Editors: Tom Whipple, Steve Andrews

Quote of the Week

“Based on the current trend in confirmed cases, there appears to be a clear indication that while the Chinese authorities are doing their best to prevent the spread of the coronavirus, the fairly drastic measures they have implemented to date would appear to have been too little, too late.”

Adam Kamradt-Scott, an infectious diseases expert

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and trade wars 5. Renewables and new technologies 6. Briefs 1. Energy prices and production Oil prices rebounded last week as traders decided that the coronavirus was not going to expand much further outside of China and that control measures were starting to work. WTI closed out the week at $52 a barrel and London at $57. The on and off possibility that OPEC+ would cut production further also helped prices. However, Moscow’s resistance to further production cuts and the recent 1 million b/d drop in Libyan output seems to have put a further OPEC+ cut on hold. US crude stocks climbed for a third week as production ticked higher, and exports slowed. Commercial crude inventories increased 7.46 million barrels to 442.47 million barrels during the week ended February 7th. OPEC saw its crude oil production dip by nearly 500,000 b/d in January from December, over-complying with the collective cut. At an emergency meeting of the OPEC’s Joint Technical Committee, Moscow refused to agree to the cartel’s proposal to reduce production by an additional 600 000 b/d. Explaining Russia’s position, Energy Minister Novak said that to make such a decision, it takes time to evaluate the effect of coronavirus on the oil market. The size of the demand drop occasioned by China’s virus outbreak has resulted in varying estimates as to how far the demand for oil will fall this year. OPEC cut its global oil demand growth forecast for 2020 by an optimistic 230,000 b/d. The International Energy Agency cut its oil demand forecast for 2020 by almost 500,000 b/d and said demand would contract for the first time in a decade during the first quarter. The virus outbreak will reduce Chinese refining throughputs by 1.1 million b/d during Q1, the IEA forecasts, causing global demand to shrink by 435,000 b/d, the first quarterly contraction since the global financial crisis in late 2009. Rystad Energy is revising its global oil demand growth forecast down by 25 percent to 820,000 b/d in 2020. Their previous growth forecast stood at 1.1 million b/d. The company says coronavirus’s impact on demand growth could be even worse however, slashing growth to as low as 650,000 b/d. Oil production in North Dakota could peak over the next two-five years as producers will have drilled up the core production areas. They will have to move to less prolific locations, according to North Dakota’s Mineral Resources Director, Lynn Helms. The state’s oil production fell to 1.475 million b/d in December, down nearly 43,400 b/d, from what is now a record November, the North Dakota Pipeline Authority said Friday. Warmer winter weather this year has reduced US natural gas demand for heating. As production growth continues to exceed demand growth, US natural gas prices slumped this month to their lowest February levels in two decades. Natural gas prices at the Henry Hub benchmark closed at $1.77 per million BTUs last week. The IMF said in a report last week that the Gulf Cooperation Council (GCC) countries—Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates — urgently need deeper reforms in their economies. The global drive to mitigate the impact of climate change and boost renewable energy is threatening the immense wealth that the Arab Gulf oil producers have accumulated from crude oil over the past decades. In less than a decade and a half, the six members of the GCC members could see their combined $2 trillion wealth wiped out if they do not significantly accelerate fiscal reforms. |

2. Geopolitical instability

It has been relatively quiet in the Middle East recently. Washington continues its sanctions to bring Iran to the conference table, trying to force it to stop supporting various Shiite groups around the region in return for sanctions relief. Knowledgeable observers say the sanctions and the recent exchange of military blows have only made Tehran more determined to acquire a nuclear deterrent.

Last week, the new commander of Tehran’s revolutionary guards reiterated that Iran is ready to strike the United States and Israel if they give it any reason to do so. As China has been taking shipments of Iranian oil despite the US sanctions, the reduction in China’s oil imports as a result of the coronavirus epidemic could still bring more pressure on Tehran.

The US has again extended a waiver allowing Iraq to import Iranian electricity and natural gas despite US sanctions. Analysts had speculated that the US might allow the waiver to expire following Iraq’s parliament vote in January to expel US-led coalition troops, in response to the US killing of the Iranian General Soleimani. The vote drew the threat of a sanction from Trump. Baghdad is highly dependent on Iran’s natural gas for its power plants. With still more electricity shortages, the current protests are likely to become worse, threatening the stability of the country.

Forces loyal to Khalifa Haftar have blocked flights carrying UN staff to and from Libya, hampering humanitarian and mediation efforts, the UN mission said on Wednesday. Haftar’s eastern-based “Libya National Army” has, on several occasions in recent weeks, refused to grant permission for the regular UN flights to land. The LNA has been trying since last April to capture the capital Tripoli from the internationally recognized government but has failed to breach the city’s defenses. “The arms embargo has become a become a joke, we all really need to step up here,” U.N. Deputy Special Representative to Libya Stephanie Williams told a news conference in Munich. “It’s complicated because there are violations by land, sea and air, but it needs to be monitored and there needs to be accountability.”

Haftar controls the bulk of Libya’s critical oil infrastructure but does not have access to the oil revenues via the Central Bank of Libya. Neither does he control the state-owned National Oil Corporation.

In its latest information bulletin on the oil blockade last week, Libya’s state National Oil Corporation (NOC) confirmed a drop in production to 191,475 b/d, as of Wednesday, with losses at $ 1.3 billion.

Purchasers of Libyan oil so far have refused to deal with Haftar and the Eastern Government. However, sources say the LNA, which controls most of the country except Tripoli, is discussing ways to export crude from the oil terminals it controls, with some of its allies such as Russia, Egypt, and the UAE. The Tripoli-based NOC is the legitimate producer and exporter of Libyan oil, according to several UN resolutions, and this was also confirmed in the official communique at the recent Berlin peace talks. NOC has regularly warned its oil buyers and shipowners to avoid “illegal” cargoes from the east.

The situation is complicated by the on-going discussion of more OPEC+ production cuts. The revival of 1 million b/d to the international markets at a time of very low oil prices induced by the coronavirus epidemic is not going to help the current oversupply situation.

Chevron has boosted oil production at its joint venture with Venezuela’s PDVSA to the highest in almost a year, and the Maduro government is considering giving foreign oil field operators more control over their joint business with PDVSA as a way of advertising Venezuela’s oil industry and increasing revenues. The likely goal is to make it so attractive that the oil companies start to lobby harder in Washington to lift the sanctions.

Venezuela’s state-owned PDVSA has 677,000 b/d of crude available to sell this month, but no buyers because of US sanctions. The sanctions against the Maduro government alienated the few clients that were still daring to enter Venezuelan ports,” said a PDVSA official, who spoke on condition of anonymity. “For February, there is 661,000 b/d of crude that has no takers. PDVSA has offered deep price discounts for its crude, and flexible loading windows of more than 30 days, the official said.

Chevron is the only US company still doing oil business in Venezuela. The supermajor was granted a sanction exemption waiver by Washington, which was extended until April.

3. Climate change

The IEA says global carbon dioxide emissions from power production flattened last year at around 33 gigatons after two years of increase, even though the world economy expanded. The growth of renewable energy and fuel switching from coal to natural gas led to lower emissions from advanced economies. Milder weather in several countries and slower economic growth in some emerging markets also contributed, the agency said.

Emissions from the power industry in advanced economies fell to levels last seen in the late 1980s when electricity demand was one third lower than today, the IEA said. Power generation from coal plants fell by almost 15 percent last year due to the growth of renewable energy, fuel switching to gas, a rise in nuclear power, and weaker electricity demand. European Union emissions fell by 160 million tons or 5 percent last year from a year earlier due to more use of natural gas and wind power in electricity generation. The United States recorded a fall of 140 million tons or 2.9 percent in emissions from the previous year.

But emissions in the rest of the world increased by nearly 400 million tons in 2019, with almost 80 percent of the growth coming from countries in Asia where coal-fired power generation continues to rise. China’s emissions increased at a slower pace than previously due to slower economic growth and higher output from low-carbon sources of electricity such as nuclear and renewables. Emissions growth in India was “moderate” last year, according to the IEA. Coal-fired power generation in the country fell for the first time since 1973, but fossil fuel demand in other areas such as transport offset the decline in India’s power industry. Emissions grew strongly in southeast Asia, driven by robust coal demand.

While 2019 was a good year for emissions, increasing amounts of associated gas that is coming from US shale oil production will not last for much longer. Cheap natural gas prices are losing money for their producers, and, like shale oil, will not last forever. Steadily climbing global temperatures, increasing the need for more air conditioning as summer temperatures become intolerable, will in turn increase the demand for more coal. Economic growth will increase the demand for more energy. Those organizations which are projecting 20 or 30 years ahead are saying that carbon emissions will be higher in the future than today.

The IEA is working on a global roadmap to bring about rapid cuts to greenhouse gas emissions by 2030, its director Fatih Birol said Wednesday. The additional effort comes as the agency seeks to build a coalition of countries to accelerate efforts to reduce emissions and comes after an IEA report released Tuesday showed that global CO2 emissions from energy stabilized in 2019. “We are going to come up, just before our July 9 meeting, with a roadmap for the entire world [for] how to bring emissions down between now and 2030 at a very deep reduction,” Birol said.

As extreme wildfires burn across large swaths of Australia, scientists say we’re witnessing how global warming can push forest ecosystems past a point of no return. Some of those forests won’t recover in today’s warmer climate, scientists say. They expect the same in other regions scarred by flames in recent years; in semi-arid areas like parts of the American West, the Mediterranean Basin, and Australia, some post-fire forest landscapes will shift to brush or grassland.

Results from a decade-long study of greenhouse gases over the Amazon basin appear to show around 20 percent of the total area has become a net source of carbon dioxide in the atmosphere. One of the leading causes is deforestation. While trees are growing, they absorb carbon dioxide from the atmosphere; dead trees rerelease it. Millions of trees have been lost to logging and fires in recent years.

In the face of shifting poll numbers, top House Republicans are hoping to turn over a new green leaf with a fresh package of climate bills that addresses climate change by sucking carbon dioxide out of the air rather than cutting the use of oil and natural gas. Right-wing think tanks, which for decades have made a name for themselves by railing against the scientific consensus that human activity is warming the planet, aren’t yet willing to recognize the reality of human-caused climate change.

“The sponsors of these bills seem to be conceding the argument about whether global warming is a problem or crisis that needs government action,” said an executive at one of those conservative groups, the Competitive Enterprise Institute, who sees alarm among conservatives about global warming as a pretext for expanding government.

4. The global economy and trade wars

China’s latest figures showed 68,500 cases of the coronavirus and 1,665 deaths, most of them in Hubei. The National Health Commission reported on Sunday 2,009 new cases, down from 2,641 the previous day, and 142 new deaths, just one lower than the 143 on the previous day. All but four of the new deaths were in Hubei. The province has been virtually sealed off and locked down since Jan. 23, with schools, offices, and factories shut and most travel suspended. It says that companies cannot resume work without first receiving permission from the government.

China’s Communist Party leader, Xi Jinping, issued internal orders about the coronavirus epidemic in early January, about two weeks before his first public remarks on the outbreak. The speech confirmed for the first time that he was aware of the virus while officials at its epicenter were openly downplaying its dangers.

With the extended Lunar New Year holiday ending last Monday, last week was supposed to be the week that China returned to “normalcy.” However, as the coronavirus (now called cvid-19) spread, chaos ensued as the government struggled to contain the virus and get the economy moving again, with new orders and policies flying in all directions. Many outside experts on epidemics are saying that Beijing’s official numbers are still way too low.

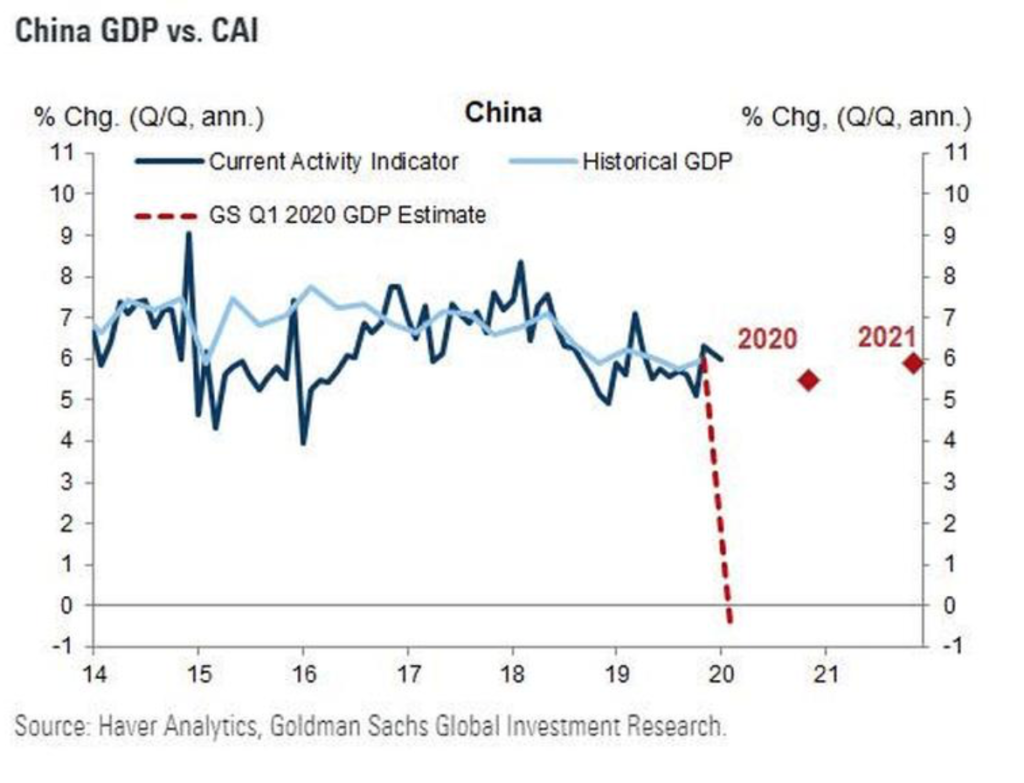

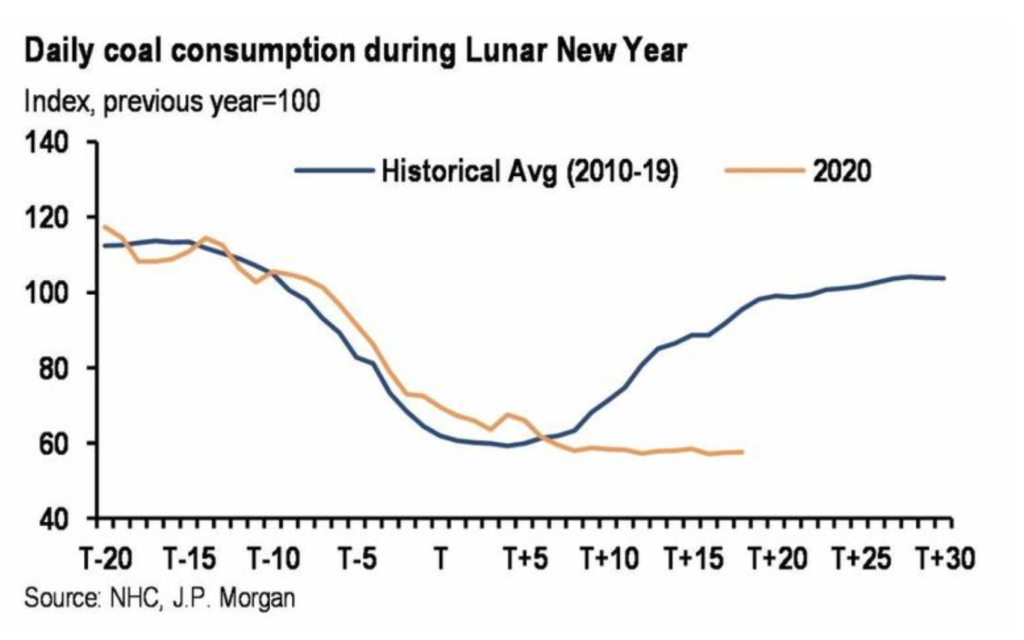

It is still too early to assess the economic impact of the virus. Indirect evidence such as daily coal consumption or the quality of urban air shows that the country’s economic activity is below 50 percent of normal. Two-thirds of scheduled airline flights were not taking place, and tens of millions of people are under a full or partial quarantine, which prevents them from getting to jobs. In some areas, anybody suspected of being ill is sent to a “quarantine facility,” which have minimal medical care.

The economic casualties from the epidemic are mounting as foreign plants run short of parts, Chinese tourists stay home, and American companies brace for falling sales. The financial hangover is expected to linger for months, even if the illness is soon brought under control. The Chinese epidemic’s aftereffects will probably cause the global economy to shrink this quarter for the first time since the depths of the 2009 financial crisis.

China’s independent refineries in eastern Shandong province have cut February runs to a four-year low of around 40 percent, down from 63.5 percent in January, as product sales slump due to the virus.

In other developments, The American Petroleum Institute warned the Trump administration that the US oil industry would be hard-pressed to produce all the oil China has committed to buy under the Phase 1 trade deal. Beijing is supposed to buy some $18.5 billion in additional energy supplies from the US this year and another $33.9 billion in 2021. According to the API, the total for 2020 and 2021 translates into an additional 1 million b/d of crude oil daily, half a million b/d of oil products, and 100 cargoes of LNG. Yet US oil production is projected to grow by less than 1 million b/d, and even this number is beginning to look shaky.

The German economy stagnated in the fourth quarter due to weaker private consumption and state spending, renewing fears of a recession just as the conservatives are preoccupied with a search for a new leader. Europe’s biggest economy has been losing momentum as its manufacturers linger in a recession prompted by a reduction in exports. At the same time, its automotive sector faces disruption from the shift to electric cars.

5. Renewables and new technologies

Rare Earth Elements (REEs) are used in the manufacture of smartphones, cars, television screens, and defense technologies. Wind generators and other green energy equipment need these substances to function. The “rare” in rare earth elements stem not from a scarcity of deposits, but rather in their sparse concentrations. Appalachia’s coal, along with fly ash and acid mine drainage, contains recoverable REEs, and extracting them via hydrophobic-hydrophilic separation has shown some successes.

Now the US National Energy Technology Laboratory is collaborating with the University of Kentucky and Virginia Tech to demonstrate a novel process for the extraction of REEs from coal using plasma. The objectives of this REE program are to demonstrate the feasibility and performance of existing commercial or newly developed separation technologies. These technologies are aimed at separating and recovering REEs from coal containing a minimum of 300 ppm and concentrating them to levels greater than 2 percent by weight, thus producing 90 to 99.99 percent high-purity, salable, rare earth metal oxides.

If a geothermal well could tap into a reservoir of supercritical fluids and use them to spin a turbine on the surface, it would be one of the most energy-dense forms of renewable power in the world. In Tuscany’s Apennine Mountains, the Venelle-2 geothermal well is being drilled. This well reaches nearly two miles beneath the surface to a region where temperatures and pressures are so high that rock begins to bend.

Drilling at Venelle-2 stopped just shy of when temperatures at the bottom of the well overwhelmed the equipment. Sensors at the bottom of the well indicated temperatures had breached 1,000 degrees Fahrenheit and pressure 300 times greater than at the surface. Nevertheless, Venelle-2 is the hottest borehole ever created, and it demonstrated that it’s possible to drill at the extreme end of supercritical conditions. And this week, a paper published in the Journal of Geophysical Research showed that it could be done without producing any significant seismic activity.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

Stranded assets: Few, if any, oil and gas companies have ever told investors that a large chunk of their assets could be doomed to forever remain buried in the ground – and essentially worth nothing – should environmental regulations tighten. Yet, the specter that these assets might one day end up stranded and theoretically worthless as the clamor for clean energy heats up looms large. According to estimates in the Financial Times’ Lex column, nearly $900 billion worth of reserves – or about one-third of the value of big oil and gas companies – is at risk of one day becoming worthless. (2/13)

BP’s oil and gas output is expected to decline “gradually over time” as it pursues a goal of becoming carbon neutral in its business overall, and in the carbon content of its production, new CEO Bernard Looney said Wednesday. (2/13)

In Russia, Rosneft’s hydrocarbons production reached 5.8 million barrels of oil equivalent per day in 2019, CEO Igor Sechin said Tuesday during a meeting with Russian President Vladimir Putin. Russia’s participation in the OPEC+ crude production agreement limited Rosneft’s output in 2019. (2/12)

Israel ordered natural gas production at the vast offshore Leviathan field to be reduced by around 40 percent after a fault was detected in a subsea pipeline leading to the wells, the energy ministry said. There wasn’t any damage to the platform and associated facilities, nor any leak into the sea, the ministry added. Leviathan has just begun production, and the fault discovered on Thursday was the second malfunction on the site this week. (2/14)

Sources from Kuwait and Saudi Arabia last week let it be known that trial production of 10,000 b/d would start at the Khafji field in the ‘Partitioned Neutral Zone’ (PNZ) that it shares with Kuwait on or around the 25th of February, with the field likely to be pumping about 60,000 b/d by August. Trial production of 10,000 b/d will also begin in the Kuwaiti area of the Zone in late March, likely increasing to around 80,000 b/d by the end of September, according to the sources. The plan is that within 12 months, Khafji will be producing approximately 175,000 b/d and Wafra about 145,000 b/d. (2/13)

Neutral zone start-up: Crude oil from the Wafra field in the Neutral Zone shared by Saudi Arabia and Kuwait could flow again as soon as this weekend after a nearly five-year hiatus, with joint operator Chevron on Thursday saying it is preparing to restart operations. (2/14)

In the United Arab Amirates, Fijian soldiers may become guards of strategic assets under a memorandum of understanding the two countries are to sign after current negotiations conclude, Fijian media report. The most likely assets to be guarded by Fijian troops will be the Emirates’ oil fields. (2/15)

Nigeria’s oil production could drop by 35 percent in the next ten years as regulatory uncertainty and costs amid languishing oil prices may prompt oil majors to postpone final investment decisions on three major deepwater projects, according to consultant Wood Mackenzie. (2/14)

Nigeria’s oil minister said that about one billion barrels of crude oil had been discovered in the Northeastern part of the country, with more to follow. (2/13)

The Canadian police on Monday began moving against protesters who had set up transportation blockades around the country in sympathy with an Indigenous group’s campaign to halt construction of a natural gas pipeline to Canada’s West Coast. The first blockade appeared on Thursday night and led to the shutdown of all rail passenger trains between Toronto, Montreal, and Ottawa. (2/11)

The US oil rig count edged up by two to 678, according to Baker Hughes data. Gas rigs declined by one to 194, as did the miscellaneous count, leaving the total rig count unchanged at 790, down 261 total rigs over the last 52 weeks.

US crude oil exports will average 3.6 million b/d in 2020, a growth of 650,000 b/d from 2019 but 300,000 b/d lower than previously expected on slower production growth, and as Gulf Coast refiners use more domestic, light, sweet grades. (2/12)

Closure on PA refinery: A federal judge finally confirmed the Chapter 11 bankruptcy plan of Philadelphia Energy Solutions (PES) on Thursday. The plan includes the sale of PES’s 1,300-acre refinery complex to a real estate company — putting an end to the largest oil refining operation on the East Coast. (2/15)

SPR sale proposed; President Donald Trump has proposed selling 15 million barrels of oil from the US emergency stockpile—the Strategic Petroleum Reserve—as part of his fiscal 2021 budget plan. The proposal, which requires approval from Congress, would use the proceeds of the sale to fund certain Energy Department activities, including the environmental remediation of an oil field in Elk Hills, California, the government once owned that. (2/11)

Oil spill worse than expected: A new study of farther-reaching damage from the Deepwater Horizon disaster comes as the Trump administration is preparing to allow the oil and gas industry to buy leases in every part of the Atlantic, Pacific, and Arctic oceans, in addition to a leasing expansion in the Gulf. (2/13)

EU car sales: Overall, in 2019, almost 60 percent of all new cars registered in the European Union ran on gasoline (58.9 percent, compared to 56.6 percent in 2018), while diesel accounted for 30.5 percent of registrations (35.9 percent in 2018). Last year, 3.0 percent of new passenger cars in the EU were electrically chargeable vehicles (one percentage point more than in 2018). (2/10)

EU wind turbines generated a record 109 GW Sunday afternoon as a powerful storm moved across Northwestern Europe. Wind covered 27.4 percent of European power demand on the day. (2/11)

UK wind: The UK needs to invest $62 billion in wind machines to reach their energy production target of 40 GW of wind power capacity by 2030. The UK’s offshore wind capacity currently stands at 10 gigawatts, having been a mere one gigawatt at the beginning of the last decade. Ten GW of new wind power facilities has been contracted, meaning an additional 20 GW worth must still be contracted. (2/14)

US coal production is forecast to be about 596 million tons in 2020, down 13.7 percent from the estimated 2019 output of 690 million tons, data from the EIA shows. It projects production of about 587 million tons for 2021, the lowest level since the early 1970s. (2/12)

Air quality mortality: More than half of all air-quality-related early deaths in the United States are a result of emissions originating outside of the state in which those deaths occur, MIT researchers report in a paper in the journal Nature. The study focuses on the period between 2005 and 2018 and tracks combustion emissions of various polluting compounds from numerous sectors, looking at every state in the contiguous US (2/15)

EPA slash proposed: President Trump’s proposed budget for fiscal 2021 calls for significant reductions to environmental programs at federal agencies, including a 26 percent cut to the EPA. Trump’s budget would eliminate 50 EPA programs and impose massive cuts to research and development, while also nixing money for the Energy Star rating system, which would rely on businesses to pay a fee to participate in the program. Trump has consistently proposed cutting funding for agencies such as the Energy Dept. (-8%), the Dept of the Interior (-16%), and the EPA. At the same time, Congress has routinely ignored the president’s budget request by instead increasing funding. (2/12)

Renewables climb: California continues to lead the nation in renewable generation, but multiple other states are rapidly increasing renewable capacity, and the US EIA projects renewables will surpass natural gas generation as the lead fuel source by 2045. (2/15)

Damming the sea? A proposal to build two huge barriers — one that would connect Norway to Scotland, the other France to England — was described as a warning about the urgency of the climate crisis. (2/15)

Climate policy shift? Despite having a sharply divided US Congress often at odds with the White House, power market experts said Wednesday they see bi-partisan movement on energy and climate-related initiatives that could significantly impact power markets in the near term. (2/13)

Antarctic record temps: A weather research station on Seymour Island in the Antarctic Peninsula registered a temperature of 69.3 degrees (20.75 Celsius) on Feb. 9. The nearly 70-degree temperature is significantly higher than the earlier record 65-degree reading taken Feb. 6 at the Esperanza Base along Antarctica’s Trinity Peninsula. (2/14)

An iceberg about twice the size of the District of Columbia broke off Pine Island Glacier in West Antarctica sometime between Saturday and Sunday, satellite data shows, confirming yet another in a series of increasingly frequent calving events in this rapidly warming region. (2/11)

Florida GOP and climate change: Florida Rep. Chris Sprowls, a Republican, declared it so in September 2019 at a speech designating him the next speaker of the House: “We need to stop being afraid of words like ‘climate change’ and ‘sea-level rise.’” And Republican Gov. Ron DeSantis has used the term repeatedly since his campaign for the job in 2018, even saying it three times in a news release that announced a new statewide job, chief resilience officer, tasked with preparing Florida for sea-level rise. (2/12)

Tree planting fix? Republican lawmakers on Wednesday will propose legislation setting a goal for the United States to plant a trillion trees by 2050 to fight global warming, a plan intended to address climate change by sucking carbon out of the air instead of by cutting emissions. The proposed legislation reflects an acknowledgment in the Republican party of rising voter demand for action on climate change, even as it seeks to preserve the economic benefits of a historic drilling boom that has made the US the world’s biggest oil and gas producer. (2/13)

No-sacrifice fix: People warned Marc Benioff, the billionaire CEO of Salesforce, not to bother talking to the White House about global warming. But Mr. Benioff, a tech mogul and environmental philanthropist felt sure he had found a climate change solution that even President Trump could love: Planting trees. The idea of planting one trillion trees had one enormous political advantage: It was practically sacrifice-free, no war on coal, no transition from fossil fuels, no energy conservation, or investment in renewable sources of power that Mr. Trump did not favor. (2/13)

Carbon-capture techniques have existed for decades. But it’s incredibly expensive—not to mention energy-intensive—to remove the carbon dioxide from the atmosphere on a large enough scale to make a significant dent. Now, Exxon Mobil Corp., Microsoft Corp., and others are focused on reducing the cost and the amount of energy required to capture carbon dioxide. (2/13)

In southeastern Australia, a four-day downpour across the east coast has brought relief after months of devastating bushfires and years of drought, but also widespread storm damage and forecasts of more wild weather to come. The weekend drenching represented the biggest sustained run of rainfall in Sydney and surrounding areas for 30 years, dousing some bushfires and replenishing depleted dams across New South Wales, the country’s most populous state. (2/10)

Insurance hike: US companies are paying more for insurance, a reversal after years of flat or declining rates for property and liability policies. Insurers have raised prices aggressively in the past year on companies of all sizes across the country. And they have warned price hikes are likely to continue. The turnabout underscores a challenging landscape…catastrophe losses and continued low-interest rates, which have weighed on their investment returns. (2/11)

Cracking down on plastic: Federal lawmakers unveiled a new bill Tuesday in the latest attempt to tackle the plastic pollution crisis by shifting waste and recycling costs away from governments and on to companies. (2/12)

The Nile River is under assault from pollution, climate change, and Egypt’s growing population, which officially hits 100 million people this month. And now a fresh calamity looms. A colossal hydroelectric dam being built on the Nile 2,000 miles upriver, in the lowlands of Ethiopia, threatens to constrict Egypt’s water supply further — and is scheduled to start filling this summer. (2/10)