Editors: Tom Whipple, Steve Andrews

Quote of the Week

“The climate is changing, and humans are contributing to these changes. We believe that there is much common ground on which all sides of this discussion could come together to address climate change with policies that are practical, flexible, predictable, and durable.”

— The US Chamber of Commerce

Graphic of the Week

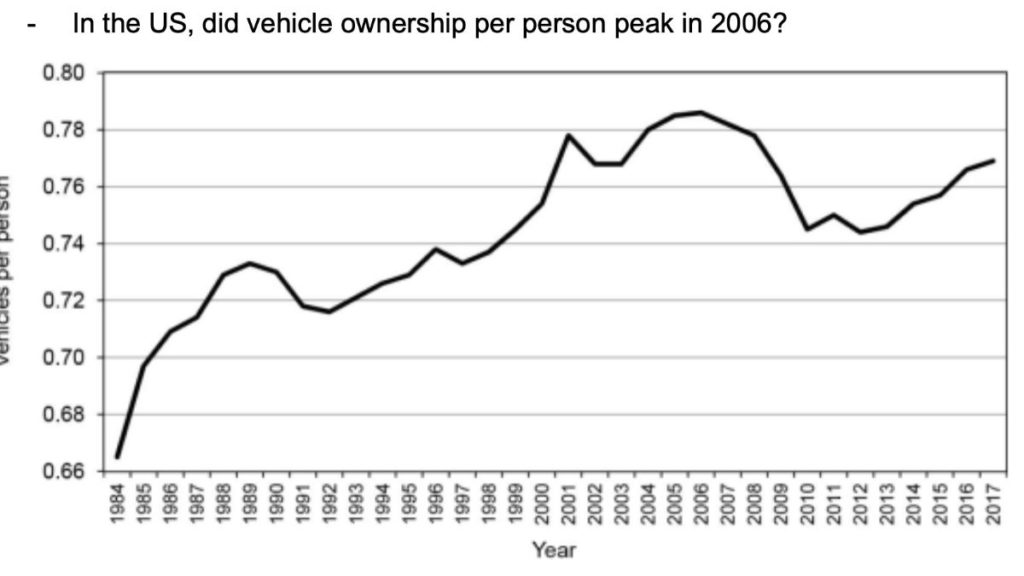

| Contents 1. Oil and the Global Economy 2. The Middle East & North Africa 3. China 4. Russia 5. Nigeria 6. Venezuela 7. The Briefs 1. Oil and the Global Economy Last week began with oil prices continuing to climb on concerns that tightening sanctions on Iran would cut oil supplies. Brent crude touched $75 for a short time after Moscow announced that it was halting some crude shipments to Europe due to contaminated pipelines. Thursday afternoon market sentiment reversed, and prices plunged circa $3 a barrel to close at $62.86 in New York and $71.61 in London on Friday. The price drop was helped by a presidential tweet that said “Spoke to Saudi Arabia and others about increasing oil flow. All are in agreement.” The weekly stocks report showed US commercial inventories growing by 5.5 million barrels to an 18-month high, although most of this growth came from a surge in imports which were 500,000 b/d higher than recent averages. A fire and contamination of the Houston Ship Canal reduced imports two weeks ago, and many tankers were waiting to unload. The stocks report and a statement from the IEA that the markets “are now adequately supplied, and that global spare production capacity remains at comfortable levels,” helped dampen the surge in oil prices that has been going on for several weeks. US retail gasoline prices, which are now averaging $2.89 a gallon for regular in the US and $4.07 in California, are raising concerns. Crude prices are up 37 percent since January, and there are at least four geopolitical confrontations underway in Iran, Libya, Venezuela, and Nigeria which could reduce oil supplies. We are at the time of the year when refiners start producing more expensive blends of gasoline to reduce air pollution, and the floods in the mid-west are slowing ethanol supplies. The OPEC Production Cut: The Saudis may be pumping more oil in response to the US’s elimination of waivers to import Iranian oil and the recent increase in oil prices. President Trump’s announcement over the weekend that he had called the Saudis and that they are willing to increase production is another indication that this is taking place. For now, the official line of all the Gulf Arab oil producers is that they will wait to see what happens to prices and demand in May and June before making any decision about the sanctions. Moscow, which has not taken a large production cut in the current OPEC+ deal, continues to maintain that there is no need to extend the agreement. US Shale Oil Production: The number of active oil and gas rigs fell sharply in the US last week, the second substantial weekly drop in a row. The combined oil and gas rig count is now down year on year for the first time since the end of 2016, with oil seeing just a 20-rig decrease year on year and gas rigs down nine since this time last year. The decline in active rigs is in line with statements from many middle and small-sized drillers that they are being forced by their lenders to cut back on new drilling until they can establish that they are producing oil at a profit. The large international oil companies remain convinced that they can make money where smaller drillers have failed and continue efforts to expand their output in the Permian Basin. So far, the major oil companies are staying away from the smaller basins such as Eagle Ford and the Bakken which are showing signs of peaking and spending their money on the Permian. They are relying on larger scale operations and innovations such as artificial intelligence and cloud computing to make money where most others have failed. We should know the results of their aspirations in another three or four years. While some of the answer lies in the price of oil, most important is the quality of the land the major oil companies drill. It makes a big difference whether a newly drilled shale oil well produces 250,000 barrels of oil or only 120,000 over its lifetime. Some observers are noting that since oil companies exist to produce more and more oil, the Permian Basin is one of the few places left in the world where they can still invest and extract a lot of oil relatively quickly. Lost in this imperative is a serious consideration of whether shale oil will make or lose money in the long run. Occidental Petroleum, already the largest holder of drilling rights in the Permian region, made its play to expand its territory last week by launching a hostile $55 billion bid for Anadarko Petroleum. The bid is an attempt to break up the recent agreement for a $50 billion takeover of Anadarko by Chevron. The contest is likely to be won by the side that is the most effective in convincing shareholders that it would be the best owner of Anadarko’s Permian assets. If Occidental is successful in its bid, it will become the third largest US oil production company. ExxonMobil is interested in acquiring more assets in the Permian Basin of Texas and New Mexico, and could do a substantial deal, the company said on Friday. A senior vice-president of Exxon told analysts on a call to discuss the company’s first-quarter earnings that he “would be surprised if over time we did not pick up more Permian acreage,” either through small-scale purchases of assets or a larger acquisition. Output gains in the US Permian Basin helped drive first-quarter oil production growth for ExxonMobil and Chevron. ExxonMobil’s first-quarter total upstream liquids production rose 5% from the same period in 2018, driven by a 140% surge in its Permian Basin output. ExxonMobil’s first-quarter oil-equivalent production averaged 3.98 million b/d, up 2% from the same period in 2018. First quarter Permian Basin output climbed 36,000 boe/d from 4Q 2018 to 226,000 boe/d, and ExxonMobil revised its Permian growth expectations to more than 1 million boe/d “as early as 2024.” However, Exxon reported a 50 percent drop in earnings per share for the quarter to 55 cents, well below the average of analysts’ forecasts, as it was hit by “extremely challenging” conditions in its refining and chemicals operations. The group’s refining operations fell to a $256 million loss in the quarter as their margins were hurt by oversupply in world gasoline markets. 2. The Middle East & North Africa Iran: Most of the news last week dealt with reactions to the announcement that Washington would not be extending the 180-day waivers that allowed Iran’s best customers to continue importing some Iranian oil without fear of US sanctions on the importers. By week’s end, Washington had reiterated that there would be no wind-down period for imports and there would be no more waivers despite the complaints from several importers. Some analysts are saying that the new policy eventually could remove around 1.1 million b/d from the market. Rystad Energy forecasts that production will drop to 2.27 million b/d for the second half of 2019, which equates to a drop of 0.43 million b/d from current March 2019 levels. As could be expected, Tehran issued a stream of bluster warning of all the consequences that would befall the US should its exports be halted, including closing the Straits of Hormuz choking off the bulk of Middle Eastern oil exports and resuming the pursuit of nuclear weapons. Supreme Leader Khamenei said Wednesday Iran will “not remain silent” and will respond after the US said it intends to impose “maximum economic pressure” on Tehran through its sanctions, which aim to block all Iranian oil exports. The Pentagon issued the usual rebuttal that it had the military strength to ensure that the straits remain open. For now, the Trump administration seems pleased with the results of the sanctions on Iran. Special Envoy for Iran Brian Hook told the media that the sanctions had denied the Tehran some $10 billion in oil revenues so far. Washington is counting on the OPEC+ production cut ending soon and that the Saudis and the other Gulf Arab states will increase oil production by enough to offset the loss of Iranian oil. Some observers, however, are noting that US retail gasoline prices are up by 55 cents a gallon since the first of the year. Most of Tehran’s customers such as Japan, South Korea, and India do so much business with the US and its banking system that they are likely to stop their overt purchases of Iranian oil but may continue to import some through cutouts. However, what China, which imported 556,000 b/d of Iranian crude in the first quarter, does is the key to the effectiveness of US efforts to damage Iran’s economy to the point it will be forced to moderate some of its activities in the Middle East. Most observers believe that China will respond to the US demand with a nuanced policy of cutting some imports but will continue importing Iranian oil. According to Jarrett Blanc, former State Department coordinator for Iran nuclear implementation during the Obama administration, China “clearly has the capacity to ignore the US if they wish. They can route these transactions in a way that it kind of doesn’t matter.” Iraq: Compliance with the OPEC cuts, bad weather in the Basra Gulf, and flooding caused Iraq’s output in March to fall by 210,000 b/d compared to February or more than 4 percent – the lowest level in five months. The factors that caused the fall in production are all temporary, and Baghdad’s oil industry is slated to keep growing. Iraq is one of the few remaining countries with plentiful, onshore, and cheap to extract, oil reserves. A new report from the International Energy Agency says Iraq is expected to add 1.2 million b/d of oil production by 2030. Oil Minister Thamer Ghadhban recently said the country had enough oil production capacity to boost output to as much as 6 million b/d if need be. Last week an Iraqi government official said the country was ready to boost exports by 250,000 b/d to compensate for the loss of Iranian exports due to the harsher sanctions. According to an analysis from Rystad Energy, natural gas developments in Iraq will overtake oil projects in 2019. New projects should triple the country’s gas production from just over 1 billion cf/d in 2017 to about 3 billion in 2022. These projects will allow the country to satisfy its own growing domestic demand for gas and possibly even launch Iraq into the global market as a gas exporter for the first time. Reuters reports that officials from Baghdad will meet with their Kurdish counterparts soon to talk about oil exports from the semi-autonomous region. The two sides are to discuss the increase of oil production from the fields around the northern city of Kirkuk by as much as 50 percent. The Kurdistan Regional Government is stepping up its crackdown on illegal oil refineries. Under orders from Prime Minister Barzani, equipment at these operations will be impounded to ensure they can’t start up again. Saudi Arabia: The Trump administration believes that the impact of cutting Iranian oil exports to zero would be countered largely by increased production from Saudi Arabia. However, analysts say global output cooperation would be more challenging. Saudi Arabia has the physical capacity to replace the Iranian exports which may be potentially lost when the sanctions waivers expire early in May but also has the spare capacity to replace other supply at risk, including Venezuela and Libya. In a statement Monday, Energy Minister Khalid al-Falih said Saudi Arabia was committed to oil market stability and will “coordinate with fellow oil producers to ensure adequate supplies are available to consumers while ensuring the global oil market does not go out of balance.” The Saudi state news agency reported last week that the Kingdom is happy with Washington’s decision to not extend the waivers for Iranian oil. The agency quoted a statement from Saudi Arabia’s Foreign Minister Al-Assaf, which said, “Saudi Arabia believes the US decision is a necessary step to pressure the Iranian government to stop jeopardizing peace and end their global support for terrorism.” Regarding oil production, Al-Assaf said Saudi Arabia would cooperate with other producers to make sure to fill the gap left on international markets by the elimination of the waivers. The recent increase in oil prices has done wonders for Riyadh’s economy. The government announced last week that it posted a budget surplus of 27.8 billion riyals ($7.4 billion) in the first quarter of the year. The Kingdom had a budget deficit of 34.3 billion riyals in the first quarter of last year as the Saudi economy emerged from a recession in 2017. According to its 2019 budget, Saudi Arabia plans to increase state spending by 7 percent this year to spur economic growth that was hurt by low oil prices late last year Saudi Aramco will acquire Shell’s 50 percent stake in their Saudi refining joint venture SASREF for $631 million, the two companies said on Sunday. The purchase, which is part of Aramco’s strategy to expand its downstream operations, will be completed later this year. When Aramco published its first-ever profit figures since its nationalization nearly 40 years ago to support the Aramco bond sale, it also lifted the veil of secrecy around its Ghawar oil field and revealed that the field is only able to pump a maximum of 3.8 million b/d — well below the more than 5 million that had become conventional wisdom. The Energy Information Administration listed Ghawar’s production capacity at 5.8 million b/d in 2017. Ghawar, which has been producing since 1938, is key for Saudi Arabia because it has accounted for more than half of the total cumulative crude oil production in the kingdom, according to the bond prospectus. The Saudis say that Ghawar’s output has been replaced by production from newer oil fields, but someday all oilfields must decline, and 80 years of oil production is a long time. Libya: Militias loyal to the UN-backed government have pushed back General Haftar’s Libyan Nation Army (LNA) south of Tripoli in recent days. Over the weekend, airstrikes, which may have come from a drone, hit the Libyan capital. Supporters of the Tripoli government had blamed a UAE drone for previous air strikes. The United Arab Emirates and Egypt had helped Haftar in the past with air strikes when he was gradually taking control of the east. The LNA controls eastern oil ports and the county’s oilfields but left the National Oil Company (NOC) to run them as foreign buyers of oil only want to deal with NOC. The NOC is based in Tripoli and has sought to stay out of the conflict between the two governments. The firm gives the export proceeds to the Tripoli central bank which mainly funds the Tripoli government but also pays some public servants in LNA-controlled eastern Libya. Haftar is allied to eastern administration which has set up its own state oil firm, AGOCO, and repeatedly sought to take over oil exports from NOC Tripoli. The NOC said last week that revenues rose to more than $1.5 billion in March and that oil production is currently about 1.15 million b/d. The other “state oil firm” AGOCO says it is producing about 300,000 b/d. If these numbers are true, then Libyan production could be approaching the 1.6 million b/d that it was producing at the end of the Gadhafi era. Washington’s decision to support Haftar in his drive to take over the country and become the new “strongman” is coming in for much criticism in the world’s press. Many believe a new “Gadhafi” is not the answer to the country’s problems. 3. China Chinese state-run refiners are awaiting further instructions from the government regarding imports of Iranian crude, but officials and executives indicated a substantial likelihood of pushback against compliance with US sanctions. China is the single largest importer of Iranian oil, and along with India accounted for nearly 70% of the combined share of Iran’s exports in the fourth quarter of 2018. Sinopec received its first cargo of US crude oil last week since halting imports of American crude in September. The resumption is a sign that the Chinese refiner sees fewer risks from importing US oil as trade talks have progressed. Sinopec suspended imports in September in case Beijing imposed punitive tariffs on US oil imports. By official estimates, the outbreak of African swine flu has already been catastrophic. More than a million pigs have been culled. A billion pork-loving Chinese are facing much tighter meat supplies. China’s agricultural ministry estimated recently that there were 19 percent fewer hogs in the country in March than a year earlier. Losing that much pork output in the country that is home to half the world’s pigs would cut the global meat supply by some 6 percent People living in countries along China’s new “Silk Road” favor investment in renewable energy over the construction of coal-fired power plants, according to a poll released on Wednesday. Environmental group E3G, which commissioned the survey, said the results showed there was little support for investment in coal, despite China’s offer of major funding for new plants. 4. Russia Last week an unknown Russian oil producer contaminated Russia’s export crude with high levels of organic chloride that is used either to boost oil output or clean pipelines, but which must be separated before shipment as it can destroy refining equipment. The contaminated oil came through the Druzhba pipeline that supplies refineries as far west as Germany. By week’s end, Poland, Germany, Ukraine, and Slovakia suspended imports of Russian oil, triggering a rare crisis for the world’s second-largest crude exporter. After joint talks on Friday, Russia’s Deputy Prime Minister Kozak said in a statement that the four countries had agreed on measures to eliminate the effects of the contamination. “This would allow us, as earlier planned, to supply… (clean) oil to the border with Belarus by April 29 and to restore the pipeline to stability in two weeks.” Gazprom plans to start injections of Russian gas into the new 38 billion cm/year “Power of Siberia” pipeline in the third quarter of this year. Commercial deliveries to China are to begin in December. 5. Nigeria Aiteo Eastern Exploration and Production has declared force majeure on crude oil pumped through Nigeria’s 150,000 b/d Nembe Creek Trunk Line after a fire started by sabotage. This pipeline connects to the Bonny export terminal which handles 200,000-250,000 b/d. Shell, Nigeria’s biggest producer, pumps a large share of the Bonny Light crude produced in the eastern part of the Niger Delta through the closed pipeline. Last week’s fire resulted in the second shutdown of the pipeline in as many months after an explosion from a wellhead in Nembe Creek resulted in a separate fire. Aiteo said it has repaired the breach but did not disclose whether the oil was flowing again at normal capacity. Nigeria has a long history of militants disrupting the country’s oil flows, but recent months have seen relatively stable production levels between 1.723 and 1.733 million b/d. Saudi Arabia hinted at the possibility of establishing a refinery in Nigeria after the oil ministers from both countries met in Riyadh last week. Nigerian Oil Minister Kachikwu affirmed the Saudi oil minister’s hint and said Nigeria was looking towards Saudi Arabia because of the country’s successes as an oil producer. “We want to leverage on the huge success of Saudi government in terms of petroleum. Last year alone Saudi Aramco, an equivalent of NNPC, made about $200 billion as profit. We have a lot of common ground, historical ties, and religious ties and there’s a need to move further.” In the current edition of its World Oil Outlook, OPEC says the Dangote Refinery, which is the first privately-owned refinery in Nigeria, will refine about 650,000 barrels of crude oil per day once it starts operating. OPEC noted that the world is expecting some capacity expansion in Nigeria by 2020, either through the rehabilitation of existing refineries or through grassroots projects, like the Dangote Oil Refinery. Given Nigeria’s track record on completing complex projects, it is doubtful that overhauls of the existing refineries, which are in terrible condition or the new Dangote refinery will start operating next year. 6. Venezuela According to the company’s monthly export plan. PDVSA is set to export 955,000 b/d of crude in April, up from 843,000 b/d in March, when blackouts crippled export infrastructure. Asian refiners are taking 786,000 b/d, or 82% of April’s shipments, up from 632,000 b/d or 75% of March’s exports. Most of the April shipments represent repayment of loans to China and Russia, including deliveries to India’s Reliance Industries. PDVSA has trilateral deals with the China National Petroleum Corp. and Russia’s Rosneft which sells the crude to a third party, who then pays CNPC or Rosneft. As a result, India’s Reliance might be the final buyer of most of the 220,000 b/d of crude sold to Rosneft for April. The flow of Venezuelan oil to India has not fallen despite pressure from the US Department of State to reduce its dependence on the sanctions-hit oil exporter. India’s petroleum secretary told US officials that the government was stressing to private Indian refiners the risks of importing Venezuelan crude amid US sanctions against PDVSA. Reliance, which operates two mega-refineries, said it would reduce its Venezuelan crude imports in compliance with US sanctions. Reliance also halted sales of diluent like naphtha to Venezuela which depends on imported naphtha to dilute its heavy crude grades. Indian refiner Nayara Energy’s largest shareholder is Rosneft, and Russia has committed to helping the regime of President Nicolas Maduro withstand US sanctions. 7. The Briefs (date of the article in Peak Oil News is in parentheses) UK fracking barrier: Barclays said it is exiting the British gas fracking industry after gas developer Third Energy, in which the bank owns a significant stake, agreed to sell its onshore gas activities to a division of U.S.-based Alpha Energy. Third Energy had planned to frack at the Kirby Misperton site in Yorkshire, northern England, last year but failed to receive government consent after a crackdown on the financial status of fracking firms. (4/26) Qatar Petroleum said Monday it has issued an invitation to tender for the construction of more than 100 LNG vessels to help meet its expected output increase to 110 million tons a year by 2024 from 77 million tons/year now. The shipping tender also includes options for replacing Qatar Petroleum’s existing LNG fleet, which include 45 Q-flex and Q-Max ships. (4/23) MENA electricity push: Countries in the Middle East and North Africa have a total of $1 trillion in committed and planned investments in the energy sector over the next five years as electricity demand grows and regional economies invest more in natural gas, petrochemicals, and renewable energy. This is the gist of new research from the Arab Petroleum Investments Corporation, a multilateral development bank. (4/26) EV angle in India: Instead of targeting electric vehicles at environmentally minded drivers in Europe, Bangalore-based entrepreneur and EV manufacturer Chetan Maini is focused on the scooters, three wheelers, and buses that account for the vast bulk of the passenger road transport in his home nation. (4/26) The Vaca Muerta shale play in Argentina has been a hot spot in global oil and gas for the past few years after exploration suggested it could yield oil and gas at competitive production costs, offering Argentina the chance to emulate the US shale boom. But now obstacles are beginning to emerge, slowing down the potential boom. A recent report by S&P Global Platts quoted industry insiders from the South American country as saying the play needed more independent E&Ps in addition to the supermajors to make the hoped-for boom happen. (4/23) In Mexico, Illegal taps on petroleum pipelines increased in both January and February compared to the same months last year despite the federal government’s crackdown on fuel theft. The state oil company reported that 1,342 new pipeline perforations were detected in February, an increase of 9.6% over the same month in 2018. Hidalgo, where more than 100 people were killed in January by an explosion at a tapped pipeline, recorded the highest incidence of the crime in both months. (4/22) The US oil rig count declined by 20 to 805 while the gas rig count slipped one to 186, GE’s Baker Hughes said. The combined oil and gas rig count is now down year on year for the first time since the end of 2016, with oil seeing just a 20-rig decrease year on year and gas rigs down 9 since this time last year. (2/27) Gasoline exporter: The EIA forecasts the US to be a net exporter of about 90,000 b/d of gasoline during the 2019 summer driving season. If this materializes as predicted, it would be the first time the US was a net gasoline exporter for a whole summer since 1960, the agency said. However, most recent EIA weekly data showed gasoline imports rose on planned and unplanned refinery outages, reaching 990,000 b/d for the week ended April 12. (4/23) CA’s oil in sunset? Entrepreneurs in California were pioneers of the American oil industry. One of the oldest still producing oil fields in the US is located in the Golden State in which in 1901 the Midway-Sunset field was discovered. But since California’s peak in 1985, production has plunged almost 60 percent to 460,000 barrels per day. This reversal doesn’t only impact the state’s economic situation, but also its position towards foreign producers who are increasingly required to supply the necessary oil. (4/26) The world’s largest oil companies are reporting underwhelming first-quarter profits as an array of geopolitical challenges and weaker prices around the world slowed recent progress in generating excess cash and crimped margins for processing oil into fuel. Sanctions in Venezuela, production cuts in Canada and lower natural-gas prices in Asia took a toll on Exxon Mobil Corp., Chevron Corp. and other companies. (4/27) No SPR release: The US is not considering a release from government oil stocks to dull the price and supply impacts of Monday’s announcement it would not renew sanctions waivers for Iran’s top crude and condensate buyers but may announce an additional sale if oil prices climb this summer, sources said. (4/23) In Washington state, a bill that could dramatically impact roughly 150,000 b/d of crude-by-rail traffic to refineries in the Pacific Northwest has been sent to Washington Governor Jay Inslee’s desk to be signed into law, but it remains unclear what the governor plans to do. (4/24) Offshore delay, version #1: The Trump administration’s proposal to vastly expand offshore oil and gas drilling has been sidelined indefinitely as the Interior Department grapples with a recent court decision that blocks Arctic drilling, according to Interior Secretary David Bernhardt. The ruling by a federal judge in Alaska last month may force Interior Department officials to wait until the case goes through potentially lengthy appeals before they can make a final decision on what offshore areas to open up for the oil and gas industry. (4/26) Offshore delay, version #2: President Donald Trump is considering a delay in the introduction of a plan for the expansion of oil and gas drilling in federal waters until after the 2020 elections. A delay would make sense given the opposition that the offshore drilling plan has been attracting from governors and legislators from coastal states, including Republicans. If the five-year offshore lease sale plan is released now and features more acreage to be offered to drillers, the argument goes, Trump will lose votes in next year’s election. (4/27) The Jones Act ending? The president of the United States may remove a 1920 piece of legislation, known as the Jones Act, that bans any non-US vessels from moving any cargo between two US ports. The reason: an imbalance between natural gas supply and demand in some parts of the country, especially in the Northeast and in Puerto Rico. (4/26) Exxon Mobil Corp.’s worst refining performance in almost two decades may revive questions from analysts about the so-called integrated model engineered by founder John D. Rockefeller and espoused by every CEO in the company’s 149-year history. A surprise loss in a business line Exxon typically relies on to prop up more volatile units eroded first-quarter profit and cast doubt on the strength of the oil titan’s comeback from its annus horribilis in 2018. In the last decade, when other oil companies spun off refining businesses to concentrate on drilling for crude, Exxon steadfastly adhered to the wells-to-retail model. (4/27) Workers’ salary nears $200,000: It was a fruitful year for the rank and file at oil-and-gas companies, from Exxon Mobil Corp. to Phillips 66. Oil-and-gas drillers and refiners had some of the highest-paid median workers in the energy and utility sectors in 2018, according to The Wall Street Journal analysis of annual pay disclosures for hundreds of big US companies. (4/25) In the U.S., vehicle ownership per person reached a maximum in 2006, two years after a maximum for distance driven per person. Vehicles per person has been on a rebound since 2012, but it is still down from 2006 by 2.2%. In comparison, distance driven per person is down by 5.2% from its maximum. (4/23) Traditional biofuels breakthrough: By combining an unorthodox solvent—super-critical carbon dioxide—and a genetically engineered bacterium, a team of researchers at Worcester Polytechnic Institute (WPI) in Worcester (MA) has discovered a groundbreaking method for producing biofuels that uses five times less energy than traditional manufacturing methods. In short, this breakthrough discovery is an important step in a cheaper, more efficient, and more environmentally friendly biofuels industry. (4/25) PG&E Corp. can’t prevent its power lines from sparking the kinds of wildfires that have killed scores of Californians. So instead, it plans to pull the plug on a giant swath of the state’s population. No US utility has ever blacked out so many people on purpose. PG&E says it could knock out power to as much as an eighth of the state’s population for as long as five days when dangerously high winds arise. (4/27) States push RE: The Trump administration has done its best to promote coal, oil and gas at the federal level, but individual US states continue to step up their ambition on renewable energy. A wave of clean energy policies has recently washed through state capitols across the country, a trend that has come despite, or because of, the federal deregulation effort. Washington State just passed a bill requiring 100 percent clean and renewable electricity by 2045, while also completely eliminating coal-fired power by 2025. New Mexico passed a similar bill that calls for 100 percent clean energy by 2045. Along with previously passed 100 percent clean energy mandates in California and Hawaii, there are now four states with such laws on the books. (4/26) Electricity from falling snow? A team of researchers from the University of California Los Angeles have created a unique device that can generate electricity from snowfall, science media report, citing a paper published in the journal Nano Technology. The device is basically a vastly improved weather station, which, in addition to measuring how much snow is falling at any given time and what direction and speed the wind is blowing at, can convert the snow power utilizing the principles of static electricity generation. The researchers have called their creation a snow-based triboelectric nanogenerator. (4/22) Air pollution worse: More Americans are breathing air that will make them sick, according to the American Lung Association’s annual State of the Air report. The country had been making progress in cleaning up air pollution, but during the Trump administration, it has been backsliding, the report says. Deregulation and climate change are largely to blame. (4/25) Ground-level ozone twist: During California’s severe drought of 2011-2015, researchers found that drought altered ozone production such that the process became chemically more sensitive to the decrease in drought-affected VOCs. These factors led to an estimated overall decrease in ozone production of approximately 20% during the severe drought. However, this decrease was offset by a comparable reduction in ozone uptake by plants, leading to only a 6% reduction in ozone levels overall during the severe drought period. The results suggest that drought influence on ozone pollution are complex and depend on drought severity and duration. (4/23) Greenland’s melt: Home to Earth’s second-largest ice sheet, Greenland has lost ice at an accelerating pace in the past several decades — a nearly six-fold increase that could contribute to future sea level rise, according to a new study based on nearly a half-century of data. A key finding is that out of nearly 14 millimeters of sea level rise in total caused by Greenland since 1972, half of it has occurred in just the past eight years. (4/23) Hotter world: Vietnam broke its record high national temperature Saturday, the latest in records to fall as the world continues to warm. The scorcher set the mercury thermometer soaring to 110 degrees Fahrenheit (43.4 Celsius) in the community of Huong Khe, a rural district in Ha Tinh province. It’s situated in Vietnam’s northern central coast region, about 150 miles south of the capital, Hanoi. (4/23) The US Chamber of Commerce, through its Global Energy Institute (GEI), recently announced the launch of a major new climate initiative called the American Energy: Cleaner, Stronger campaign. Its admitted purpose is to “…counter the Green New Deal (GND) with an energy innovation agenda…to persuade the public and Congress that technology is better than regulation in addressing climate change.” (4/25) Climate fight commitment: Some Californians will soon see a new 1 percent fee added to their restaurant check as the Restore California Renewable Restaurants look to help fight climate change by offsetting the carbon footprint of going out to eat. The fee, to be optionally added to restaurant bills at the restaurant’s discretion, will be spent on carbon plans for farms and ranches. Restaurant patrons would still have the option to not pay the 1% fee but would have to ask to have it removed from their bill. (4/26) Carbon scrubbers: In Huntsville (AL), two bright green structures the size of shipping containers gleam in the warm sunlight, quietly sucking from the air the carbon dioxide that is warming the planet. One structure houses computer monitors and controls. Atop the other, large fans draw air through slabs made of honeycomb-style ceramic cubes. The cubes hold proprietary chemicals that act like sponges, absorbing carbon dioxide at room temperature. (4/23) |