Editors: Tom Whipple, Steve Andrews

Quotes of the Week

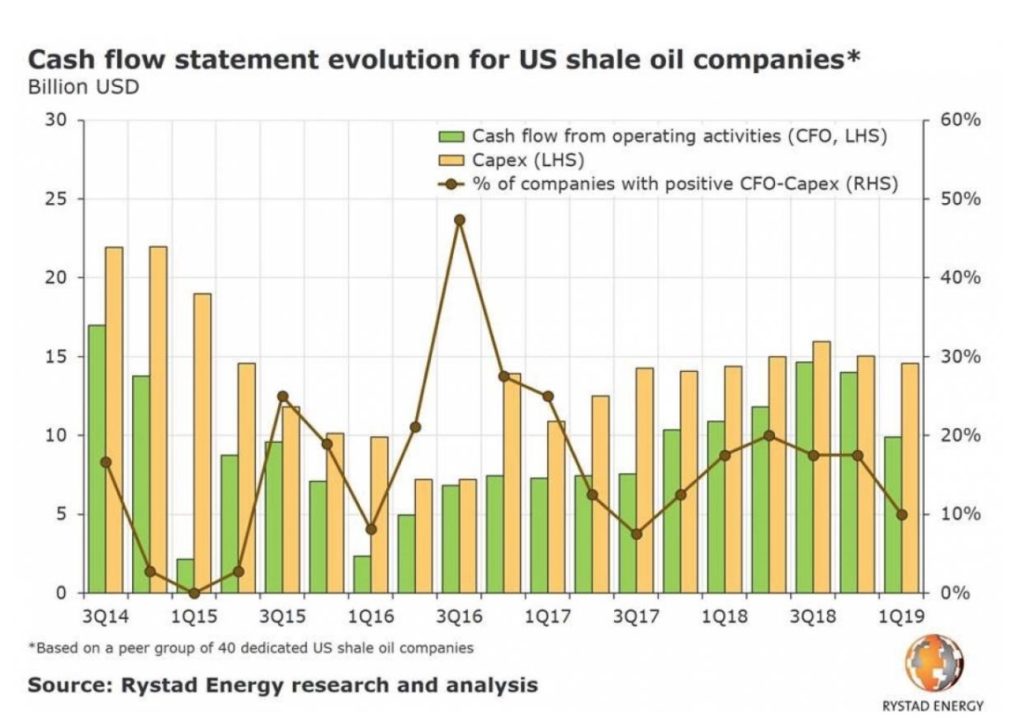

“Recently released data, which confirmed dismal first quarter earnings, only served to cement negative market sentiment. While shale operators continue to focus on improving capital efficiency, investors are putting the industry under extreme pressure, leaving no room for undisciplined spending in 2019.”

Alisa Lukash, Rystad Energy’s North American Shale team (5/30)

“Many people still think that to giving fossil fuel subsidies is a way to improve living conditions of people. There is nothing more wrong than that. What we are doing is using taxpayers’ money – which means our money – to boost hurricanes, to spread droughts, to melt glaciers, to bleach corals. In one word – to destroy the world.”

UN Secretary-General Antonio Guterres said at a climate change conference in Austria (5/30)

Graphic of the Week

| Contents 1. Oil and the Global Economy 2. The Middle East & North Africa 3. China 4. Russia 5. Nigeria 6. Venezuela 7. The Briefs 1. Oil and the Global Economy Oil prices fell on Friday posting their biggest monthly drop in six months, after President Donald Trump threatened tariffs on imports from Mexico. Unless the Mexican government stops people from illegally crossing into the US, he would impose a 5 percent tariff on imports starting on June 10th that would increase monthly, up to 25 percent on Oct. 1. Following the threat Brent crude futures fell $2.38, or 3.6 percent, to settle at $64.49 a barrel and New York futures fell $3.09 to $53.50 a barrel, a 5.5 percent loss. Brent touched a session low of $64.37 a barrel, lowest since March 8. WTI hit $53.41 a barrel, weakest since Feb. 14. During May Brent futures posted an 11 percent slide and WTI 1 percent, their largest monthly losses since November. US refiners import some 680,000 b/d of Mexican crude so that a 5 percent tariff would add an additional $2 million to the cost of their daily purchases and a 25 percent tariff an extra $10 million. Given the scale of the pushback from the Congress and the many organizations that have interests in the US-Mexico trade, it seems unlikely that the tariffs will be imposed. Other important factors bearing on the price decline last week were the on-going US-China trade war and the US stocks report showing that the US crude inventories decreased by less than 300,000 barrels. The American Petroleum Institute had estimated a 5.2-million-barrel drawdown earlier in the week sending the markets higher. On the last day of every month, the US’s Energy Information Administration releases its Petroleum Supply Monthly, which contains the US oil production number up to 60 days before publication. While the newest of these numbers are two months old, they are more accurate than the forecasts the EIA releases in its Drilling Productivity Report on the 15th of each month. Recently these forecasts have been too optimistic about how much shale oil would be produced in the coming month forcing revision when the actual production numbers become available ten weeks later. When the May production numbers were released on Friday, Reuters headlined its conclusions as “US crude output rises 2.1% in March to a near record high.” While this sounds great, digging into the details tells another story. The EIA has been predicting that US crude production, which now is critical to global economic growth, will grow by some 1.2 million b/d this year. While US production was up in March, it has been largely static for the last six months with production in November and December 2018 slightly higher than in March 2019. Growth in output between February and March largely came from a rebound in North Dakota production which was hampered by frigid weather in February. The other significant increase during March was an 11 percent increase in Gulf of Mexico production, which usually comes when a new production platform comes online and is unlikely to grow much in coming months. The most interesting revelation in the report was that oil production in Texas declined by 0.1 percent between February and March to 4.873 million b/d. This decline suggests that the press stories saying that small and medium-sized shale oil drillers are cutting back may be showing up in production numbers. The decline further suggests that the US will have difficulty in achieving a 1.2 million b/d increase this year. On the positive side, the new numbers show that oil production in New Mexico was up by 23,000 b/d last month and up by 39.5 percent since March 2018 to 870,000 b/d. This westward extension into New Mexico’s portion of the Permian Basin seems to be the fastest growth area in the shale oil industry. The OPEC+ Production Cut: Preliminary figures show that OPEC’s production dropped to a four-year low of 30.17 million b/d in May, as a 200,000 b/d increase in Saudi production was not enough to offset Iran’s and Venezuela’s lower output. Crude oil has fallen from a six-month high above $75 a barrel in April to below $65 on Friday, due to concerns about the economic impact of the US-China and US-Mexico trade disputes. This decline in prices is likely to affect the decision on whether to extend the production cut that is to be taken at the end of this month. Despite the US sanctions, Iran was able to ship out about 400,000 b/d last month, less than half as much as it exported in April. Venezuela’s production fell by 50,000 b/d in May due to the impact of US sanctions and long-term deterioration of its production infrastructure. Output also dropped in Nigeria because of a pipeline shutdown that disrupted exports. The decline in oil prices increases the chances that that OPEC+ production cut will be extended for another six months at the June 25-26 meeting to consider the cuts. The Saudis have been hinting for weeks that they want an extension and we have indications that Russia may be changing its position. Moscow’s Finance Minister Siluanov said last week, “there are many arguments both in favor of the extension and against it, but we see that all these deals with OPEC result in our American partners boosting shale oil output and grabbing new markets.” Russia’s energy ministry and the government will determine their stance on the pact’s extension after weighing these pros and cons and the longevity of current market trends. US Shale Oil Production: Despite the hype of lower breakeven prices, and the hype around longer laterals, energy digitalization, and other technological breakthroughs, most shale companies are still not profitable. Nine in ten US shale oil companies are burning cash, according to Rystad Energy. The consulting firm has studied the financial performance of 40 dedicated US shale oil companies, focusing on cash flow from operating activities. Free cash is the money available to expand the business, reduce debt, or return to shareholders. Only four companies in the group reported a positive cash flow balance in the first quarter of 2019, bringing down the share of companies with a positive cash flow balance from the recent average of around 20% to just 10%. Evidence continues to mount that US shale oil production is slowing. Last week, Schlumberger, the largest oilfield service company in the world, saw its debt rating downgraded by S&P due to the slowdown in drilling by US shale companies. Meanwhile, rival Halliburton saw its outlook downgraded from “stable” to “negative.” An analyst at S&P wrote in a report, “The oilfield services industry has fundamentally changed due to permanent efficiency and productivity gains realized by E&P companies as well as investor sentiment calling for E&P companies to live within cash flow and limit production growth.” Independent shale drillers in the US are facing pressure to either expand or be acquired, Robert Kaplan, president of the Federal Reserve Bank of Dallas, said recently. “Smaller, independent drillers are losing access to capital and hearing complaints from shareholders.” In the Dallas Fed’s most recent Energy Survey – a quarterly poll of about 200 oil and gas companies – one anonymous oil industry executive wrote that “the shrinkage in market capitalization of some companies is breathtaking.” North Dakota drillers are falling short of the state’s goals to limit the burning of excess natural gas. This situation comes five years after the state adopted rules to reduce the environmentally harmful practice. The industry has spent billions of dollars on building new infrastructure but is at least two years from catching up. Regulators are saying that the state’s increasing gas production will continue to outstrip new pipeline capacity to pipe it away. Occidental Petroleum acquired some of the richest shale oilfields in Texas when it beat out Chevron Corp in a bidding war to acquire Anadarko Petroleum. It also quadrupled its debt – to $40 billion – at a time when investors are calling for spending cuts and higher dividends. The acquisition’s success will depend on how quickly Occidental can sell off some of Anadarko’s assets and focus on optimizing and integrating the assets it keeps – especially the US shale fields. Corporation activist investor Carl Icahn has filed a lawsuit against the company over what it called its “misguided” acquisition of Anadarko and may seek a special meeting to remove and replace board members. |

2. The Middle East & North Africa

Iran: After a month of “waiverless” sanctions Tehran’s exports now are likely to be below 500,000 b/d and are not expected to sink much lower as the Iranians have many ways to sneak oil out to markets. The war of words between Washington and Tehran continues with the Iranians saying they see no prospects of ever negotiating with the US. Yesterday, a senior Iranian official warned that US military vessels in the Gulf are within range of Iranian missiles and that clash between the two countries would push oil prices above $100 a barrel. Washington reiterated that the US would sanction anyone who bought Iranian oil without exceptions and accused Iran of using naval mines to attack four oil tankers off the UAE coast last month.

The White House stressed last week that it is not planning any military offensive against the Iranians and that the US is not seeking to change the government in Tehran. Reports from inside Iran say that life is getting harder with the loss of so much oil revenue, but that the people are adjusting to living under the US sanctions. There is little evidence that the people are becoming disillusioned with their leaders or that an uprising is in the offing. About the only objective that Washington has gained from its Iranian policy is that less aid is flowing to Iran’s allies in Lebanon, Syria, Gaza, and Yemen. The Iranian people suffered considerably during the Iran-Iraq war some 40 years ago when hundreds of thousands were killed or wounded.

Iraq: In contrast to earlier statements, the issue of whether Iraq can continue purchasing electricity from Iran without being sanctioned by the US is still open. Baghdad desperately needs this power to get the country through the summer and has few other options in the short run.

A series of explosions at Kirkuk has killed at least five people and injured 18 more. No one has claimed responsibility for the attacks yet, although Islamic State insurgents are active in the area. Last month, the US evacuated all non-essential personnel from Iraq, citing the threat from Iran. The announcement prompted Exxon to remove some 60 staff members from the country.

Iraq’s state-run North Oil Company is taking legal action in an attempt to reclaim the Khurmala Dome of the Kirkuk oil field. This area contains more than one-third of the Kurdistan Regional Government’s independent oil production.

Baghdad lifted a state of emergency which was declared at the Majnoon oil field in the south of the country because of floods. The state-run Basra Oil Co took over the operations at the field after the withdrawal of Shell last year, and the firm has announced plans to boost output from Majnoon to 450,000 b/d in 2021.

Syria: Humanitarian workers voiced growing alarm at the plight of civilians in northwestern Syria last week, as fighting intensified in the last rebel-held province and hundreds of thousands of people fled north toward the Turkish border. Ankara closed that border after eight years of civil war in Syria spurred more than three million people to seek safety in Turkey. Now, refugees are camping in open fields and in desperate conditions, repeatedly moving as Syrian and Russian forces have increased artillery and aerial bombardments in an attempt to advance into the province Idlib.

The area controlled by the Assad government requires about 136,000 b/d of oil products to function, yet it produces only about 24,000 b/d. This situation means that the government must import significant volumes of crude oil at an estimated expense of more than $2 billion per year. Last week US-led aircraft blew up three oil transporters carrying oil from the Kurdish-controlled sector of Syria to government facilities. The attacks came after the EU extended its sanctions on the Assad regime for one year after the Syrians stepped up its repression of the Syrian people.

Libya: The attack launched by General Haftar against Tripoli and its 2.5 million inhabitants on April 4 has been halted and pushed back by the militias of the city and their allies from other towns in the western parts of Libya, like Misurata and Zintan. The military situation is still, however, very fluid — within the same day, the front moves forward and back many times. One thing that is clear so far after six weeks of fighting is that Haftar’s promise to take over Tripoli within days has failed to materialize.

There is the risk that this situation will last for much longer than anyone wished, especially given the active involvement by foreign countries which support Haftar’s forces with money, air support, and weapons in defiance of the UN’s resolutions against arming the warring factions in Libya. For now, the fighting does not seem to be affecting Libya’s oil industry. National Oil Company’s estimate for its April oil revenues came in as one of its best in a long time, suggesting that the stalemate at Tripoli has yet to impact oil production. It’s not all good news for Libya though, as ISIS is now taking advantage of the security vacuum that has been created by Haftar’s forces focusing on Tripoli.

The oil company reported revenues of $1.87 billion for April due to a rise in global crude oil prices and a busy loading schedule at the end of March.

3. China

The US began collecting 25 percent tariffs on many Chinese goods arriving at US ports on Saturday morning in an intensification of the trade war. President Trump imposed the tariff increase on a $200 billion list of Chinese goods on May 10 but had allowed a grace period for sea-borne cargoes that departed China before that date, keeping them at the prior, 10% duty rate. The tariff increase affects a broad range of consumer goods and intermediate components from China, including internet modems and routers, printed circuit boards, furniture, vacuum cleaners, and lighting products. Earlier on Saturday, China began collecting higher retaliatory tariffs on much of a $60 billion target list of US goods. The tariffs, announced on May, apply additional 20 or 25 percent tariffs on more than half of the 5,140 US products targeted.

Activity in Chinese factories slumped in May, according to a key measure, as new orders for goods fell in response to uncertainties created by the trade dispute. The official manufacturing purchasing managers index fell to 49.4 in May from 50.1 in April, indicating that Chinese manufacturing is declining.

China increased its subsidies to domestic companies to a record level last year to help them weather a slowdown. Payments by Beijing and local governments rose 14 percent year on year to $22.3 billion in 2018, according to corporate earnings data. This data reinforces the impression that Chinese companies start the race for business far ahead of their competitors,” said Scott Kennedy, director of the project on Chinese business and political economy at the Center for Strategic and International Studies. He noted that the disclosed payments exclude “a range of implicit subsidies and other non-tariff barriers.” As part of their trade talks, Washington is trying to force China to dismantle state support for the corporate sector that gives Chinese companies an unfair advantage in global markets.

No further trade talks between Chinese and US negotiators have been scheduled since the last round ended in a stalemate on May 10th. This was the same day that President Trump announced higher tariffs on $200 billion of Chinese goods and then took steps to levy duties on all remaining Chinese imports. Beijing’ rhetoric has grown more strident in recent weeks, accusing Washington of lacking sincerity and vowing that it will not cave to the Trump administration’s demands. Chinese rhetoric has hardened even more since Washington put Chinese company Huawei Technologies on a blacklist that effectively bans the firm from doing business with US companies.

As the world’s largest producer, Beijing has a firm grip on rare earths by producing 71.42 percent of the world’s supply last year. These minerals are used in smartphones, batteries, turbines, lasers, electromagnetic guns, missiles, advanced weapon sensors, stealth technology, and jamming technology. Lanthanum is used in lighting equipment and camera lenses; neodymium in hybrid vehicles; praseodymium in aircraft engines; europium in nuclear reactors and gadolinium in MRIs and X-ray. Oil refiners also use rare earth catalysts to process crude oil into gasoline and jet fuel.

A well-publicized visit by President Xi to an obscure rare earths production facility last week raises the possibility that China could be contemplating cutting off the supply of critical materials to the US and potentially crippling large swathes of its industries. China says it is willing to meet reasonable demand for rare earths from other countries, but it would be unacceptable that countries using Chinese rare earths to manufacture products would turn around and try to harm China.

China is the world’s biggest source of greenhouse gases and has pledged to stop further growth in emissions by “around 2030” as part of its commitments to the 2015 Paris accord. To meet its commitments would require coal consumption to be cut or replaced by renewable energy, but the growth of coal usage in the past four years has raised concerns over China’s ability to fulfill its commitment. Last year, coal consumption in China grew by 34 million tons from a year earlier to 3.83 billion tons. Expanding coal-fired utilities and record-level crude steel output have helped to increase coal consumption according to a recent study. The expansion of coal-chemical and petrochemical industries in China are expected to further boost the usage of coal in the country.

4. Russia

The 1 million b/d Druzhba pipeline was shut down in April after excessive levels of organic chloride were found on the million-barrel-per-day pipeline. The line runs from Russia to the Mozyr refinery in Belarus, then splits into two routes. The southern branch runs via Ukraine to Slovakia and Hungary, while the northern branch runs via Poland to Germany. Pipeline operator Transneft, which denies responsibility for the contamination, has started to pump back 1.3 million tons of oil from Belarus, where the contaminated crude allegedly did considerable damage to refineries before the contamination was discovered. Polish and German refineries have reached a preliminary agreement to process contaminated oil, which still sits in pipelines from Belarus, by themselves rather than pump the oil back to Russia for dilution. The latest estimates are that clean crude will reach Poland via the northern route by June 9th or 10th.

Between May 1st and 26th, Russia’s oil production was 11.126 million b/d, which means that Moscow is likely to be below its quota under the production cut deal. As part of the OPEC+ production cuts which started last January, Russia was supposed to cut its production from October’s post-Soviet record level of 11.421 million b/d to 11.191 million b/d. Moscow was never very enthusiastic about the cut and never really participated until it was forced to by the Druzhba incident.

5. Nigeria

Output dropped in Nigeria in May due to a pipeline outage. In April, the country hit a 14- month high of 1.95 million b/d even though its OPEC+ quota was only 1.69 million b/d, the largest overproduction, by percentage, of any OPEC+ signatory.

The Nigerian Senate pointed out that the government has spent some $35 billion in oil subsidies in the last six years and warned that continuing this practice could kill the economy. The Senate asked the Federal Government to put an end to the payment of oil subsidies and build new refineries to halt the importation of expensive refined oil products. Nigeria’s population is now 191 million, which requires a lot of oil even with low per capita consumption.

Chinese President Xi Jinping held talks with Nigerian President Issoufou last week. Calling China and Nigeria good friends, partners, and brothers, Xi hailed the constantly strengthening political mutual trust and fruitful pragmatic cooperation between the two countries. As the international oil companies tire of dealing with the endless insurgencies and corruption in Nigeria and are starting to pull back, China sees an opportunity.

6. Venezuela

A meeting between the Venezuelan government and the opposition to resolve the country’s deep political crisis ended without agreement on Wednesday. Neither side has scored a decisive victory, and their struggle has ground to a halt. Mr. Maduro controls most state institutions and has the support of the armed forces, while Mr. Guaido enjoys the backing of the US and most countries in Europe and Latin America.

Venezuela’s economy contracted 19.2 percent in the first nine months of 2018 from the year-earlier period, as private consumption fell sharply, and inflation soared according to the Central Bank of Venezuela. Private consumption was down 18.7 percent in the first nine months of last year, while public consumption fell 9 percent. The manufacturing sector contracted 22.5 percent, and retail fell 34.1 percent in the same period.

The central bank said inflation totaled 130,060 percent in all of 2018, the highest in the world but far below figures from economists and the International Monetary Fund. In an April report, the IMF said that Venezuela’s economy fell 18% in 2018, while inflation totaled 929,790 percent last year—and is expected to reach 10 million percent in 2019. This rate of inflation is probably worse than in Germany’s Weimar Republic in the 1920s.

As the gasoline lines grow, Venezuelans are driving to Brazil to tackle long queues to buy gas in Pacaraima, a border town in Roraima. Those living along the Venezuelan border with Columbia have long enjoyed ridiculously cheap gasoline smuggled across the border. With motorists waiting in line for days to buy gasoline in most of Venezuela, smuggling into Columbia has dried up.

7. The Briefs (date of the article in the Peak Oil News is in parentheses)

A global shortage of heavy crude will create hurdles for America’s refineries just as they ramp up gasoline production for summer driving season. On the Gulf Coast, dwindling heavy oil supplies have suppressed refining margins, while Midwest refiners may not reach the high run rates seen last summer. Gulf Coast profits from coking — a process where heavy crude is broken down into fuels such as gasoline and diesel — are already at their lowest levels in nearly a decade. (5/29)

Subsidies for the fossil fuel industry should be eliminated as they help to “destroy the world” the United Nation’s Secretary-General Antonio Guterres told media this week, adding pollution should be taxed. Global fossil fuel consumption subsidies, including for electricity generation, exceeded $300 billion in 2017, according to data from the IEA released in its 2018 World Energy Outlook. (5/30)

In the North Sea, Ithaca Energy is buying Chevron’s British oil and gas field interests for $2 billion, the unit of Israel’s Delek Group said on Thursday. The acquisition would mark another step for Delek toward its expected public listing. (5/30)

In Brazil, Petrobras set a new monthly record in April (1.94 million b/d) for output from ultra-deepwater fields in the country’s offshore subsalt frontier in April and May, capping a 10-year run since first oil was pumped from the Santos Basin in May 2009. By the middle of the next decade, Brazil’s development of the subsalt is expected to elevate the country’s total output to more than 5 million b/d and make the continent-sized nation one of the world’s top five crude exporters. (5/30)

Venezuela’s widespread gasoline shortages are starting to affect some cities in Colombia, where drivers depend on cheap fuel smuggled in from their socialist-governed neighbor. Residents of the Colombian border city of Cucuta lined up for several hours outside local gas stations on Wednesday to fill their tanks fearing that shortages will get worse. (5/31)

The US oil rig count increased by 3 to reach 800 while the gas rig count declined by 2 to 184, according to GE’s Baker Hughes. Rigs drilling tight-oil formations were unchanged at 581.

North Slope producers BP and ExxonMobil have agreed to contribute $20 million to help the state of Alaska complete a federal licensing process for the proposed $41 billion Alaska LNG Project. The state-owned Alaska Gasline Development Corporation needs $30 million and another year to complete work with the Federal Energy Regulatory Commission on a license for Alaska LNG. If built, the project could export up to 20 million mt of liquefied natural gas from an LNG plant in south-central Alaska. (6/1)

In Alaska, the US Interior Department is determined to sell oil leases for the first time this year in the ecologically sensitive but presumably petroleum-rich coastal plain of the Arctic National Wildlife Refuge. The decision marks a likely turning point in a decades-long battle between environmental groups and fossil energy companies over the Beaufort Sea coast of the wildlife refuge. (5/31)

“Freedom gas”??: US energy officials appeared to rebrand natural gas produced in the country as “freedom gas”, in a statement announcing an increase in exports. The US Department of Energy said the expansion of a Texas facility meant more “molecules of US freedom” could be produced and exported worldwide. (5/31)

Air-sourced jet fuel?” Rotterdam/The Hague Airport and a European consortium led by EDL Anlagenbau Gesellschaft mbH signed a cooperation agreement to develop a demonstration plant that produces renewable jet fuel from air. This plant aims to be the first worldwide to offer renewable jet fuel from air to the market. Following the study, a demonstration plant is to be realized and commissioned on the premises of the airport. (5/31)

Biofuels dustup: The Trump administration on Friday lifted restrictions on the sale of higher ethanol blends of gasoline, keeping a campaign promise to farmers suffering from the trade war with China but drawing a legal threat from the oil industry. The announcement will allow gasoline stations to sell blends containing up to 15 percent corn-based ethanol, called E15, year-round, ending a summertime ban that President Obama’s EPA imposed in 2011 to reduce smog pollution. (6/1)

Vehicle miles traveled (VMT) in the US was seven times higher in 2017 than in 1950, according to the US Department of Energy (DOE). The number of vehicles in operation was more than six times higher in that same period, while the resident population doubled. Growth of VMT and vehicles slowed from 2008 to 2011 but continued the upward trend thereafter. Because the number of licensed drivers grew more slowly than VMT did, the average miles per driver increased each year. (5/29)

The UK passed 300 hours of coal-free generation on Thursday, the National Grid said, as mild, windy conditions reduced the need for older power plants. (5/31)

Global nuclear power capacity could plunge by two-thirds over the next 20 years. Even as investment in solar and wind is surging, nuclear power has been the main source of carbon-free electricity for decades. “However, in advanced economies, nuclear power has begun to fade, with plants closing and little new investment made, just when the world requires more low-carbon electricity,” the International Energy Agency warned in a new report that takes stock of the nuclear industry. (5/29)

Nuclear sunsetting: In Massachusetts, the 728-MW Pilgrim Nuclear Power Station commenced early retirement Friday after 47 years online because lower power prices have made operating the unit uneconomical. The plant is among eight US nuclear power units with combined capacity of 6,306 MW that have been shut since September 2009. Now 10 more units with combined capacity of 10,585 MW have specific closure announcement dates. (6/1)

Falling renewable power costs could be the solution to boosting global climate action, the International Renewable Energy Agency said in a report released Wednesday. In 2018 the global weighted-average cost of electricity from solar photovoltaics and from onshore wind declined by 13% compared to 2017, the report said, and cost reductions for these two technologies are set to continue to decline into the next decade. Over three-quarters of the onshore wind and four-fifths of the solar PV capacity that is due to be commissioned [in 2020] will produce power at lower prices than the cheapest new coal, oil or natural gas options, the report said. (5/30)

Renewable energy investment in Asia excluding China will overtake spending on upstream oil and gas projects in the region as soon as next year, according to Rystad Energy. Total capital expenditure (capex) in renewables will overtake exploration and production (E&P) spending in 2020, with contributions from Australia and other Asian countries such as Vietnam, Taiwan and South Korea. (5/28)

Big storage plan: A pioneering $1 billion project for large-scale storage of energy from wind and solar power has been launched in Utah, offering a way to manage the variability of renewable generation. A consortium including Mitsubishi Hitachi Power Systems of Japan on Thursday announced a plan to use a huge salt cavern to store hydrogen or compressed air, which could be used to generate up to 1,000 megawatts of power. (5/31)

SA passes carbon tax: After nearly a decade of delays, South Africa has just joined some 40 countries that have enacted national carbon tax policies, aiming to curb the rise in carbon emissions to meet global climate change targets. In the first phase of the tax implementation—June 2019 through December 2022—the tax rate will be equal to US$8.32 per one ton of carbon dioxide equivalent. However, allowable tax breaks will effectively slash the carbon tax to between $0.42 and $3.33 per ton of CO2 equivalent, according to the treasury. (5/28)

Climate pledges: About 80 countries want to increase their climate pledges ahead of schedule under the Paris climate accord, the United Nations said Tuesday, signaling that some of them would do so at a summit of world leaders in September. (5/30)

European Green parties on Monday were cheering EU elections that vaulted them into a kingmaking position of power, as voters abandoned traditional political parties in favor of climate-focused activists in a green wave that swept several countries. The results propelled the Greens into second place in Germany and third place in France and elsewhere, amid a surge in excitement from young voters who faulted old-school parties for ignoring their concerns about the environment and offering few alternatives for a generation beset by economic pain following the global financial crisis. (5/28)

H2 collaboration: At the 10th Clean Energy Ministerial meeting, a new international hydrogen partnership was announced under the leadership of the United States, Canada, Japan, the Netherlands and the European Commission with the participation of several other CEM member countries. The IEA would be coordinating efforts under this initiative. For the first time under the Clean Energy Ministerial, this effort will put the spotlight on the role that hydrogen and fuel cell technologies can play in the global clean energy transition. (6/1)

This year’s Atlantic hurricane season should be “near normal,” government forecasters announced on Thursday, with the likelihood of nine to 15 named storms, and two to four major Category 3 hurricanes with winds of 111 miles per hour or greater. Hurricane season officially begins on June 1 and runs through Nov. 30. (5/27)