Editors: Tom Whipple, Steve Andrews

Quote of the Week

“Climate change is happening faster than it’s ever happened before in our record. We’re right in the middle of it.”

Bryan Thomas, the station chief, Barrow Atmospheric Baseline Observatory, Alaska’s and America’s northernmost scientific outpost.

Graphic of the Week

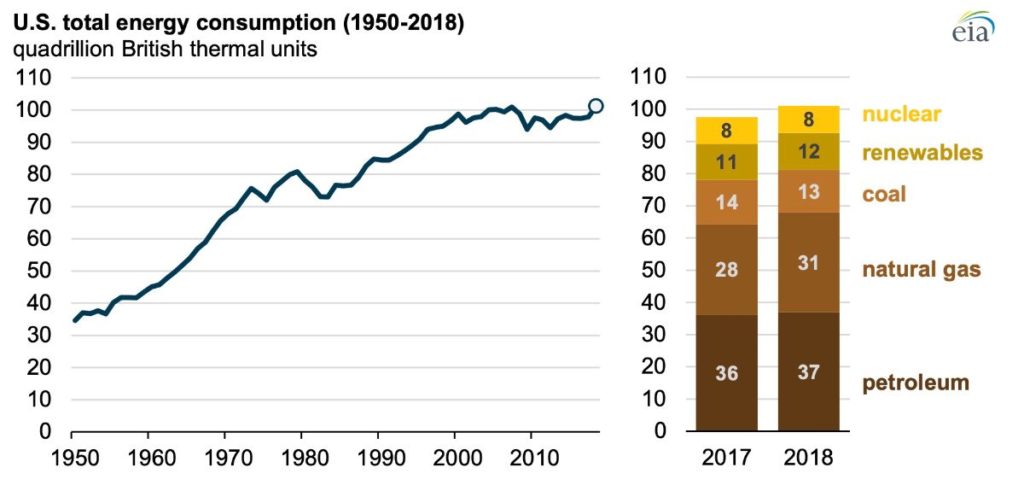

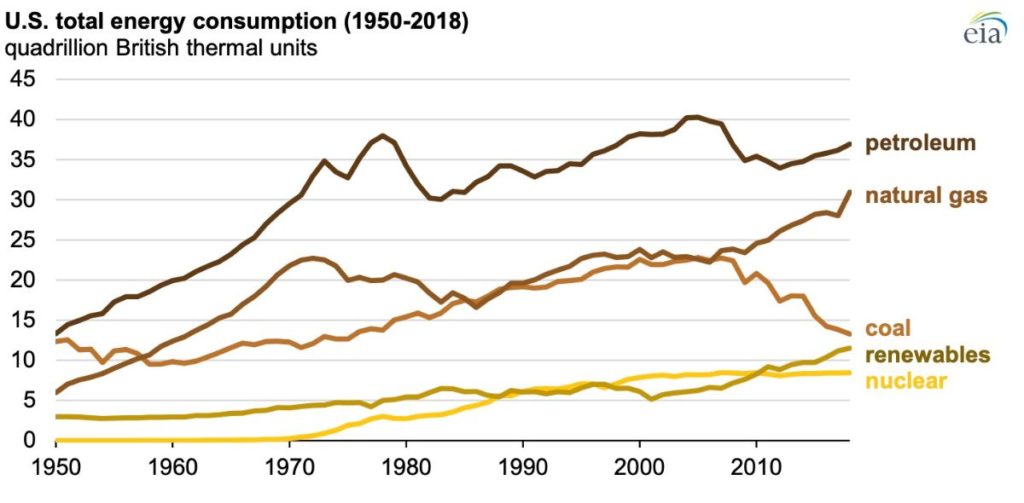

| Contents 1. Oil and the Global Economy 2. The Middle East & North Africa 3. China 4. Nigeria 5. Venezuela 6. The Briefs 1. Oil and the Global Economy Oil prices continued to climb slowly last week with Brent closing just below $72 a barrel, a new high for the year, and New York futures closed $8 a barrel lower at $64. Prices are still about $13 a barrel below the 2018 high of $85 set last October. The news last week was generally bullish with the Saudis reporting an official 277,000 b/d drop in February, Iran having trouble selling its oil, Venezuela’s production continuing to fall, and the prospect that the civil war in Libya seems likely to reduce its exports. China reported that its massive dose of pump priming appears to have stabilized its economic slowdown for now and Washington keeps talking about an end to the China-US trade dispute. The US oil rig count fell by eight to 825 for the first time in three weeks as production growth forecasts, except those of the ever-optimistic EIA, continue to shrink. US refineries are due for some heavy maintenance this spring which is likely to cut oil product output and force up retail prices. The average US retail price for a gallon of regular is now up to $2.84, and California topped $4 a gallon last week due to local problems. On the bearish side, the EIA forecast last week that US crude oil output from seven major shale formations is expected to rise by about 80,000 b/d in May to a record 8.46 million b/d. Talk continues that the OPEC+ production cut may not continue beyond June, which could drop more than a million b/d onto the market. The OPEC Production Cut: There was little movement on the issue of extending the OPEC+ production cut last week. The Saudis and Russian continue to maintain it is too early to decide before May. On Wednesday, Russia’s Energy Minister Novak reiterated that it was too early to speak about preferable options. “We should do what is more expedient for us, and the deal should be aimed at balancing the global oil market but should not be designed to achieve a certain oil price level.” However, Vadim Yakovlev, first deputy CEO of Gazprom Neft expects the OPEC+ deal to end in the first half of the year. “In that case, Gazprom Neft’s (the oil arm of natural gas giant Gazprom) oil production will be higher by around 1.5 percent from last year.” This assertion is one of several by Russian officials that the deal will be over at the end of June. Russia’s crude oil production stood at around 11.24 million b/d at mid-April, according to Reuters, citing an industry source. This announcement means that Moscow has yet to live up to its pledge to cut 230,000 b/d from its record post-Soviet high of 11.421 million b/d last October. The Russians are very good at surging to establish an abnormal base just before production cut agreements. In reality, Moscow has done little to cut production this time, saying it was not possible to cut output during the cold winter months. The Saudi energy minister recently said it was premature to tell whether a consensus existed among OPEC and its allies to extend the supply cuts, but a meeting next month would be key. A joint OPEC and non-OPEC ministerial committee known as the JMMC is due to meet in May. Saudi Arabia and Russia are members of the panel, which includes other major oil producers that took part in a global supply-cutting agreement. US Shale Oil Production: According to Paal Kibsgaard, the CEO of oilfield services giant Schlumberger, investment in the US shale oil industry continues to fall, production growth is slowing, and the balance of spending is shifting to other parts of the world. He said that “the higher cost of capital, lower borrowing capacity, and investors looking for increased returns” from the US shale industry would mean that exploration and production companies would have to limit spending on new wells to what they could cover from their cash flows. The US shale oil industry is likely to be cutting total expenditures by about 10 percent. However, this assessment of the future of the US shale oil industry comes as some of the world’s largest oil companies, including ExxonMobil and Chevron of the US, are committing heavily to the Permian Basin, as seen in Chevron’s recent $50 billion deal to buy Anadarko Petroleum. Kibsgaard believes major oil company aspirations will not be enough to outweigh the general trend. He also notes that the drop-off in investment in US shale reflects a move “toward a more sustainable financial stewardship of the global resource base,” as companies use less debt financing to increase production. Contrary to this opinion is the EIA’s forecast that US oil production will grow by another 1.4 million b/d this year. Despite the EIA’s optimism in its April Drilling Productivity Report which forecasts an 80,000 b/d increase in production during April, the report also says that its March estimate for the December to March increase of 282,000 b/d was revised down to 42,000 b/d. Total oil shale liquids supply was revised down 213,000 b/d to 8.38 million b/d in April, including downward revisions of 83,000 b/d for the Permian, 84,000 b/d for the Bakken and 20,000 b/d for Eagle Ford. Among the other problems the shale oil industry currently is facing is that the Permian Basin is producing so much unneeded natural gas, along with its oil, that drillers are being forced to burn the gas or slow oil production. Bloomberg reports that at the end of last year, producers were flaring enough natural gas to power every home in Texas. The lack of natural gas pipelines from the booming Permian Basin will hinder oil producers in the region at least into 2020, according to a new report from Moody’s. While there’s a rush to bring more oil pipelines online to carry the crude away from the Permian, there are fewer natural gas pipeline projects in the works. 2. The Middle East & North Africa Iran: Oil exports have dropped in April to their lowest daily level this year, as waivers are soon set to expire according to Refinitiv Eikon and tanker tracking data. The US will announce new waivers—if there will be any—on May 2. Last-minute buying pushed Iran’s March exports near the previous months’ levels as waiver-holders sought to get shipments in under the wire. January and February exports from Iran were higher than many thought they would be, between 1.1 and 1.3 million b/d. Iran shut down some oil fields in its southwestern Khuzestan province bordering Iraq and the Persian Gulf as a result of flash floods that have caused billions of dollars in damages. By week’s end, however, crude production in the flooded oil fields was down by only 10,000 b/d to 20,000 b/d. These oil fields usually produce some 320,000 b/d, so the flooding does appear to have had a significant impact. Iraq: Prime Minister Abdul-Mahdi traveled to Saudi Arabia this week and met with King Salman in a sign of deepening relations between two countries that for years had no diplomatic ties. The two countries signed agreements in the fields of energy, power, and education; however, analysts said the value of the trip was mostly symbolic. For years, Riyadh sponsored Sunni armed groups and politicians to challenge the Shiite-led political order that took over after the US toppled Saddam Hussein. Now, however, the Saudis are seeking to engage with moderate Shiite politicians. Many Iraqi politicians have come to resent Iran’s involvement in their affairs and wish to diversify the country’s relationships. Moreover, sectarian identity is shrinking as a force in Iraqi politics. Baghdad is still heavily committed to the Shiite government in Tehran so there are limits to how far improved relations will go. Iraq is set to build a 150,000 b/d oil refinery in the northern city of Kirkuk, according to Iraqi Oil Minister Thamer Ghadhban. Such a refinery would help to solve Baghdad’s problem of the 300,000 b/d of crude that currently is exported to the Turkish port of Ceyhan via Kurdistan – the only available export path. Last November, Iraq resumed oil exports from the Kirkuk province, a year after it had stopped oil flows due to a dispute with the semi-autonomous Kurdistan region. Baghdad is planning to increase production from around Kirkuk and would like to reduce its dependence on the Kurds’ pipelines to ship the oil. Saudi Arabia: The kingdom continued to cut its oil exports as this year progressed, with February crude shipments dropping by 227,000 b/d from January to just below 7 million b/d. According to data released last Thursday by the Joint Organizations Data Initiative database, which collects self-reported figures from 114 countries, Saudi Arabia’s crude oil exports stood at 6.977 million b/d in February, compared to 7.254 million b/d in January and 7.687 million b/d in December 2018, when the Kingdom started to cut its oil supply aggressively. In early March, the Saudis signaled their determination to do ‘whatever it takes’ to rebalance the market by keeping its April crude oil exports at below 7 million b/d, despite requests for more oil from its customers. The lower allocations by Saudi Aramco for April will also mean that the Kingdom’s oil production will be “well below 10 million bpd” in April. Ibrahim al-Muhanna, an adviser to the Saudi energy minister, said last week he expects the oil market to be “well balanced” soon. “This year, we have seen the implementation of the OPEC Plus decision. It is possible to extend the cut until the end of the year depending on market conditions,” al-Muhanna told an oil summit in Paris. Aramco is in “serious discussions” to buy up to 25 percent of the refining and petrochemicals businesses of India’s largest company, Reliance Industries, the Times of India reported on Wednesday. The two sides could reach an agreement on the value of the stake by June, the Indian outlet’s sources said. A stake of 25 percent could bring around $10 billion to $15 billion for Reliance, which would value the Indian company’s total refining and petrochemicals business at some $55 billion-$60 billion. In recent years, the Saudis have been pursuing downstream acquisitions in Asia, aiming to lock in future demand for Saudi crude oil. India’s demand for oil is snowballing and is the world’s third-largest oil consumer after the US and China. Libya: The death toll now exceeds some 200 in the fighting taking place in the southern suburbs of Tripoli, where General Haftar and his Libyan National Army is seeking to take over the country. Haftar is backed by Egypt, Russia, the Saudis, and the UAE, while the UN-sponsored government is supported by most of the international community. So far there are no reported disruptions to oil exports as most oil facilities are far from the fighting. The likelihood of significant interruptions increases every day as cutting oil production is one of the few levers available to Haftar’s opponents. On April 7th, Secretary of State Pompeo said, “We have made clear we oppose the military offensive by Haftar’s forces and urge the immediate halt to these military operations against the Libyan capital.” Pompeo noted that there was no military solution to Libya’s woes and urged Libyan leaders to return to U.N.-brokered political negotiations. Last week, however, President Trump undermined Pompeo and flipped the US onto the side of Haftar’s efforts to seize the country. In a White House statement, the President “recognized Field Marshall Haftar’s significant role in fighting terrorism and security of Libya’s oil resources, and the two discussed a shared vision for Libya’s transition to a stable, democratic political system.” The new US policy is likely to prolong the fighting and lead to a large number of casualties as Washington turns its back on the international community’s and the UN’s efforts to broker a peaceful solution. Aside from his infatuation with “strongmen” the president seems to have been persuaded that a Haftar victory is the best way to keep the 1 million b/d of Libyan oil flowing. With Washington tightening the screws on Iran and Venezuela, the collapse of Libyan oil production would likely drive oil prices higher. 3. China China’s economy stabilized in the first quarter after Beijing flooded the financial system with money in a whatever-it-takes approach to arrest a slowdown. The Chinese economy grew 6.4 percent in the first three months compared with the same period in 2018. The pace of growth matched that of the fourth quarter when growth slowed. While economists generally regard China’s economic figures with skepticism, the new numbers point to signs that the country’s slowdown may have reached the bottom. The improved economic situation is mostly a product of the hundreds of billions of dollars that Beijing has pumped into the country’s economy in recent months, as well as the loans that officials have pressed state-run banks to make to businesses. All of that comes at a cost, however, and it raises a question about how willing Beijing is to spend to keep growth going. Some believe that the first quarter’s growth is not solid, and we will see another dip in economic activity shortly. Beijing appears to have kept the flow of crude into strategic and commercial storage facilities at high levels in the first quarter, even as the price of oil climbed. China’s refineries processed 12.6 million b/d of crude in the first quarter, up 4.4 percent from the three months to end-December, and also up by the same margin from the first quarter of last year. Crude imports in the January-March period were 9.83 million bpd, while domestic output was 3.84 million bpd, giving a total of 13.67 million bpd. Subtracting the refinery throughput from the total crude available leaves a gap of 1.07 million bpd, and it’s this oil that has likely found its way into either SPR or commercial storage tanks. African swine fever is plaguing China’s pork production. To meet China’s insatiable demand for pork, Beijing is turning to imports, which are expected to hit a record high in 2019. The European Union, Brazil, Canada, and the United States are providing the meat. “China normally accounts for 49 percent of global pork consumption. This epidemic is a big problem for China, and analysts expect it to be a five to seven years before pork production will return to normal. 4. Nigeria The nation’s fuel shortage worsened last week as consumers spent hours in queues waiting to fill up, despite assurances by the Nigerian National Petroleum Corporation that all was well. Two weeks ago, the IMF called for Nigeria to eliminate the subsidy which kept retail gasoline prices below $2 a gallon. While the local oil workers union berated the IMF for such a dastardly suggestion as raising the price of gasoline, the government announced that it had no plans to remove the subsidy. Fear that the fuel subsidy might be removed was enough to trigger panic buying which led to the shortages. The World Bank says the fuel subsidy cost the government some $2 billion last year which should be spent on education and infrastructure. The last legislation on the flaring of natural gas that is produced along with oil was the Associated Gas Re-injection Act of 1979, which came into force 40 years ago. Since then there has been no review or amendment of the Act despite its devastating effect on the host communities. Last week, the Nigerian Senate passed a new bill, which provides for penalties against improper gas flaring and other malpractices in the oil and gas sector. The Bill has sections on punishment for supplying inaccurate data, a gas flaring penalty fee, and empowers the minister to make regulations, as well as a repeal of the Associated Gas Re-injection Act 1979. Like so much else in Nigeria, it is doubtful that this bill will reduce the widespread flaring of natural gas, but it is a start. 5. Venezuela PDVSA is funneling cash from its oil sales through Russia’s Rosneft as it seeks to evade US sanctions. The deals are the latest sign of the growing dependence of Venezuela’s cash-strapped government on Russia as the US tightens a financial noose. There was no news about oil production this week which is thought to be in the neighborhood of 600,000 b/d. Spain’s Repsol is suspending fuel shipments to Venezuela due to fears that it could violate the US sanctions against the Latin American nation. Refineries in Venezuela are no longer able to supply sufficient oil products, which forced the government to import much of its needs. The fuel provided by Repsol to Venezuela is in exchange for crude oil. Repsol and Venezuela began the product swaps in late 2018, and have continued the arrangement until now, despite the sanctions that have been in place for months. At least two tankers chartered by Repsol—laden with PDVSA crude oil—have been sitting off the Venezuelan coast for more than a week. They join tankers chartered by Chevron, Citgo, and Valero who are also having problems figuring out whether doing business with PDVSA is still in their best interest, and if so, how to go about paying for the crude. Venezuelan opposition leader Juan Guaido will seek to annul an $8.7 billion arbitration award to ConocoPhillips as he moves to preserve foreign assets. If accepted, the annulment request would halt enforcement of the award over the 2007 loss of Conoco’s projects in the South American country. It would follow a March decision by the World Bank’s International Center for Settlement of Investment Disputes to impose the arbitration award against Venezuela. Guaido is looking at the situation in the country after Maduro leaves and realizes that paying $8.7 billion for the nationalized assets will slow economic recovery for a long time. 6. The Briefs (date of the article in Peak Oil News is in parentheses) Total OECD annual production of crude oil, natural gas liquids, and refinery feedstocks increased by 10.3 percent in 2018 compared to 2017, reaching a record total monthly production of over 100 million tons at the beginning of the year and remaining above this for almost all of 2018, according to the IEA. This trend was observed across all OECD regions with the OECD Americas seeing the largest growth (+12.2 percent), followed by OECD Europe (+0.6 percent) and OECD Asia Oceania (+2.5 percent) in absolute terms. (4/20) The era of oil is coming to an end, according to Energy Watch Group based in Germany. To avoid a global economic slump, the transition to 100 percent renewables worldwide needs to be accelerated. The group says peak oil has been constantly underestimated by media, politics, and companies alike. Back in 2008, Energy Watch Group was among the first to warn about peak oil in a study finding that global oil supply is likely to decrease by 2020. (4/20) (Editors’ note: since turn of the century, when the discussion about peak oil ramped up, nearly all estimates of the year when peak oil would hit have been proven too pessimistic.) In the Caspian Sea, BP PLC and its partners will lead a $6 billion development of the giant Azeri-Chirag-Deepwater Gunashli oil-field complex offshore Azerbaijan, the U.K. oil major said Friday. (4/20) Kuwait will start this year the first phase of a heavy oil field production. They aim to reach 60,000 b/d by January with an ultimate goal of producing 430,000 b/d of heavy crude. Kuwait—like another Saudi ally, the United Arab Emirates (UAE)—is strictly adhering and even over-delivering in its production reduction under the OPEC+ deal. Kuwait’s crude oil output in March stood at 2.709 million bpd, according to OPEC’s secondary sources. (4/18) Offshore the border of Senegal and Mauretania, Tortue FLNG is edging increasingly closer to its estimated commissioning date, 2022. It is one of the largest deepwater gas find of recent years – discovered in 2015, the field complex in total is estimated to contain 20 Trillion cf of gas, of which the Tortue West field takes up around 15 trillion cf. The project represents one of those rare occasions when two developing nations have agreed to a fair and equitable distribution of resources. (4/18) Offshore Guyana, Exxon Mobil said on Thursday the US oil major along with its partners have made another oil discovery. That adds to the previously estimated 5.5 billion barrels of oil-equivalent. The discovery was in the Stabroek Block, which is expected to become a major development hub. This is the thirteenth discovery in the block, which is part of one of the biggest oil discoveries in the world in the last decade. Hess Corp and China National Offshore Oil Corporation are part of the consortium. (4/19) Chevron 1, Ecuador 0: The Supreme Court of the Netherlands dismissed Ecuador’s attempts to annul decisions of an international arbitral tribunal that ordered Ecuador to prevent enforcement of a $9.5 billion judgment against Chevron Corp anywhere in the world, the US oil major said on Tuesday. (4/15) The US oil rig count declined by eight to 825 while gas rigs dropped by two to 192, according to GE’s Baker Hughes. Total active rigs came in at 1,017. Year-to-date, the total number of oil and gas rigs active in the United States has averaged 1,039. That keeps the total count for 2019 on track to be the highest since 2014, which averaged 1,862 rigs. (4/19) Permian pipes: Two new projects to enhance the local Permian crude gathering and trunk line infrastructure were announced earlier this week, which could help bolster Permian crude prices by expanding takeaway capacity. (4/20) The US nearly doubled its oil exports in 2018, the EIA reporting on Monday. Exports increased from 1.2 million barrels per day in 2017 to 2.0 million b/d last year. That increase was in line with increased oil production, which averaged 10.9 million b/d last year, and was made possible by changes to the Louisiana Offshore Oil Port (LOOP) which allowed it to load VLCCs. (4/16) American refiners are preparing for a busy overhaul season in the second quarter of 2019 as the entry into effect of the new International Maritime Organization’s emission rules approaches. Total US production of refined production has already fallen 8.5 percent since the start of the year, suggesting it has yet to fall further. The aim is to avoid the need for maintenance closures ahead of winter this year. The new IMO emission rules cap sulfur emissions from bunkering fuel at 0.5 percent, which is a substantial reduction on the current 3.5-percent cap. As a result, refiners have raced to prepare for the demand for new, lower-sulfur fuels. Many see the upcoming changes as the most important to hit the refining industry in many years. (4/20) The State of Washington’s House of Representatives has just passed a bill to reduce vapor pressure limits on crude-by-rail shipments through the state. If the bill becomes law, analysts say that it could create cost barriers for Bakken oil producers to ship their oil to the Pacific Northwest and could increase Washington State’s imports of crude from sources other than North Dakota, such as Alaska and Asia. (4/16) ConocoPhillips is exiting the oil exploration and production market in the U.K., the latest move by the company to refocus its portfolio. The company said Thursday it reached a deal to sell two subsidiaries that focus on production in the U.K.’s North Sea for about $2.68 billion in cash to Chrysaor E&P Ltd. (4/19) The US Gulf Coast imported the least amount of crude in nearly three decades as shipments from Iraq plummeted and congestion lingered on a critical waterway weeks after a blaze and chemical spill at the Intercontinental Terminals Co. tank farm. (4/20) Primary energy consumption in the US reached a record high of 101.3 quadrillion British thermal units (Btu) in 2018, up 4 percent from 2017 and 0.3 percent above the previous record set in 2007. The increase in 2018 was the largest increase in energy consumption, in both absolute and percentage terms, since 2010. Consumption of fossil fuels—petroleum, natural gas, and coal—grew by 4 percent in 2018 and accounted for 80 percent of US total energy consumption. Natural gas consumption reached a record high, rising by 10 percent from 2017. This increase in natural gas, along with relatively smaller increases in the consumption of petroleum fuels, renewable energy, and nuclear electric power, more than offset a 4 percent decline in coal consumption. (4/17) |

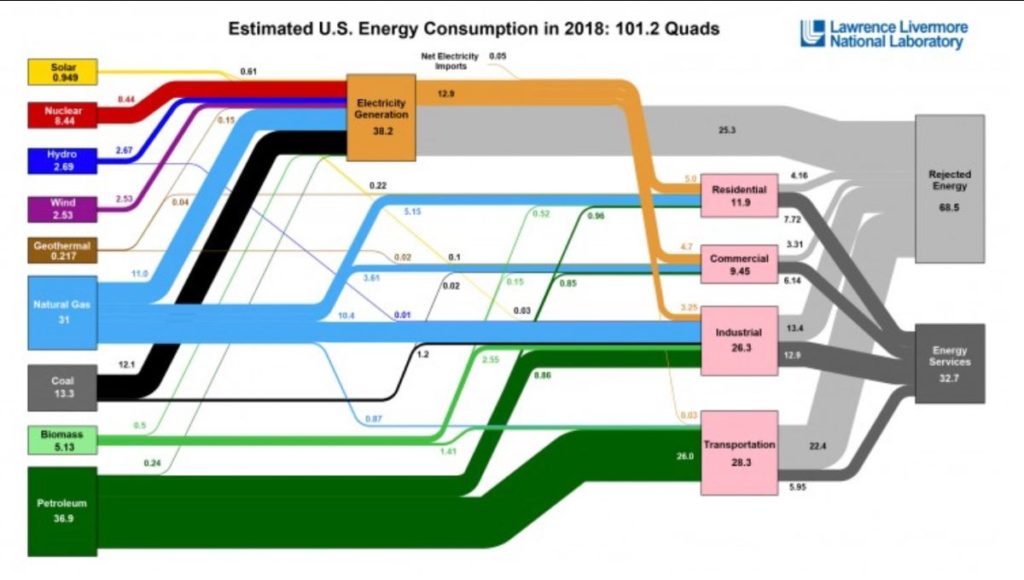

Energy spaghetti chart: Lawrence Livermore National Lab released their energy flows chart for US energy consumption for 2018. (4/17) (Ed. note: the “rejected” or wasted energy is always worth a close study.)

US natural gas and power markets experienced higher average prices in 2018, while gas markets had record high demand and supply, and power generation capacity additions were led by gas-fired and wind-powered resources. US gas spot prices generally rose in 2018, with Henry Hub averaging $3.12/MMBtu for the year, up 5 percent from $2.96/MMBtu in 2017, FERC reported. Total retail sales across all sectors have remained steady since 2015, when accounting for differences in weather and increased economic activity (4/19)

Natural gas futures tumbled to the lowest in almost three years as US shale output swamps the market amid mild spring weather, soothing concern about a potential supply crunch next winter. A seasonal lull in heating and cooling demand, coupled with surging production, is accelerating gains in stockpiles of the fuel in underground caverns and aquifers. While inventories are more than 30 percent below normal, they’re poised to refill quickly. (4/18)

FERC favors LNG exports: A day after the Federal Energy Regulatory Commission approved two more major US Gulf Coast LNG projects, the agency’s chairman was bullish Friday on the notion that even more US LNG is needed. FERC Chairman Neil Chatterjee answered strongly in the affirmative when asked if it is important to advance more US LNG export projects. (4/20)

The Haynesville Shale in northeastern Texas and Louisiana is producing 10.522 billion cubic feet per day of natural gas this month, and is expected to produce even more next month, beating the previous production record of 10.4 billion cu ft/day from back in 2011. Among the key shale plays in the U.S., Haynesville currently ranks third in terms of natural gas production after the Appalachia basin (Marcellus and Utica shale plays) and the Permian region. (4/20)

Colorado Governor Jared Polis declared an end to the “oil and gas wars” in the state Tuesday after he signed into law legislation giving local governments more control over future drilling sites. (4/18)

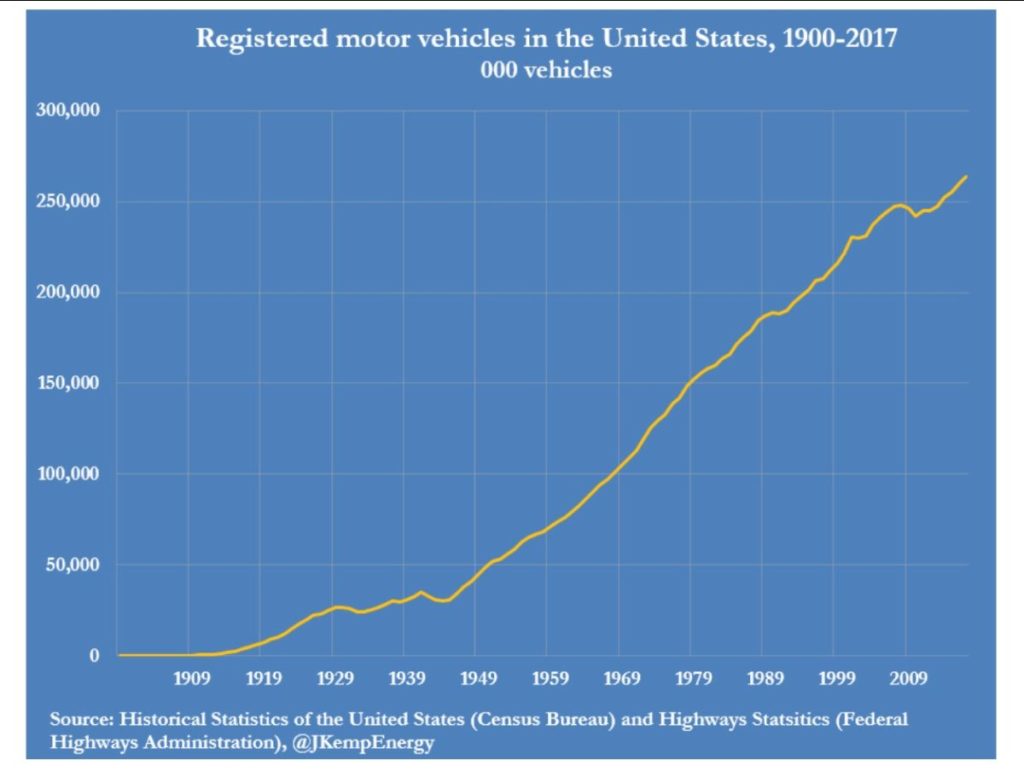

US vehicle registrations continue their long climb. At roughly 265 million vehicles in 2017, the only two periods during the last century that saw a modest decrease in vehicles on the road were during World War II and during 2008-2011. (4/17)

CA gasoline price bump: The average price for regular grade gasoline at the pump in California has jumped above $4/gal, for the first time since the summer of 2014, according to a AAA company blog post. (4/16)

US EV’s lagging: According to data from the IEA, the US ranks seventh in the world in terms of EV sales and Tesla accounts for a third of this, as of the end of 2018. As a proportion of total sales, electric cars and hybrids accounted for 2 percent last year, at 361,307, according to Inside EVs. Projections for the future are not overly optimistic. (4/20)

Electric bus revolution: As with EVs, electric buses promise lower life-cycle costs when compared to their gasoline and diesel counterparts, but upfront costs remain painfully high. However, Proterra, an electric bus manufacturer, is rolling out leasing plans that could eliminate this barrier. Proterra and Mitsui & Co. are teaming up to lease the batteries in electric buses so that the upfront costs of an electric bus reaches parity with a traditional diesel bus. In other words, no upfront cost for the battery, just monthly lease payments over the lifespan of the vehicle. The monthly payments would be offset by the fuel savings. (4/18)

Virginia’s State Air Pollution Control Board on Friday approved a regulation to reduce and cap carbon dioxide emissions from large fossil fuel-fired power plants. In an effort to address climate change, the regulation is designed to cap emissions from 32 fossil fuel-fired power plants, those larger than 25 MW of generation capacity, starting in 2020 and then require a 30% emissions reduction over the following 10 years. (4/20)

Warming Arctic: Alaska is in the midst of one of the warmest springs the state has ever experienced — a transformation that has disrupted livelihoods and cost lives. The average temperature for March recorded at the National Oceanic and Atmospheric Administration (NOAA) observatory in Utqiagvik (which was known as Barrow before 2016, when the city voted to go by its traditional Inupiaq name) was 18.6 degrees Fahrenheit above normal. Ice roads built on frozen waterways — a vital means of transportation in the state — have become weak and unreliable. At least five people have died this spring after falling through ice that melted sooner than expected. (4/20)

Climate relocation advisor: As the West burns, the South swelters, and the East floods, some Americans are starting to reconsider where they choose to live. For advice, a few of them are turning to Jesse Keenan, a lecturer at the Harvard University Graduate School of Design. (4/20)

Climate protest: In the U.K., environmental activist group Extinction Rebellion shut down four key London thoroughfares on Monday, including Waterloo Bridge and Oxford Circus, at the start of a multi-day protest designed to bring the city to a standstill. The group, which is calling for urgent action to prevent climate change, said its protesters were preparing to camp overnight and maintain the London blockades for “as long as possible”, potentially up to two weeks, or until the government agrees to talks. On Monday similar protests by Extinction Rebellion’s international groups were planned in more than 80 cities in 33 countries, from Melbourne in Australia to Accra in Ghana and Berlin, the German capital. The group is calling on the UK government to declare a climate emergency, slash greenhouse gas emissions to net zero by 2025, and create a “citizens’ assembly” that will debate climate issues (4/15)