Editors: Tom Whipple, Steve Andrews

Quote of the Week

“EIA’s evolution, in their Annual Energy Overview from 1979-2019, of their primary energy forecast shows clearly that EIA forecasting was not good in the past and the present forecast should be about the same!… “The US shale burst will be over soon and then it’s back to the reality of post-1970 oil peak. US energy independence is fake news.”

– Jean Laherrère, retired French petroleum geologist

Graphic of the Week

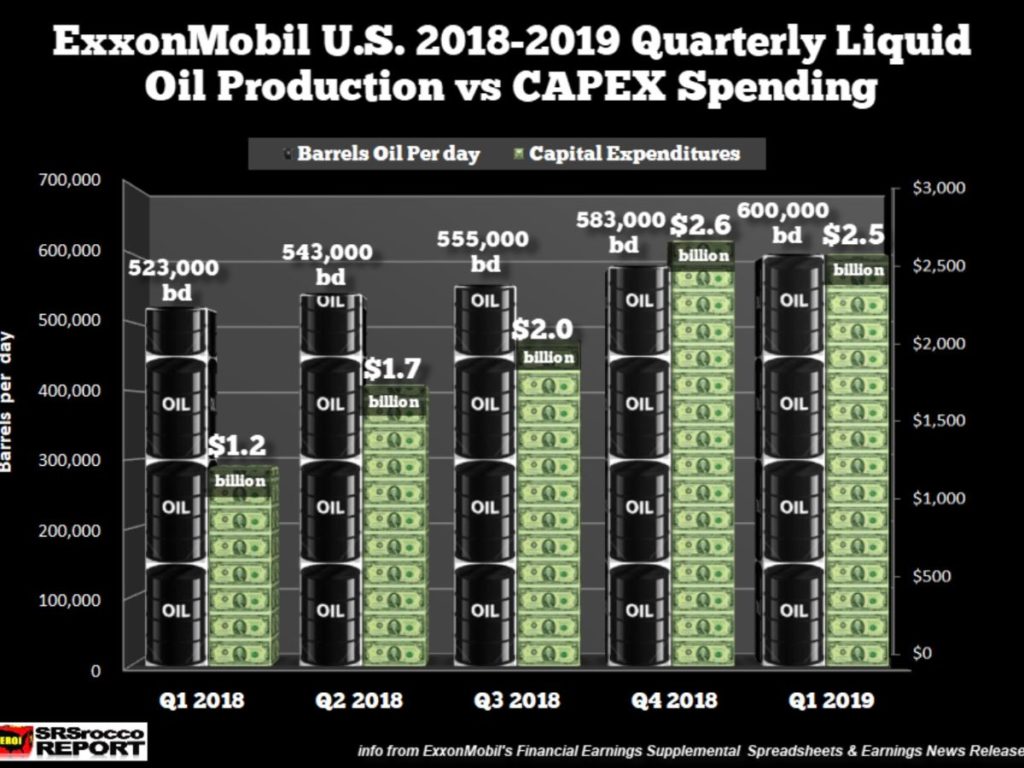

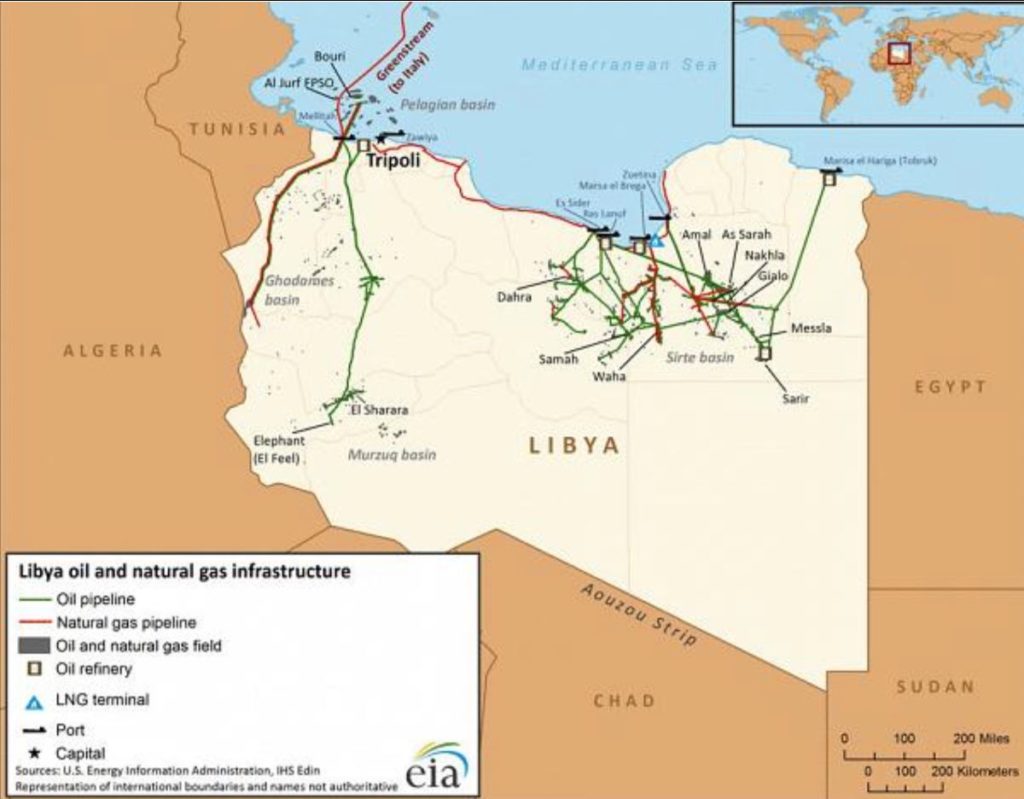

| Contents 1. Oil and the Global Economy 2. The Middle East & North Africa 3. China 4. Russia 5. Nigeria 6. Venezuela 7. The Briefs 1. Oil and the Global Economy After climbing more than $20 a barrel from $52 in late December to nearly $75 on April 23rd, prices have fallen back so that Brent closed at $70.85 on Friday. Despite threats to the oil supply from the geopolitical situations in Iran, Libya, Venezuela, and Nigeria, prices have been falling for the last two weeks. Last week prices fell to recent lows after the US stocks’ reports showed unexpected crude oil builds for two weeks in a row and EIA said that US oil production was growing again after holding steady for two weeks. It takes about 60 days to compile accurate US production data. EIA estimates and forecasts of US production have been a bit shaky of late so we will not know if the prediction that US shale oil output grew by 84,000 b/d to a record of 8.4 million in March is correct until the end of this month. Recently there have been numerous reports that the mostly unprofitable US shale oil industry is having trouble raising money to expand operations and does not expect to be increasing production as fast as in the past. The recent US drill rig count shows that number of rigs drilling for oil and gas has fallen by 9 percent since the November peak. Some believe that the increasing presence of the integrated and well-financed major oil companies, such as Exxon and Chevron in the US shale oil industry will be enough to offset declining production from the smaller shale oil drillers. However, other major oil companies such as Shell and BP have said that they do not share the enthusiasm for US shale oil. Some are saying that the reason major oil companies are becoming more deeply involved in the Permian stems from a compulsion to keep growing their oil output and that shale oil is the fastest way to increase production these days no matter the cost and long-term prospects. The policies of the Trump administration too have become a significant factor bearing on oil production. Washington has not only imposed harsh sanctions on Iran and Venezuela, but it has supported General Haftar’s assault on Tripoli, opposed efforts to start combatting global warming and boosted US oil production through reduced regulation. One analyst recently opined that President Trump himself may be more important than fundamental factors in determining the price of oil in the next year. US commercial crude oil inventories have been rising in recent weeks. However, they have been increasing less than usual for this time of the year mainly due to lower demand from US refineries which have been undergoing extended spring maintenance to be ready for the winter gasoline blends and the new low-sulfur requirements for marine fuels which come in force on January 1st. Last week, a contamination problem in Moscow’s 1 million b/d pipeline into Europe forced a 10 percent cut in Russian oil production. Some are saying it could take weeks or months to rectify this situation. Given that developments in Iran and Venezuela seem likely to lower the world’s oil supply by 1 million b/d and the civil war in Libya and the insurgency in Nigeria could conceivably shut in another 500,000 to 1 million b/d, it seems probable that oil prices will be higher later this year. The OPEC Production Cut: OPEC’s oil supply hit a four-year low in April due to declines in sanctions-hit Iran and Venezuela and output restraint by Saudi Arabia. A month ago, with international oil prices moving steadily upward towards $80, it seemed possible that the Saudis and the other Gulf Arabs would agree to increase production in the 2nd half of the year. In April, Moscow signaled OPEC and its allies could raise oil output after June because of improving market conditions and falling stockpiles. Now with prices sliding back to circa $70 a barrel and Russia facing a multi-billion-dollar loss due to its oil contamination problem, the situation has become cloudier. Last week Saudi Energy Minister al-Falih told the RIA news agency that the global deal on oil production could be extended to the end of 2019. The minister did not specify whether, or by how much, output levels could change after June. His comments came after President Trump said he had called OPEC and told the group to lower oil prices, without specifying to whom he spoke or whether he was referring to previous discussions with OPEC officials. The parties to the OPEC+ 1.2 million b/d oil cut meet on June 25-26 to decide on whether to extend the agreement. Oman’s Energy Minister al-Rumhy said last Wednesday OPEC, Russia, and other producers would be looking to extend their oil output cut agreement when they meet. US Energy Secretary Perry met last Thursday in London with Saudi energy minister al-Falih and IEA Executive Director Fatih Birol, the same day the US sanctions waivers expired for eight importers of Iranian oil. “Secretary Perry remains actively engaged with his counterparts from the world’s major oil supplying nations and remains confident in the ability of these nations to offset any potential disruptions in global energy markets,” the DOE said in a statement after the meeting. US Shale Oil Production: After a pause, the EIA resumed estimating that US shale oil production continues to climb, this time by 100,000 b/d in the week ending on 26 April. We shall have to wait until the end of June before actual figures rather than estimates are available. Oil production in the lower 48 was up by 1.6 million b/d in the three months from December to February compared with a year earlier. However, growth is down from more than 1.8 million b/d in August-September and is slowing significantly for the first time since 2016. The EIA continues to forecast that US crude production will rise by around 1.4 million b/d this year and 0.7 million b/d in 2020. In the meantime, big oil’s enthusiasm for the Permian Basin continues with Occidental Petroleum offering $38 billion ($5 billion higher than the Chevron offer) for Anadarko’s stake in the Permian. Wall Street is waiting to see if Chevron raises its offer and a bidding war ensues. It is going to take a lot of profitable oil production from those Occidental acres to recover a $38 billion investment. In the months leading up to the Chevron and Occidental bids for Anadarko, there were suspicious purchases of Anadarko securities, according to the Securities and Exchange Commission, who obtained an order to freeze the assets in question. As has been pointed out in the past, some people have made more money in flipping shale oil properties than producing oil. ConocoPhillips’ production from the Eagle Ford, Bakken, and the Permian Basin grew 30 percent year over year in the first quarter to 326,000 b/d of oil equivalent and will increase later this year. Note that the industry always includes an unspecified amount of the much less valuable natural gas production in its “barrels of oil equivalent” announcements. Conoco expects to produce some 350,000 boe/d this year up from 290,000 last year and just over 200,000 in 2017. The company says it can generate free cash flow at less than $40/b and generate absolute and per-share organic growth and return at least 30% of cash from operations each year to shareholders. Capex for 2019 will be $6.1 billion. According to Exxon’s 1st quarter earnings release, the company invested $2.5 billion in capital expenditures on its U.S. oil and gas wells, to earn only $96 million during the period. Apache Corp. said Wednesday it lost $47 million in the first quarter versus a $145 million profit during the first three months of 2018. About half of Apache’s global production now comes from the Permian, which accounts for almost 250,000 barrels of oil equivalent per day, up 36 percent from last year. In April, Apache said it would dramatically cut back on its natural gas production in the Alpine High for an extended period because of steep pricing discounts caused by pipeline shortages in the region. There’s so much associated gas produced along with crude oil that many companies are having to pay to have the excess gas shipped away. Either that or they’re flaring more of the gas and burning it into the atmosphere, contributing to pollution and climate change. Conoco, which has spare capacity in its gas lines to California, said last week that it is earning considerable money from smaller producers who are paying the company to take natural gas away from the Permian. 2. The Middle East & North Africa Iran: President Trump’s decision to ban all Iranian oil purchases after May 1 – ending exemptions for eight nations – came after hawkish economic and security advisors allayed the president’s fears of an oil price hike. The move to fully sever Tehran’s oil revenues has resulted in appeals of the US decision on waivers from several of Iran’s best customers, including India, China, and Turkey, and a stream of bombast and threats from Tehran. The biggest oil importers in Asia collectively bought 1.57 million b/d of oil from Iran in March, a 36-percent increase over February, as buyers rushed to use up the sanction waivers before they expired. Reuters reports that some 20 million barrels of Iranian crude worth a billion dollars are sitting at the port of Dalian in northeastern China as importers are unable to obtain insurance or financing for the oil because of the uncertainties surrounding the waivers. Reactions to the US decision are coming from all over. Tehran, of course, is threatening to block the Straits of Hormuz for the umpteenth time and says it is preparing for an American invasion and even beginning work on nuclear weapons. Qatar says the sanctions will harm oil-consuming nations. Some are talking about the Revolutionary Guard taking direct control of the Iranian government. Some observers foresee higher oil prices, inflation, and even the end of OPEC. Nobody believes that Iran’s exports will fall to zero, but most analysts believe Iran will continue to export only about 500,000 b/d for the next couple of months. This amount of exports would be down from the current 1 million b/d and 2 million b/d before the sanctions started. Tehran will always find covert ways to keep some exports moving. At week’s end, the Trump administration was considering even more aggressive sanctions on Iran by targeting more companies and financial institutions that do business with the Islamic Republic. Iraq: Exports remained steady from March to April, as the Baghdad government and the Kurdistan Regional Government combined for oil sales of 3.858 million b/d. Federal exports rebounded to 3.466 million b/d in April, up from 3.377 million in March, when bad weather in the Basra Gulf slowed tanker loadings. The central government will meet with its Kurdish officials soon to talk about oil exports. The two sides will also discuss the increase of oil production from the fields around the northern city of Kirkuk by as much as 50 percent. The fields were under the control of the Kurdish government until the fall of 2017 to protect them from ISIS, although the area was not officially part of the Kurdistan region. Iraq is facing a severe water crisis. Last summer the city of Basra fell sick with more than 100,000 people rushed to hospital after being poisoned by the city’s water supply. The country’s southern marshes – believed to be the original Garden of Eden – shrunk to a quarter of their original size. Saudi Arabia: Riyadh’s oil production in the coming months has been the center of much speculation during the past week. The Saudis’ production has been way below normal for the last few months as the kingdom takes the lead in forcing up oil prices in face of increasing US shale oil production. A report last week stated that the Saudis plan to increase production in June, but that will not increase exports, especially to the US. The additional oil will be used to produce more electricity during the hot summer months. President Trump has been urging the Saudis to step up production to avoid a price spike now that the Iranian sanction waivers have ended. Saudi Arabia has now officially joined the ranks of the world’s LNG exporters club. Saudi Aramco’s chief executive said last week that the company was in discussions with many partners regarding potential joint ventures in gas. He added that Aramco had sold its first LNG cargo in the Asia-Pacific region, which accounts for two-thirds of global LNG demand. Libya: Forces loyal to the internationally recognized Government of National Accord launched a counter-offensive last week leading to a stalemate on the ground on the southern outskirts of the capital. Clashes south of Tripoli eased on Tuesday after a push by Haftar’s Libyan National Army backed by artillery failed to make inroads toward the center of the city. Shelling audible in central Tripoli was less intense on Wednesday than on previous days. At least 392 people have been killed and 1,936 wounded since Haftar launched an offensive against Tripoli last month, the UN’s World Health Organization said on Friday. More than 50,000 were displaced as a direct result “of the intensifying armed conflict in Tripoli” according to the UN. |

Last week, the National Oil Company released figures showing first-quarter oil revenues of $4.4 billion. General Haftar would get his hands directly on these oil revenues, but foreign oil-buyers will only deal with the National Oil Company based in Tripoli. Haftar’s forces, which he only loosely controls, have taken over the eastern oil export terminals and are using them to import arms to support his offensive.

3. China

Factory activity in China expanded for a second straight month in April but at a much slower pace than expected, suggesting the economy is still struggling despite government efforts to increase growth. A private business survey issued last week also pointed to a loss of momentum with factories starting to shed jobs again after adding staff in March. The official Purchasing Managers’ Index (PMI) for manufacturing fell to 50.1 in April from March’s reading of 50.5, hovering just above the neutral 50-point mark which separates expansion from contraction every month.

China is likely to miss its 2020 shale gas production target as technical and commercial problems slow progress in exploiting what some consider to be the largest shale gas resources outside the US, according to production estimates compiled by market participants. According to analysts at S&P Global Platts and Wood Mackenzie, China will barely meet half of that target by next year, despite the increased efforts. “We think the 30 billion cubic meters by 2020 target is unreachable unless there is a breakthrough in technology and infrastructure.”

After a late entrance to nuclear power in the 1990s, China now has the third biggest nuclear power industry in the world with 45.9 gigawatts of nuclear power production. Optimistic projections released by the Chinese government show that China could take the US’s place as the number one nuclear energy producer in the world within the next ten years. Moreover, Chinese companies have been eyeing export opportunities from Argentina to Saudi Arabia and from the United Kingdom to Romania to export nuclear technology. However, according to a forecast released by the China Electricity Council just this week, China will not be able to meet its nuclear power generation goal for next year. The nation’s target for nuclear power generating capacity by 2020 is 58 gigawatts, but China will likely fall short at a projected 53 GW.

4. Russia

Last week the contaminated-oil-in-the pipeline saga, which has led to a temporary 10 percent reduction in Russian oil production, dominated the news. At least 5 million tons of oil, or about 37 million barrels, have been contaminated by organic chloride, a compound used to boost oil extraction, which must be removed before the oil is heated and damages refining equipment. Once in the pipeline, there is no way to remove the chloride and it must be diluted with clean crude to acceptable levels.

Problems with crude quality on the Druzhba pipeline emerged early last week and quickly spread over several countries as the contaminated oil made its way through the pipeline. Druzhba is one of the world’s largest oil pipeline systems, supplying about 1 million b/d of Urals crude to refiners across some 4,000 km in Belarus, Poland, Germany, Slovakia, Hungary, and the Czech Republic. Damage at Belarus’ Mozyr refinery which received the contaminated oil first is reported to be on the order of $100 million.

Moscow says the oil was deliberately contaminated with chloride at the Samaratransneft terminal which receives oil from several small producers. Law enforcement agencies are investigating several private companies in Samara to determine their involvement in the incident.

The problem may get worse this week as refiners storing the tainted oil have no capacity remaining to hold clean crude which can be mixed with the tainted oil to dilute it. Some of the contaminated oil is being loaded on tankers to free up space. Belarus said it could take months to fix the problem, while refiners across Europe have been cutting processing runs and asking governments to allow them to use strategic oil reserves.

5. Nigeria

The condition of Nigeria’s refineries is so poor that the nation of 190 million people must import the bulk of the oil products needed to keep the country running. As these products are subsidized, the government spends substantial sums each year on importing expensive gasoline and other fuels. To help the situation, in 2016 the government established a Direct Sale and Direct Purchase scheme whereby the National Oil Corporation sends crude to overseas refineries to be refined and returned as oil products. The company only pays for the refining and shipping thereby saving the markup of middlemen and claims the scheme has saved $2.2 billion in the last three years.

Nigeria is known to be plagued by “poor records, corruption, and tardiness in the enforcement of rules,” so that the situation continues to get worse. The country has established a “Nigeria Extractives Industry Transparency Initiative (NEITI),” a national body responsible for ensuring transparency and accountability in the extractive industries, but little seems to happen. The government is talking about doubling oil production to 4 million b/d by 2025 from the current 1.7 million but this is unlikely to happen. Five oil wells in Ondo State were gutted by fire on last week – most likely by sabotage. Militant attacks have been fewer in the last two years but may be on the upswing.

Several international oil companies which founded Nigeria’s oil industry are trying to reduce their presence in the country or move offshore where there is less sabotage and oil does not have to be transported through vulnerable pipelines.

6. Venezuela

Venezuela’s opposition came close to removing President Nicolás Maduro from power last week, according to more than a dozen people involved in talks to oust him. But in the end, it all went wrong. Under the plan, the Supreme Justice Tribunal was to recognize the opposition-controlled National Assembly, the last democratically elected body in Venezuela, as the legitimate representative of the Venezuelan people. The armed forces would then have legal grounds to abandon Maduro. The defense minister, Vladimir López, and others who were negotiating with the opposition would join the new government.

The failed coup attempt set off a round of finger-pointing, with US officials blaming members of the Venezuelan military for getting cold feet, though independent analysts have questioned whether the Trump administration trusted faulty intelligence. The turmoil is likely to continue raising the question of what happens to the country’s 800,000 b/d of oil production. Some are predicting that Washington will order home the remaining US personnel still working in the country.

Some analysts are saying that Venezuela’s oil industry is in such bad shape that it does not matter who is in charge, the problems are so bad that exports could fall to zero. In the meantime, PDVSA says it would install 20 generators by the end of May to make a crude project partly owned by Chevron “independent” of the national grid after a wave of blackouts crippled crude production. Given the overall situation in Venezuela, it seems highly unlikely that PDVSA can procure and install 50 megawatts of generating capacity in the next three weeks.

7. The Briefs (date of the article in the Peak Oil News is in parentheses)

The Clean Shipping Alliance, or CSA 2020, has received written approvals and no-objection letters from more than 20 ports covering Europe, the Americas, Asia and Australasia indicating they have no intention of banning the use of open-loop scrubbers in their waters. An open-loop scrubber uses seawater to remove sulfur oxides from the engine exhaust. The sulfur oxide in the exhaust reacts with the water to form sulfuric acid, which is then washed back into the sea after neutralization. Some industry sources argue that open loop scrubbers do not address environmental issues as they take sulfur out of the air and put it into the ocean. (5/3)

In the UK, shale gas commissioner Natascha Engel, just 6 months on the job, has handed in her resignation, calling the earthquake rules adopted by the government “ridiculous” and an effective “ban on fracking.” The rules, according to a BBC report, stipulate a suspension of fracking activities if an earthquake with a magnitude of 0.5 on the Richter scale is detected. (4/30)

Israel’s Delek Group confirmed it submitted a proposal through its Ithaca unit to buy Chevron’s oil and gas fields in the British North Sea. The price of the fields is reported to be about $2 billion. (4/29)

Swiss driller Transocean’s customers are moving ahead with more offshore projects amid a rebound in crude oil prices and the continued improvement in offshore economics, company executives said Tuesday. (5/1)

In the Middle East, uncertainty over the outlook for oil prices and weaker global economic conditions have added pressure on oil exporters to deepen reforms and boost job creation, the International Monetary Fund said on Monday. Many countries in the region embarked on fiscal and economic reforms after a slump in crude prices in 2014 hit state finances and hampered growth, but unemployment remains high and overall growth is projected to remain subdued this year. (4/29)

Pemex, Mexico’s long-mismanaged state-owned oil company, has been bleeding money as its production levels have fallen to a trickle of the production levels over the last decade. Now, Pemex is reporting a 36 billion-peso ($1.9 billion US dollars) loss in the first quarter. While these numbers are grim, especially compared to the 113-billion-peso profit reported in the first quarter last year, Mexican officials say that things are headed in the right direction for Pemex. (5/3)

The Panama Canal Authority has reduced the maximum authorized draft for vessels transiting the Neopanamax locks for the fifth time this year, following a drought that has reduced water levels in two of the canal’s largest tributary lakes. The latest maximum authorized draft now is 13.41 meters (44 feet). When water levels are normal, the maximum draft for Neopanamax vessels is around 15.20 meters (50 feet). (5/2)

Alberta’s new government has enacted a law enabling it to restrict the flow of oil and gas to neighboring British Columbia, raising the stakes in a spat between Canada’s two westernmost provinces over the Trans Mountain pipeline. The legislation, dubbed the “turn off the taps” act, was passed but not enacted by the province’s previous, left-leaning New Democratic Party government last year in retaliation for British Columbia opposing the expansion of the Trans Mountain pipeline. (5/2)

The US oil rig count increased by two while gas rigs declined by three, for a new combined rig count of 990, according to GE’s Baker Hughes. (5/4)

Chevron has completed its $350 million acquisition of a refinery in Texas from Petrobras America. The transaction gives Chevron its second US Gulf Coast refinery, a 110,000-barrel-per-day facility in Pasadena, Texas. (5/3)

Exxon Mobil Corp.’s worst refining performance in almost two decades may revive questions from analysts about the so-called integrated model engineered by founder John D. Rockefeller and espoused by every CEO in the company’s 149-year history. A surprise loss in a business line Exxon typically relies on to prop up more volatile units eroded first-quarter profit and cast doubt on the strength of the oil titan’s comeback from its annus horribilis in 2018. (4/30)

Exxon Mobil Corp on Friday sued Cuba’s state-owned Cuba-Petroleo and CIMEX Corp in US federal court seeking $280 million over a refinery, gasoline stations and other assets seized after Fidel Castro’s revolution. Exxon, the largest US oil producer, is the first corporation to sue Cuba since the Trump administration allowed a long-dormant section of the 1996 Cuban Liberty and Democratic Solidarity Act, known as the Helms-Burton Act after its sponsors, to take effect on May 2. (5/4)

Oil pipeline battle: Michigan’s Attorney General Dana Nessel has threatened to “use every resource available” to shut down Enbridge’s 65-year-old Line 5 oil pipeline that runs under the Straits of Mackinac, in a statement on Monday. (4/30)

The Trump administration is giving oil companies more flexibility when drilling offshore, by easing Obama-era mandates imposed in response to the 2010 Deepwater Horizon disaster that killed 11 workers and unleashed the worst oil spill in US history. (5/3)

Gas tax is toxic: Democrats and Republicans are quick to talk up a bipartisan infrastructure deal. Neither party wants to take the political risk of paying for it when all options are toxic — including the obvious choice of raising the national gas tax. Increasing the gas tax is so politically fraught that it hasn’t been touched in 26 years and it didn’t even come up at a meeting at the White House. While leaders agreed broadly on the need to upgrade roads, bridges, and airports, they put off for three weeks the tougher conversation about coming up with ways to fund an estimated $2 trillion in public works. (5/2)

RE beats coal power: In the 2000s, coal accounted for more than half of electricity generation. But in April, coal-fired power plants only accounted for 20 percent of total US electricity generation, while renewables made up 24 percent. It’s the first time on record that renewable energy generated more than coal on a monthly basis. The trend is expected to continue in May. Natural gas is the largest source of electricity at 35% in April. (5/2)

IL considers solar + batteries: Vistra Energy President Curt Morgan on Friday touted the advantages for all stakeholders if Illinois enacts the state Coal to Solar and Energy Storage Act in this legislative session but gave it a “less than 50%” chance of passage before a separate “veto session” in November. The Act would allow the Illinois Power Agency to buy long-term renewable energy credits from companies that commit to converting coal to solar and energy storage on a basis of five megawatts retired to one megawatt built. (5/4)

Niagara Falls going EV: New York Governor Cuomo announced that Maid of the Mist Company, which has been navigating the waters of the Lower Niagara River since 1846, will launch later this year two new all-electric, zero-emission passenger vessels. (5/4)

China’s EVs beat others: The combined total of light-duty all-electric vehicles (EV) and plug-in hybrid electric vehicles (PHEV) sold in China in 2018 was more than 1 million, or 8.1 percent of the light-duty vehicle market there, according to the US Department of Energy. This compared to 386,000 plug-in vehicles sold in Europe and 361,000 plug-in vehicles in the United States—about 2 percent of the market in both places. (4/30)

The European car market registered its seventh consecutive month of decline in March 2019, according to figures from JATO Dynamics. Ongoing political and economic uncertainty, including lack of clarity around Brexit, alongside consumer preoccupation with diesel bans in cities, meant that overall demand continued to decline. (4/30)

Data points to faster warming: New climate models now project even faster global warming than previous work. The models were developed by the National Oceanic and Atmospheric Administration (Princeton, NJ), the National Science Foundation’s National Center for Atmospheric Research (Boulder, CO) and six other international computational centers. If correct, these new studies give world leaders far less of a “runway” to avoid even more severe climate degradation. Older climate change models predicted that a doubling of atmospheric carbon dioxide would produce global temperature increases of between 2.5-5 degrees C. The new models suggest that previous estimates were too conservative and that doubling of atmospheric carbon dioxide will produce 5 degrees C. or more of global warming in the future. (4/30)

Flooding here: Cities along the Mississippi River are sandbagging and evacuating downtown homes and businesses as floodwaters that overwhelmed defenses in Davenport, Iowa, earlier in the week make their way toward St. Louis. (5/4)

UK decarbonizing: The UK’s electricity sector is ahead of the curve when it comes to cutting carbon emissions, but the country still needs to raise its renewables capacity four-fold by 2050 to reach a target of net-zero greenhouse gas emissions, parliament’s Committee on Climate Change said in a report Thursday. (5/2)

France decarbonizing: France will delay by ten years the shutdown of part of its nuclear power industry in order to fulfill President Emmanuel Macron’s aim of making the country carbon-neutral by 2050, the government said on Tuesday. Francois de Rugy, environment minister, presented an energy and climate bill to the cabinet that will enshrine the 2050 target in law, by proposing to cut greenhouse gas emissions to less than a sixth of their 1990 levels, compared to a quarter in the current legislation. (5/1)

Climate investors: Two Exxon Mobil Corp shareholders—churches in England plus New York’s pension fund—said they would withhold their support for the re-election of all ExxonMobil directors at the company’s annual meeting due to the US oil major’s “inadequate response” to climate change. (5/4)

Capitalism as we know it is over. So suggests a new report commissioned by a group of scientists appointed by the UN Secretary-General. The main reason? We’re transitioning rapidly to a radically different global economy, due to our increasingly unsustainable exploitation of the planet’s environmental resources. Climate change and species extinctions are accelerating even as societies are experiencing rising inequality, unemployment, slow economic growth, rising debt levels, and weak governments. Contrary to the way policymakers usually think about these problems, the new report says that these are not separate crises at all. Instead, these crises are part of the same fundamental transition to a new era characterized by inefficient fossil fuel production and the escalating costs of climate change. (5/4)