Editors: Tom Whipple, Steve Andrews

Quote of the Week

“Oil may be the most critical of the raw material resources the current industrial ecosystem consumes…. Oil will peak in production, not because there is not enough reserves in the ground to meet demand, but because consumers cannot support the oil price at a level that allows oil producers to remain economically viable. [Our analysis shows] that global peak crude oil production is relatively soon. The EIA projections of peak oil around 2040, are highly unlikely.

Geological Survey of Finland, in “Oil from a Critical Raw Material Perspective” (published 12/22/19)

Graphic of the Week

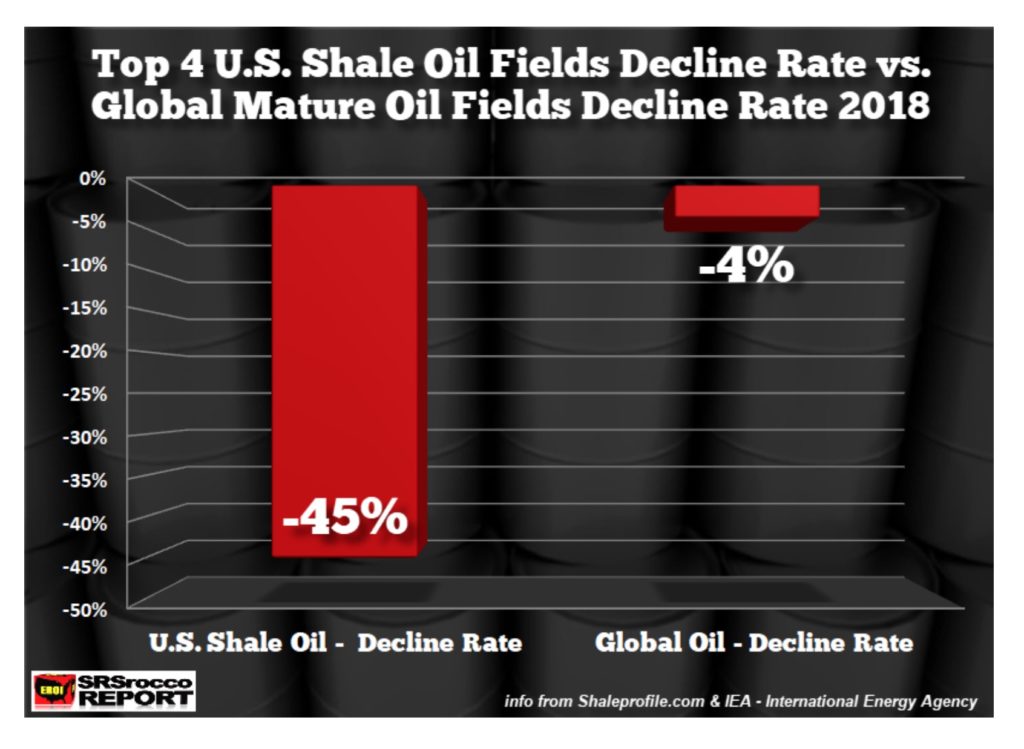

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and trade wars 5. Renewables and new technologies 6. Briefs 1. Energy prices and production Oil prices posted a fifth weekly decline, weighed down by the loss of demand from China caused by the coronavirus outbreak. OPEC and Russia tried all week to come up with a unified position on how to contain the price slide. At the close Friday, New York futures were at $50.32 after having been below $50 earlier in the week. Brent closed the week at $54.47. Today, Monday, workers in China officially went back to work after the extended New Year’s holiday, but a large, unknown number of factories, offices, schools, and business establishments remain closed. OPEC’s crude production fell by 470,000 b/d in January, with lower Saudi production and the Libyan blockade bringing the group’s output down to a four-month low. The cartel pumped 29.08 million b/d last month, down from 29.55 million b/d in December as eight of its members posted declines. But with the coronavirus still spreading and denting global oil demand, OPEC is under pressure to cut production even further. A technical committee of delegates advising the 23-country OPEC+ alliance recommended a 600,000 b/d cut after three days of intense negotiations last week. Delegates said Russian representatives in the talks asked to return to Moscow for consultations with their leaders. There are hints that Moscow may go along with the recommended cut but no official word. The possibility that China’s coronavirus could cause serious economic troubles later this year led the White House to send out the new Secretary of Energy to reassure the nation that all will be well. During an appearance at the Atlantic Council, Secretary Brouillette said that although the record-high growth of US oil production is slowing, steady economic growth will ensure that prices will remain “very, very stable” for the next two or three years. Brouillette played down the effect that the coronavirus outbreak in China would have on energy markets, describing the impact as “marginal.” “The coronavirus, as we can determine today, has not had a tremendous impact on energy production or energy purchases around the world just yet,” Brouillette told reporters on the sidelines of the event. “That may change over time. But for the moment, the Chinese seem to have a clear indication of the virus itself, where it is, and they are taking very aggressive steps to contain and control the potential outbreak.” Liquefied natural gas is selling at the lowest price on record in Asia, a troubling sign for US energy producers who have relied on overseas shipments of shale gas to buoy the sagging domestic market. The main price gauge for LNG in Asia fell to $3 per million BTUs last Thursday, down sharply from more than $20 six years ago as US deliveries have swamped markets around the world. Deteriorating conditions in US natural gas markets, partially due to warmer weather, are posing growing credit risk to the industry’s producers and midstream developers, S&P Global Ratings warned last week. Concerns are rising about the eventual impact of the coronavirus on the US oil industry. US crude prices started the year strong, rising on trade-deal optimism and geopolitical troubles in the Middle East, but then lost over a fifth of their value and dipped below $50 a barrel for the first time in more than a year. With the course of the coronavirus situation still uncertain, some financial institutions are already cutting their oil price forecasts for the first half by $15-20 a barrel. An extended drop of this amount is enough to throw many shale oil producers deep into unprofitability and damage their ability to keep borrowing money for more drilling. There were 37 oil and gas bankruptcies in the North American hydrocarbon sector in the final three quarters of 2019 compared with just 15 in the preceding three quarters, according to Haynes and Boone. Among those filing was Weatherford International, once one of the largest oil-field-service firms in the world. Other big service providers, such as Schlumberger, have shrunken considerably. With global GDP growth linked closely to world oil production growth, the main growth driver for the last decade was the US shale oil industry. However, the top US shale oil fields are depleting at ten times the rate as are the world’s mature conventional oil fields. Every year production from the US’s four top shale oil fields declines at a pace that can only be offset by drilling thousands of new wells, which are becoming increasingly difficult to finance. John Hess, CEO of Hess Corp., recently said that production in the Bakken could peak within the next two years, and the Permian will peak in the mid-2020s. Others have said that the Permian peak may arrive sooner. Steep decline rates mean that any slowdown in the pace of drilling will quickly impact production. Financial stress in the shale industry may bring a peak in shale production sooner than many believe. |

2. Geopolitical instability

Libya currently is producing about 204,000 b/d of crude as a blockade of the country’s export terminals and several fields enters its third week. This was the lowest production level since 2011 when Libya’s civil war began, and a drop from about 1.2-1.3 million b/d pumped before the blockade. Last month, the head of the National Oil Corporation warned that production could fall to zero if the blockade continues.

Forces affiliated with the Libyan National Army, an arm of the eastern Libyan government that is fighting the UN-recognized government in Tripoli, seized Libya’s oil-exporting terminals in mid-January as well as several pipelines feeding oil from the nearby fields. This, in turn, prompted the shutdown of the oil fields.

The UN envoy to Libya, Ghassan Salame, said last week there was a “genuine will to start negotiating” between rival military factions as they planned to meet for the first time for talks in Geneva aimed at securing a lasting ceasefire. However, Salame told reporters that both sides were violating the arms embargo and that new mercenaries and arms were still arriving “by air and by sea.” The blockade could continue for months, according to one analyst, Hamish Kinnear, from Verisk Maplecroft.

Iraq’s crude exports, excluding the semi-autonomous northern Kurdish region, fell 3.5 percent in January from the month before, according to government data. The January figure is 420,000 b/d lower than the all-time high of 3.726 million b/d reached in December 2018. Iraq’s oil ministry spokesperson Assem Jihad said on January 9th that the country was producing an average of 4.46 million b/d in line with its new OPEC+ quota, and exports were averaging 3.45 million b/d. Iraq flouted its quota for most of 2019 but has pledged to comply better this year.

Iraq’s top Shi’ite Muslim cleric condemned deadly violence that killed protesters at sit-ins this week in the southern holy city of Najaf and said a new government must have the trust and support of the people. Grand Ayatollah Ali al-Sistani also called on security forces to protect anti-government demonstrators from any further attacks. “It is the security forces that must take responsibility to keep the peace, protect the protest squares and peaceful demonstrators and identify attackers and rabble-rousers,” he said.

As the deadline for the US to renew its waiver on Iraq’s importing of gas and electricity from Iran approaches later this month, the three key players in this ongoing geopolitical saga have been preparing for all possible outcomes. The positioning began in earnest last week with a comment from the Trade Bank of Iraq’s chairman, Faisal al-Haimus, that he would stop processing payments if the US does not renew the relevant waiver at this end of this month. Such a stoppage would affect the payments for the 1,400 megawatts of electricity and 28 million cubic meters of gas from Iran that Iraq requires to keep its vital infrastructure in power, at least for some of the time.

Summer power demand in Iraq perennially exceeds domestic generation capabilities, and the resulting shortages cause civil unrest. The recent widespread protests across Iraq – including in the major oil hub of Basra – were widely seen as being prompted in part by chronic electricity outages. The situation also promises to become worse as, according to the International Energy Agency, Iraq’s population is growing at a rate of over one million per year, with electricity demand set to double by 2030.

Iraq’s political turmoil and the prospect of future US sanctions have triggered a warning from one of the country’s leading medical suppliers of life-threatening shortages of drugs that could rival the hardships of the “oil-for-food” era. Even if the US does not follow through on threats, that it will impose sanctions, he warned significant exchange rate fluctuations related to the political tensions could have a “big impact” on pharmaceuticals and, as a result, the health of the Iraqi people.

Venezuela’s oil exports fell 14 percent in January, exporting less than 1 million b/d of crude and refined products for the month. The 951,903 b/d that was shipped compares to 1.1 million bpd shipped in December, and 1.38 million b/d shipped a year ago January. Despite declining crude exports, its oil stocks in storage also fell—from 39.85 million barrels in September 2019 to 35.9 million barrels at the end of January.

In the year since the Trump administration declared what amounts to economic war against the government of President Maduro, the move has yielded some clear losers, including US investors now shut out of the market. US officials and analysts say secret deals between Moscow and Caracas to produce, transport and sell oil to other markets have become a cash cow for Russia that is earning its state-controlled enterprises an estimated $120 million a month.

Washington is weighing whether to sanction Russia’s Rosneft for maintaining ties with Venezuela. American officials are wary that the move could cause chaos in global oil markets by driving up the price of oil. Russia has pledged to boost military and economic co-operation with Venezuela to help the nation deal with growing US pressure, according to Russian Foreign Minister Lavrov. In comments that came after his meeting with Venezuelan President Nicolás Maduro in Caracas, Lavrov said any attempts to remove the Maduro’s government by force were unacceptable.

3. Climate change

Several models predicting the future of climate change have taken a drastic turn for the worse, and multiple research teams are now forecasting that the planet will heat up more than previously anticipated. The changes are so dire that some researchers doubt their work, according to Bloomberg. But if the simulations hold up, they convey a clear message: to stave off the worst-than-anticipated climate change, world leaders will need to take strong action soon.

It’s possible, however, that these models — which predict how much global temperatures will rise as a result of increasing levels of greenhouse gas emissions — will be shown to be inaccurate. The Swedish Meteorological and Hydrological Institute’s senior researcher Klaus Wyser, for instance, told Bloomberg that the sudden jump might well be in error — but it’s too soon to know for sure. “We hope it’s not the right answer,” he added.

Some of the discrepancy, Bloomberg reports, comes from the inherent difficulty of predicting how clouds impact weather. When one team turned off updated cloud simulations, their forecast returned to previous levels. “What really scares me is that our model looked better for some really good physical reasons,” Andrew Gettelman of the National Center for Atmospheric Research told Bloomberg. “So, we can’t throw them out yet.”

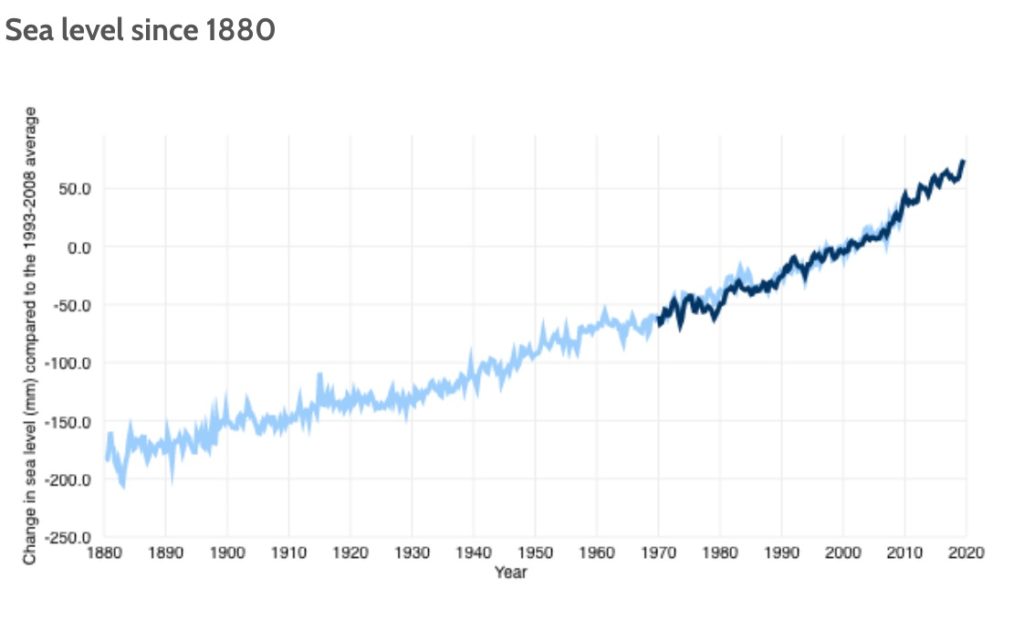

The pace of sea-level rise accelerated at nearly all measurement stations along the US coastline in 2019, with scientists warning some of the bleakest scenarios for inundation and flooding are steadily becoming more likely. Of 32 tide-gauge stations in locations along the US coastline, 25 showed an apparent acceleration in sea level rise last year, according to researchers at the Virginia Institute of Marine Science. The selected measurements are from coastal locations running from Maine to Alaska, where 40 percent of the US population lives.

The gathering speed of sea-level rise is evident even within the space of a year, with water levels at the 25 sites rising at a faster rate in 2019 than in 2018. The highest rate of sea-level rise was recorded along the Gulf of Mexico shoreline, with Grand Isle, Louisiana, experiencing a 7.93mm, about three-tenths of an inch, annual increase, more than double the global average. The Texas locations of Galveston and Rockport had the next largest sea-level rise increases.

Generally speaking, the sea level is rising faster on the US east and Gulf coasts compared with the US west coast, partially because the land on the eastern seaboard is gradually sinking. The current speed-up in sea-level rise started around 2013 or 2014 and is probably caused by ocean dynamics and ice sheet loss. Worldwide, the sea-level increase is being driven by the melting of massive glaciers and the thermal expansion of ocean water due to human-induced global heating.

The US’s National Oceanic and Atmospheric Administration also has reported an acceleration in sea-level rise, warning that if greenhouse gas emissions are not constrained, there may be a worst-case scenario of as much as an 8.2-ft increase by 2100, compared with 2000 levels.

After years of denying that the planet was growing hotter because of human activity, an increasing number of US Republicans say they need to acknowledge the problem and offer solutions if they have any hope of retaking the House of Representatives. In poll after poll, large numbers of young and suburban Republican voters are registering their desire for action on climate and say the issue is a priority. Their concern about climate change is spreading to older GOP supporters, too.

Almost 7 in 10 Republican adults under 45 say that human activity is causing the climate to change, according to a poll by The Washington Post and the Kaiser Family Foundation. Republicans “can’t win the majority back [in the House] without winning suburban districts. And you can’t win suburban districts with a retro position on climate change,” said former South Carolina congressman Bob Inglis, a Republican who is pushing his party to craft a climate plan.

4. The global economy and trade wars

As the coronavirus continues to spread across China, some observers are starting to fear that this pandemic could trigger a worldwide depression unless it is brought under control soon. As the situation worsens, Beijing is censoring more news, so that much of what the world knows is coming from a scattering of foreign news organizations.

The authorities resorted to extreme measures in Wuhan last week in an attempt to halt the spread of the virus. With the hospitals full and turning away all but the sickest, medical teams conducted house-to-house searches, rounding up the sick and sending them to large quarantine centers. With minimal medical care in the understaffed centers, there is a growing sense that its population is being abandoned. Some are saying that Wuhan and the surrounding province of Hubei – 50 million people — are being sacrificed for the greater good of China.

Outside observers say far more may have died than the official tally of at least 811 as the total number of confirmed cases rose to 37,000. A Lancet study last week by the University of Hong Kong estimated that the Chinese authorities are understating the size of the epidemic by an order of magnitude. This is based on a spread rate of 2.68 per case and a doubling in total numbers every 6.4 days, which matches with known travel movements within China and globally since the outbreak. The virus is akin to the Spanish Flu pandemic of 1918. It appears to be tracking the 1918 death rate at about 2.3 percent (20 times that of the usual winter flu) to the extent that government figures can be believed.

As of last week, some two-thirds of China’s economy was shut down. More than 80 percent of its manufacturing industry was closed, including 90 percent of exporters. China is now contributing 17 percent to the world’s GDP and is deeply integrated into international supply chains. It was just 4.5 percent of world GDP during the SARS epidemic in 2003.

The scale of economic disruption is already staggering. Hyundai has been forced to close all its factories in Korea for lack of critical components. Volkswagen, Toyota, General Motors, and Tesla closed their Chinese plants, as has Apple’s iPhone supplier Foxconn. With its heavy reliance on production networks in China and outsourcing geared towards just-in-time shipments, the technology industry is among the hardest-hit by the disruption. The epidemic is the biggest shock to the world oil markets since the Lehman crisis. The collapse in Chinese transport and refinery demand has cut oil imports by an estimated 3+ million b/d.

The battle to contain the coronavirus threatens to cut off US companies from parts and materials they need to produce iPhones, automobiles, and appliances and drugs to treat medical conditions including Alzheimer’s disease, high blood pressure, and malaria. Some of the United States’ best-known manufacturers such as General Electric, Caterpillar, and the Big Three automakers, along with many smaller American businesses, depend on what is made in Chinese factories.

The Chinese economy is supposed to return to work today, Monday, February 10th, after the virus outbreak forced an extended holiday. However, numerous stores and factories are likely to remain shut, and many white-collar employees will be working from home. Many employers in the southern technology hub of Shenzhen are taking precautions to prevent workers from returning in large crowds, asking those who have traveled from elsewhere to self-quarantine for up to 14 days. Apple supplier Foxconn plans only to “gradually” restart its factories to resume full production later this month. Goldman Sachs cut its first-quarter GDP target for China to 4 percent from 5.6 percent while saying an even deeper hit is possible.

In other news, China’s Ministry of Finance said Thursday it would cut in half tariffs on $75 billion worth of US imports. This move is part of its efforts to implement a recently signed trade agreement with Washington. Beginning February 14th, China will cut tariffs on some US goods to 5 percent from 10 percent, while levies on some other items will be reduced to 2.5 percent from 5 percent.

5. Renewables and new technologies

British companies are preparing for their government to decide how to spend more than $1 billion on infrastructure capable of capturing and burying millions of metric tons of carbon dioxide pollution. The money — 800 million pounds — will go toward partially funding a “cluster” that captures emissions from factories and power stations by the middle of this decade.

In a bid to shore up its climate credentials, the Conservative party made the promise to spend the sum in its manifesto, before it won a majority in the general election in December. In 2015, a previous Conservative-led government made the surprise decision to scrap a $1.4 billion carbon capture and storage contest. Even if all electricity came from renewables, it doesn’t address the emissions from cement and steel plants—more than 10 percent of the global total—which have few technology alternatives working at scale.

JenaBatteries and BASF are cooperating in the production of an electrolyte for a battery technology that is particularly suitable for stationary storage of electricity from renewable energy. JenaBatteries, which has developed this technology based on a redox flow battery with organic materials, has the first commercially available technology of this kind.

German scientists are to take an old Nazi-created kerosene project to make a commercially viable synthetic jet fuel in a move that could very well save airlines from flight shaming. Hitler’s 1925 kerosene creation wasn’t the green version – it relied on coal and other fossil fuels to create the kerosene. But today’s version would see this kerosene derived from water. What’s more, this green version pulls carbon dioxide out of the air during the creation process.

Bosch Engineering, together with VDL Enabling Transport Solutions and their partners, designed and built a fuel cell range extender system for battery-electric buses. The system is contained in a specially designed trailer to be attached to the tow hitch of any suitable electric bus.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

Worldwide production of oil is sourced from different methods of extraction. Conventional on-shore oil accounts for 60.27%; conventional offshore shallow-water oil extraction accounts for 21.59%; conventional offshore deepwater oil extraction produces 8.10%; U.S. Tight Oil (Fracking) oil extraction produces 6.93%; and Canadian Oil Sands oil extraction 3.10%.

The copper indicator: Copper’s voice is the loudest of the commodities, and it’s not optimistic for the global economy. The coronavirus–which had by the time of writing claimed 490 lives and infected over 24,300 people–is battering all commodities right now, but it’s copper that the oil bulls should be watching because this is the barometer of global economic health, which speaks volumes about future oil and gas demand. By Monday, copper had seen a 12% drop in price. (2/6)

Venezuelan authorities rounded up U.S. oil executives held under house arrest in Caracas Wednesday night and moved them to a prison, the top U.S. envoy to Venezuela said on Thursday. (2/7)

Guyana gouged: Watchdog Global Witness claims that Guyana is getting 52% of the revenue from the fields in question that the Exxon consortium is developing. However, the watchdog claims, “typical” deals usually offer a much higher percentage to the host country, in the realm of 65%-85%. Their new report suggests that the world’s newest oil exporter, Guyana, lost $55 billion from its deal with. (2/4)

The US oil rig count crept up by 1 rig to 676 last week, Baker Hughes reported. Active gas rigs slipped by 1 to 111. The total oil and gas rig count has fallen by 259 over the last year to 787. (2/8)

S&P ratings downgraded six U.S. shale gas companies that might find it difficult to refinance billions in debt on the back of chronically low gas prices and overinvestment, S&P Global Platts reports. The companies include EQT, Range Resources, Antero Resources, Ascent Resources Utica Holdings, CNX Resources, and Gulfport Energy. (2/6)

Ten U.S. oil refineries, including six in Texas, released the cancer-causing chemical benzene in concentrations that exceeded federal limits last year, according to government data published by the green group Environmental Integrity Project on Thursday. The study is based on the first full year of data reported by U.S. refineries since a U.S. Environmental Protection Agency rule was implemented in 2018. (2/6)

Exxon reported a drop in profits on Friday for the fourth quarter, weighed down by a deterioration in nearly every segment. Oil prices were weak, natural gas prices fell sharply, while profit margins for refining and petrochemicals also deteriorated. Exxon’s share price is also at its lowest point in a decade. (2/4)

Rescinding protection #1: The Trump administration on Thursday finalized plans to allow mining and energy drilling on nearly a million acres of land in southern Utah that had once been protected as part of a major national monument. The Interior Department’s release of a formal land-use blueprint for the approximately 861,974 acres of land will allow oil, gas and coal companies to complete the legal process for leasing mines and wells on land that had once been part of Utah’s Grand Staircase-Escalante National Monument, established by President Bill Clinton. (2/8)

Colorado stiffed: The Bureau of Land Management’s (BLM) Washington office ignored the advice of its Colorado staff, deciding to expand oil and gas drilling in the southwest corner of the state because earlier plans were “not in line with the administration’s direction to decrease regulatory burden and increase access.” (2/8)

SUV sales grow: The war on climate change is on, but the world’s utility-vehicle-gas-guzzling habit is preventing green measures from making enough headway. SUV sales across the globe last year reached a total of 42 percent of all car sales, according to the IEA. These vehicles emit 25 percent more carbon dioxide than smaller cars. (2/6)

The auto industry—more polarized than ever—is now facing a confrontation that could last for years, leaving it in a costly limbo. The Trump administration in the coming weeks is expected to finalize new fuel-economy rules that significantly dial back the targets adopted under President Obama. Mr. Trump’s legal fight with California, the state that is the U.S. auto industry’s biggest market and which is fighting to maintain the standards, is expected to be bitter and drawn-out. (2/4)

UK pushing EVs: Britain will ban the sale of new petrol, diesel and hybrid cars from 2035, five years earlier than planned, in an attempt to reduce air pollution that could herald the end of over a century of reliance on the internal combustion engine. (2/4)

US metallurgical coal exports totaled 50 million mt in 2019, down 10.4% from 2018, according to data issued Wednesday by the US Census. It was the lowest since 2016. Exports of US bituminous coal totaled 28.1 million mt in 2019, down 33% from 2018. It was also the lowest annual total since 2016. Total US coal exports in 2019 were at 84.2 million mt, down 19.7% from 2019. (2/6)

Coal’s steady slide: January 2020 began with two coal-fired generators in Montana shutting down for good. A few days later, a subsidiary of billionaire investor Warren Buffett’s Berkshire Hathaway committed to closing a coal unit in Arizona this year. The same week, an electric cooperative based in Colorado also pledged to shutter a New Mexico coal plant by the end of 2020. Two weeks after that, Arizona’s biggest utility promised to retire its last coal plant seven years ahead of schedule. (2/6)

Undercutting coal: The world’s leading central banks should purge coal-related assets from their balance sheets and set rules discouraging the financial system from financing polluting industries, according to the New Economics Foundation. (2/6)

Japan’s new coal surge: Beside Tokyo Bay, a behemoth from a bygone era will soon rise: a coal-burning power plant, part of a buildup of coal power that is unheard-of for an advanced economy. It is one unintended consequence of the Fukushima nuclear disaster almost a decade ago, which forced Japan to all but close its nuclear power program. Japan now plans to build as many as 22 new coal-burning power plants at 17 different sites in the next five years. (2/5)

Russian coal: Russia has been historically associated with oil and gas exports, yet the news somewhat underreports its coal market presence. Although neither the world’s largest coal producer nor exporter, Russia seems to continue with its strategic aim to ramp up coal exports, all the while domestic carbon demand is about to plummet. (2/7)

Yucca mtn. nuke storage: President Trump with one single tweet appeared to reverse his administration’s support of entombing dangerous radioactive material under the Yucca mountain. Just nine months away from the 2020 election, Trump tweeted that he opposed the nuclear waste repository in the remote highlands of Nevada, a state Republicans hope to turn red after years of trending toward Democrats. (2/8)

Japan’s nuke issue: A panel of experts advising Japan’s government on a disposal method for the millions of tons of radioactive water from the destroyed Fukushima nuclear plant on Friday recommended releasing it into the ocean. The recommendation will draw extreme pushback from environmental groups. (2/3)

The U.S. wind power industry recorded its third record-breaking installation year in a row during 2019, with new wind capacity hitting 9.14 GW. To date, there are another 44 GW under construction or in advanced development. Yet there are clouds on the horizon: competition from gas and solar, and the phase-out of the production tax credit that has driven the industry’s growth until now. (2/7)

All-electric push: When Berkeley, Calif., became the first city in the country to ban natural gas hookups in new construction last July, no one knew the effects would ripple out so far and so fast. The Berkeley ban was part of an effort to wean developers off buildings that consume fossil fuels, a cause of global warming, and promote cleaner electric power. And it spurred other communities in the state to enact ordinances to encourage all-electric construction. The effort has spread to other parts of the country. (2/6)

Road to carbon neutral: Lawrence Livermore National Laboratory (LLNL) scientists have identified a suite of technologies to help California to become carbon-neutral—and ultimately carbon-negative —by 2045. To achieve the goal of carbon-neutrality, California will likely have to remove on the order of 125 million tons per year of CO 2 from the atmosphere. (2/3)

Global investors are leaving hydrocarbons companies, shifting investment away from the traditional energy sector and into renewables. This move represents a big problem for energy groups such as Exxon, BP and Saudi Aramco. Vast swaths of their oil, gas and coal reserves may never be extracted and burnt because doing so would intensify global warming, worsening freak weather events and threatening the loss of farmland and huge population displacement. That could leave them with large numbers of what are known as “stranded assets”. (2/4)

Advisor hits fossil fuel investment: Chevron and ExxonMobil had just announced fourth quarter results, which saw profits drop again. Their stock prices were down by 2 percent or so. It didn’t matter. CNBC’s investment advisor Jim Cramer wanted to make a larger point. “We’re starting to see divestment all over the world. We’re starting to see big pension funds say, ‘listen, we’re not going to own them anymore.’ The world’s changed. There are new managers.” (2/3)

Antarctica has logged its hottest temperature on record, with an Argentinian research station thermometer reading 18.3C, beating the previous record by 0.8C. The reading, taken at Esperanza on the northern tip of the continent’s peninsula, beats Antarctica’s previous record of 17.5C, set in March 2015. The station’s data goes back to 1961. (2/8)

Much of Australia’s wildfire-ravaged east coast was drenched on Friday by the biggest rainfall in almost 20 years, dousing some of the most dangerous blazes and providing welcome relief to farmers battling an extended drought. The downpour came with its own risks – officials warned of flash floods and landslides across New South Wales (NSW), Australia’s most populous stat. (2/8)

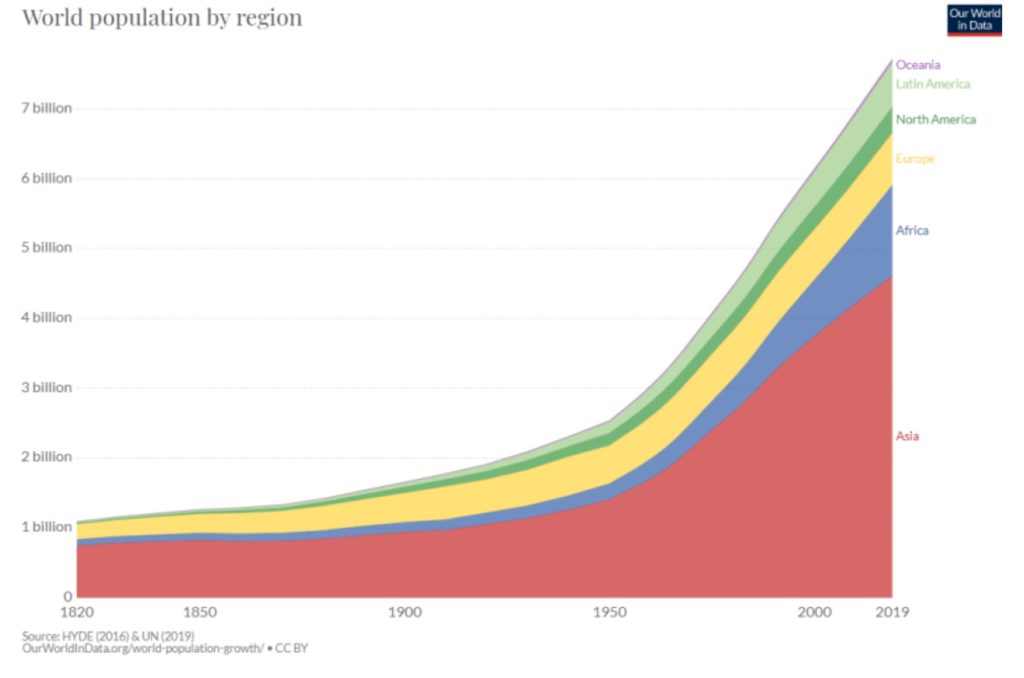

The human population on Earth has nearly tripled since 1950. In 2015, 76.5% of this global population is accounted in settlements of the urban domain (5.6 billion people). This is up from 69% in 1975. (2/8)

Japan has deployed a warship to critical oil shipping lanes in the Middle East, and has authorized use of force for those ships. The decision to authorize force in order to protect ships in danger is a controversial one, according to Reuters, because Japan’s constitution forbids the use of military force in international disputes. But the situation is a dire one, with 90% of all of Japan’s oil coming from the Middle East. (2/4)