up to more than 24 million barrels over the past four weeks. Popular guesses for the discrepancy include missing production from the boom in the Permian Basin, miscounting of imports or exports, or the failure to account for natural gas condensate which ends up in oil stocks. The analysts added that May balances implied robust production, which means U.S oil output may be even higher than the 12.4 million b/d record in last week’s data. Reuters reports that the oil currently produced in the Permian basin is increasingly too light in density for domestic refiners or for foreign buyers. Over the past year, production from the Permian has changed, with more super-light oil coming from the ground, as producers increase drilling in the western part of the basin. This geological phenomenon could have serious implications for the future of shale oil production which is increasingly being concentrated in the Permian Basin. As volumes of lighter shale oil increase and heavy crude supplies shrink, refiners are grappling with the mismatch in the density of oil they require and what the country produces, traders said. US refineries, which are designed to process mostly heavier and medium crudes, are struggling to blend the lighter oil efficiently, market sources said. The problem has grown more acute this year with heavier crude in short supply after US sanctions on Venezuela, production declines in Mexico, and transportation bottlenecks in Canada. The export market for super-light oil is limited because there are only a few refineries designed to handle light crude in Europe. Some Asian petrochemical plants can process very light crude. The rate of flaring in the Permian basin reached a record high in the first three months of this year, averaging 661 million cubic feet per day. That is more than double the amount of flaring for the same period from a year earlier. The flaring situation is not that much better in North Dakota where Bakken shale drillers flared and vented about 500 million cubic feet per day in the first quarter. Together, the shale industry in the Permian and the Bakken flared or vented 1.15 billion cubic feet per day in the first quarter. That represents 12 billion cubic meters of wasted gas per year, which exceeds the yearly gas demand of nations such as Israel, Colombia, and Romania, Rystad Energy concluded. Texas drillers are experimenting with injecting highly-pressurized natural gas into past-their-prime wells that have seen their output slip. The wells are then capped to build up pressure inside to dislodge any oil still in the rock. The methodology’s been used in conventional wells with both natural gas and carbon dioxide for years, but it’s just now being tried in America’s fracked shale oil fields. According to one firm there’s a 30-to-70 percent gain in oil output from older wells. “If widely adopted, we expect it could utilize 25 percent of the associated gas produced,” said Ramanan Krishnamoorti, the chief energy officer at the University of Houston. |

2. The Middle East & North Africa

Iran: Rosneft CEO Igor Sechin said Thursday that Iran’s oil output might fall by a further 10-20 percent by the end of 2020, as US sanctions continue to slow production. “As a result of the sanctions, production in Iran fell last year by 33% to 2.6 million b/d and by the end of next year it may fall 2.2 million b/d.” According to the latest S&P Global Platts survey, Iran pumped 2.57 million b/d in April, a 120,000 b/d drop from March and the lowest since December 1988.

Given the focus of US sanctions on Iran’s oil sector, Tehran is concentrating its significant petrochemicals capabilities to generate export revenues. The Iranians believe that foreign companies – particularly those in Europe – are more likely to defy the US over the purchase of petrochemicals than crude oil.

A fire broke out at Iran’s largest container shipping port, setting off explosions as oil products stored at the port fed the blaze. Shahid Rajaee port is on Iran’s Gulf Coast just north of the Strait of Hormuz. The port is critical for Iran, handling 39 percent of all cargo as of 2017, including oil product shipments.

Tehran’s military posturing continued last week with a top military aide to Iran’s Supreme Leader Ayatollah Ali Khamenei warning any clash between the two countries would push oil prices above $100 a barrel. He also warned for the umpteenth time that US military vessels in the Gulf are within range of Iranian missiles.

Iraq: Demonstrations targeted Basra oil installations last week, echoing last summer’s protest movement and highlighting the potential for more unrest as temperatures rise. So far, the protests have been small and quickly dispersed, but they also serve as a warning sign for a new government that needs to address long-standing grievances over poor services such as inadequate water and electricity supplies. In recent years, the Basra region has been exposed to humidex (feels like) numbers of 140o-160o during the summer months.

Baghdad moved swiftly when the US re-imposed sanctions against Iran, ordering its Oil Ministry to make up part of Tehran’s lost exports by increasing its targets for crude oil production to 6.2 million b/d by end-2020 and 9 million by end-2023. However, these targets include oil from the semi-autonomous region of Kurdistan. The Kurds also control the pipeline that enables Iraq to export oil to Europe via the Turkish port of Ceyhan. All of this is under threat over a row involving budget payments from the FGI to the KRG in exchange for Kurdistan’s cooperation on oil transfers and exports.

Baghdad and Erbil have been locked in a dispute for many years over the distribution of oil revenues. Russia’s involvement in the dispute has complicated the situation. Rosneft has now effectively taken over the ownership of Kurdistan’s export oil and gas pipelines, as part of an agreement to provide it with over US$2.1 billion in prepayment deals under the long-term supply contract, and is demanding substantial transit fees for Iraqi oil flowing through the pipe to Ceyhan. This situation has a long way to play out.

Saudi Arabia: Most of the news from Riyadh last week had to do with the Saudi’s negotiations with Moscow over the fate of the OPEC+ production cut. Oil prices are still at least $20 a barrel below what the Saudi’s need to balance their budget, which means they are again drawing on reserves to keep the government and their foreign adventures running.

Russia and Saudi Arabia are holding talks about investments worth tens of billions of dollars in various energy projects, Russia’s Energy Minister Novak said at an economic forum in Russia on Friday. The two countries are planning projects in petrochemicals, liquefied natural gas, and joint research centers in Russia. The Russia-Saudi partnership is evolving, including with the cooperation between the Russian Direct Investment Fund (RDIF) and the Saudi Arabian sovereign wealth fund, which have invested around US$2 billion in joint projects. Gazprom, Gazprom Neft, Transneft, and other Russian companies are interested in cooperation with Saudi firms, Novak said.

Saudi Aramco, on the other hand, has long been rumored to be considering buying a stake in the Arctic LNG 2 project led by Russian gas company Novatek. In March, Novatek’s CEO Mikhelson told Russia media that the firm was ready to consider selling up to 30 percent in the Arctic LNG 2 project to Aramco. The final investment decision on the Arctic LNG 2 project is expected to be made in the second half of 2019, while the first liquefaction train is planned to start up in 2023.

Libya: With General Haftar’s offensive stalled on the outskirts of Tripoli, President Trump’s fleeting enthusiasm for Haftar has waned, and the lead on Libya policy has been handed back to the State Department. Secretary of State Pompeo has been consulting Libya experts in the past two weeks and is considering a range of options, including a US-enforced ceasefire. European governments would like to see the US play an active role in persuading Haftar to pull back from Tripoli and enter ceasefire talks. Any US military involvement, however, would likely be resisted by Trump, who wants to keep the US out of any further foreign military entanglements.

There have been no reports on any change in Libyan oil production which presumably is on the order of 1 million b/d.

3. China

Chinese oil imports have risen rapidly during the past decade. The country has more than 300 million registered vehicles running on diesel and gasoline, along with expanding air travel. Oil has become inseparable from economic activity and is essential to satisfying the consumer needs of China’s growing middle class. China is regularly importing more than 9 million b/d of oil and a rapidly increasing amount of natural gas. As its domestic oil production shrinks, the country is becoming more and more vulnerable to the welfare of its suppliers.

Some 44 percent of China’s oil imports come from the Middle East and, next to Iran, China would be the biggest loser should hostilities break out in the region. To avoid oil and gas shortages brought about by outside forces, Beijing is forging alliances with most of the world’s oil producers to ensure supply. Over the last decade, Russia and China have significantly increased their energy links, with Russia ramping up supplies of crude and gas, and attracting Chinese investment into new energy projects.

Last week, Russia’s Novatek announced that it had signed a deal with Sinopec to market LNG and gas to end users in China. Novatek operates the 16.5 million ton/year Yamal LNG plant in northern Russia, which has China’s CNPC (20 percent) and Silk Road Fund (9.9 percent) as shareholders. The firm is also partnering with CNPC and China’s CNOOC in developing the massive 19.8 million mt/year Arctic LNG 2 facility, with both Chinese companies holding 10% stakes in the project.

Global gas demand is set to increase by 1.6 percent annually to 2024 to reach some 4.33 trillion cubic meters. This demand will be driven by surging consumption in the Asia-Pacific region, and particularly China.

China announced last March that it was going to spin off the pipeline operating assets of the large state-owned oil and gas companies and create a separate entity dedicated solely to pipelines. The announcement was welcomed by the local energy industry and should also be welcomed by foreign oil and particularly gas producers who will have better access to the Chinese market.

President Trump threatened to hit China with “at least” another $300 billion of tariffs last week but said he thought both China and Mexico wanted to make deals in their trade disputes with the US. “Our talks with China, a lot of interesting things are happening. We’ll see what happens. I could go up another at least $300 billion, and I’ll do that at the right time,” Trump told reporters on Thursday, without specifying which goods would be affected.

4. Russia

Russia’s average daily oil output has dropped to a three-year-low after contaminated crude clogged its main Druzhba export pipeline to Europe. Average oil output was 10.87 million b/d on June 1-3, down from an average of 11.11 million b/d in March. Exports via the Druzhba pipeline’s southern route have resumed, but the northern branch that supplies Poland and Germany remains shut. A full clean-up of pipeline systems will take months, according to official estimates. Moscow and the affected European oil refineries have reported only sparsely and misleadingly about the pipeline disaster that has sent customers scrambling for alternative supplies and led to refinery outages.

Russia is Germany’s largest oil supplier, and the interruption in oil supplies has already led to shortages of heating oil in eastern Germany. The situation could become an existential crisis for some dealers, the oil industry association in Saxony warned last week. Fuel prices in several eastern German cities have seen a rapid rise over the past couple of weeks. Transneft said on June 3 that deliveries of “clean” oil to Poland could resume by June 8 or 9. However, a report published by the state news agency TASS doesn’t mention the de facto ultimatum from Warsaw on the contaminated oil situation. The Polish foreign ministry said on May 31st that the transit of Russian oil would only be allowed after Moscow compensates customers in Poland and Germany for the damage caused and for the clean-up of the contaminated crude.

The World Bank reduced its economic growth outlook for Russia for this year because of lower crude oil production. According to the bank, Russia’s gross domestic product will only grow by 1.2 percent, which is a downward revision from a previous 1.5 percent. In 2020, GDP growth should rebound to 1.8 percent, and that this rate of growth will remain unchanged in 2021 as well.

Russia’s largest oil producer Rosneft is in talks with the government for possible compensation for losses in case OPEC and its Russia-led non-OPEC partners decide to extend the production cut deal through the end of the year, Rosneft’s chief executive Igor Sechin said last week.

Russia seems to be entering a new stage of sanctions adaptation, building on its growing technological capabilities in energy, as well as access to alternative sources of financing to become less dependent on cooperation deals with Western companies. The collapse of two major deals between Russian and western oil companies in 2019 may indicate that Moscow is now looking to reduce its exposure to Western financing and technology as it braces itself for expected tougher sanctions. However, several European oil companies, including Shell and OMV, signed new cooperation deals with Russian energy companies during the St. Petersburg International Economic Forum last week. This willingness to sign new contracts with Russia indicates some EU oil companies are willing to make investments despite risks of potential new sanctions.

5. Venezuela

Caracas’s oil exports fell 17 percent in May to 874,500 b/d as PDVSA shut down its crude oil upgraders that convert very heavy Orinoco crude into refinable oil. However, PDVSA still managed to ship 33 crude and fuel cargoes last month, most of which went to India and China. Now that the upgraders have stopped operations, some of the oil shipped in May probably came from inventories at export terminals.

Gasoline shortages have been affecting Venezuela for the last two or three weeks, with waits lasting hours and, in some remote areas, a day or two to refill the gas tank. The army and the militias control many gas stations and are collecting bribes for better places in the gas lines. This shortage threatens to completely paralyze the country, hitting deeper than the oil strike of 2002. With hyperinflation and a freeze on gas prices, a gallon of gas is now selling for US $0.000000039 which most observers are calling “free.”

The US Department of Justice is seeking documents from Citgo as part of an investigation into bribery by US suppliers seeking contracts with PDVSA. Citgo confirmed the receipt of a subpoena and on Monday agreed to cooperate with the US probe.

6. Mexico

The United States and Mexico struck a deal on Friday to avert a tariff war, with Mexico agreeing to rapidly expand an asylum program and deploy security forces to stem the flow of Central American migrants. President Trump rescinded his threat to impose 5 percent import tariffs on all Mexican goods starting on Monday if Mexico did not commit to doing more to tighten its borders. US refiners warned the Trump administration that tariffs on imports from Mexico could deliver a punishing blow to the industry and raise the cost of gasoline just as the US driving season kicks into high gear. The loss of heavy oil from Venezuela and Iran, as well as problems importing tar sands heavy crude from Canada, is becoming a problem for US refiners. Tariffs on Mexican oil would not have helped the situation.

The bonds of Mexican state oil company Pemex took a beating on Friday as investors fretted over chances that Moody’s rating agency could soon follow Fitch in downgrading the debt to “junk.” Two negative ratings would likely trigger a sell-off. On Thursday, Fitch cut the credit rating of Pemex from investment grade to speculative grade, or “junk,” with a negative outlook, a day after it downgraded Mexico’s sovereign debt.

Mexico typically buys as much as $1 billion worth of financial positions to protect its revenues from oil sales for the coming year against price fluctuation. It is the most widely anticipated hedging deal in oil markets and can make or break an investment bank’s profits. However, the Mexican government, under new President Lopez Obrador, has been slower than usual to start testing the waters for its first round of hedging due to volatile oil prices, trade tensions and new rules for marine fuel usage.

7. The Briefs (date of the article in the Peak Oil News is in parentheses)

European gas production — including Norway — is set to fall by 3.5 percent a year to just 202 Bcm by 2024, the IEA said Friday, a drop of some 48 Bcm from last year’s levels. The expected decline in European production was mainly due to the accelerated output fall at the giant Groningen field in the Netherlands plus declines in the North Sea. (6/7)

Europe saved $8 billion on its natural gas bill last year because surging US shale production and a shake-up in EU energy markets forced Russia to change its gas pricing mechanism, the head of the International Energy Agency said on Friday. (6/7)

Anglo-Dutch Shell expects the global LNG market to grow by 4 percent a year to 2035 and the company plans to “grow with it,” maintaining its leading position in the market, CEO Ben van Beurden said Tuesday. He reports the company’s LNG supply portfolio had a 22% share of global LNG sales in 2018. (6/5)

Royal Dutch Shell is building a business with the potential to return US$125 billion or more in the form of dividends and share buybacks to shareholders between 2021 and the end of 2025, compared to US$52 billion in distributions to shareholders between 2011 and 2015, and to expected shareholder distributions of around US$90 billion in the period 2016-2020. (6/5)

Shell announced higher, longer-term capital spending and cash flow targets for the coming years Tuesday, as the oil major looks to underpin growth by further developing its gas-rich upstream portfolio and emerging power sector business. Updating its strategy, Shell said it plans to invest, on average, $30 billion of cash capex a year over 2021-2025. (6/4)

The giant Kashagan oil field in Kazakhstan hit a record-high oil production of 400,000 bpd on Tuesday, a few weeks after returning from planned maintenance. In recent months, crude oil production at Kashagan, which started in 2016, has been more than 300,000 bpd. Kashagan has reserves of 13 billion barrels of crude and in-place resources of as much as 38 billion barrels. (6/6)

Cameroon has increased troops around its lone oil refinery after a weekend explosion caused a shutdown of the facility. But the government denies separatist fighters were responsible and says there will be no shortages of petroleum products. (6/5)

Colombia’s top administrative court on Friday began hearings that could be long and contentious about proposals to drill for oil using the technique known as fracking, hailed for sharply boosting supplies but criticized for causing environmental damage. Fracking is not yet in use in Colombia. While there is no law against the practice, the government says regulations are needed before it can be used. (6/8)

Canadian oil sands production is set to enter a period of slower annual production growth compared to previous years. Nevertheless, total production is expected to reach nearly four million barrels per day by 2030—almost one million more than today, according to a new 10-year production forecast by business information provider IHS Markit. (6/7)

The US oil rig count declined by 11 to 789, compared to 862 oil rigs working last year at this time, according to GE’s Baker Hughes. The number of gas rigs increased by two to reach 186, down from 198 year-over-year. Canada’s overall rig count increased by 18. Canada’s oil rigs are still down by ten year on year, with gas rigs up 1 year on year. (6/8)

The US Gulf Coast saw its crude oil imports in March at their lowest level since 1986, as rising domestic production and falling imports from OPEC including Venezuela have started to fundamentally change how the Gulf Coast is supplied with crude. Recent events and longer-term trends have been changing the crude oil supply of the Gulf Coast, leading to lower imports. These factors include this year’s US sanctions on imports from Venezuela and higher than usual refinery maintenance in the early months of 2019. (6/7)

Heavy crude demand: As many as six Very Large Crude Carriers are loading and due to load crude oil for export at the Louisiana Offshore Oil Port, Reuters reports, citing unnamed sources in the know. The cargoes will be all medium sour grades, which have become increasingly popular among refiners. The reason heavier grades are becoming increasingly popular is a shortage of heavy crude on global markets caused by falling production in sanction-bound Venezuela and Iran. (6/5)

America’s largest oil hub, in Cushing, Oklahoma, is growing even as producers and traders look to move surging West Texas production to the coast for export. The US petroleum industry is planning to build about 4.8 million barrels of storage capacity and as many as seven new pipelines to move oil to and from the hub. (6/6)

“Beyond Carbon” funded: Former New York City mayor and climate change crusader Michael Bloomberg announced Friday he is giving $500 million to a campaign to finish killing coal and start killing oil and gas. “The largest coordinated campaign to tackle climate change” ever to occur in the U.S., Bloomberg says, aims to close all of the nation’s coal plants by 2030, and put the country on track to discontinue fossil fuel use altogether.

Colorado split: Seven municipalities and one county scattered around the Denver-Julesburg Basin had passed some sort of drilling or permitting moratorium since the Colorado governor signed a law giving local governments greater control over oil and natural gas development. That number may be higher this week. Most of these moratoriums are being imposed outside of Weld County, where the vast majority of Denver-Julesburg oil and gas is produced and where most local leaders are supportive of the industry. (6/4)

A Trump administration proposal to strengthen criminal penalties against people who interfere with interstate pipelines may be harsher than the draconian legislation approved by Texas lawmakers last month. Under the federal plan released Monday, protesters who block the construction of a crude or natural gas pipeline could face up to 20 years in prison. (6/5)

Rare earths: The US Commerce Department on Tuesday recommended urgent steps to boost domestic production of rare earths and other critical minerals, warning that a halt in Chinese or Russian exports could cause “significant shocks” in global supply chains. (6/5)

Seventeen major automakers, including GM and Ford, are calling for a compromise between the Trump Administration and California on the fuel economy standards through one nationwide broadly supported final rule, to avoid regulatory uncertainty and “an extended period of litigation and instability.” (6/8)

The world’s largest automakers warned President Trump on Thursday that one of his most sweeping deregulatory efforts — his plan to weaken tailpipe pollution standards — threatens to cut their profits and produce “untenable” instability in a crucial manufacturing sector. (6/7)

A new study finds that ethanol blends reduce particulate matter (PM) coming out of the tailpipe, which in turn reduces overall toxic emissions. The study was conducted by the University of California Riverside and the University of Wisconsin, Madison and commissioned by the Urban Air Initiative. (6/7)

US coal exports totaled 7.52 million tons in April, down 10.1 percent from March. Through April, US coal exports total 30.4 million tons, down 12.6 percent from the same period last year. (6/7)

Largest storage project: The Advanced Clean Energy Storage, if it comes to life, will be the largest energy storage facility in the world—1 GW vs. just 100 MW in Australia and 108 MW in Abu Dhabi—and it will not involve lithium-ion batteries. Instead, it will combine a few different energy storage technologies to ensure a reliable supply of electricity. The site of the facility will be the Magnum Salt Dome in Iowa—a salt cave measuring at least one by three miles according to seismic surveying. (6/4)

Offshore US wind: German energy company Innogy will be seeking partnerships with major oil companies willing to go into renewables for offshore wind projects in the United States, Innogy’s chief operating officer in charge of renewables, Hans Buenting, told Reuters. “Big oil firms are muscling into the market for renewable energy – because their previous business model is finite,” Buenting said. “The oil companies may have a lot of experience with platforms out at sea. (6/6)

Heat wave in India: When the temperature topped 120 degrees (49 Celsius), residents of the northern Indian city of Churu stopped going outside, and authorities started hosing down the baking streets with water. Churu — home to more than 100,000 people — has been the hottest place in India in recent days. Five of the hottest 15 places on the planet over the previous 24 hours were in India or neighboring Pakistan. (6/6)

Canal and climate: At the end of last year, the Panama Canal had a problem: too much water. Torrential rains had swollen its primary water source, the artificial Lake Gatun, beyond capacity, forcing the canal authority to open the floodgates to evacuate the excess out into the Atlantic. But in a twist of meteorological fate, amplified by climate change, within three months the opposite was true: a severe El Nino weather phenomenon struck, and the canal began imposing cargo restrictions to cope with what turned into the worst drought in its 115-year history. As water levels in Lake Gatun sank as much as eight feet, five successive reductions in the weight of cargoes that ships could transport were imposed, costing the canal authority about $15 million in lost fees. About 40 vessels transit the canal every day. (6/4)