Editors: Tom Whipple, Steve Andrews

Quote of the Week

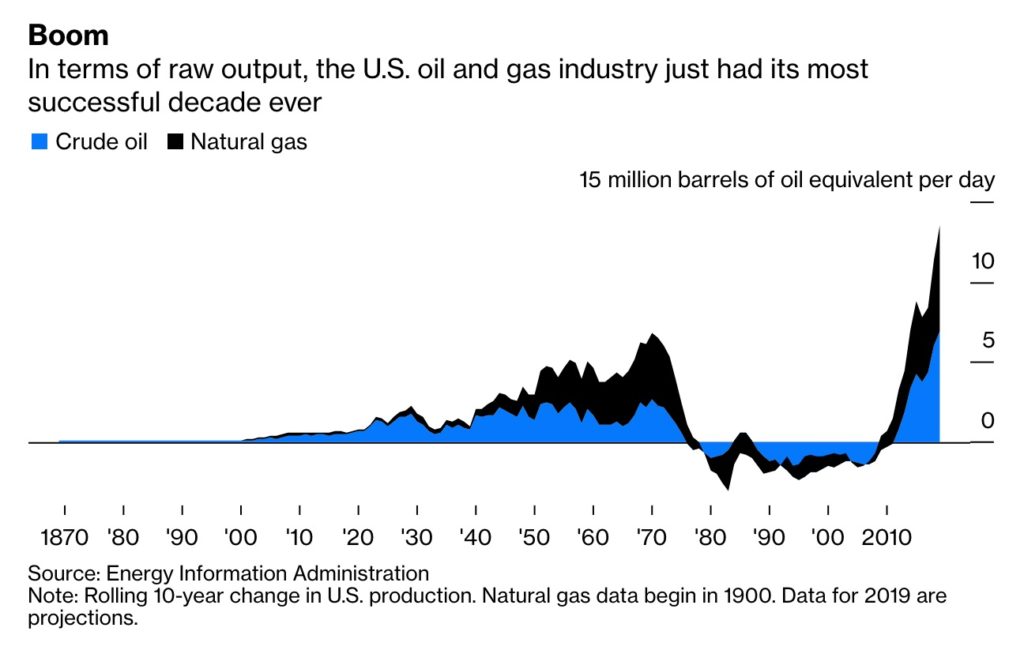

“In terms of raw output, the US oil and gas industry just had its best decade ever…The resurgence in US oil and gas production over the past decade coincides with a collapse in the industry’s financial performance.…Kimmeridge Energy Management Co. estimates that while the industry’s oil output grew at roughly 10 percent a year, compounded, in the decade through 2018, the vast majority of that was funded by third-party capital. Purely self-funded growth would have averaged less than 3 percent a year.”

Liam Denning, Bloomberg opinion

Graphic of the Week

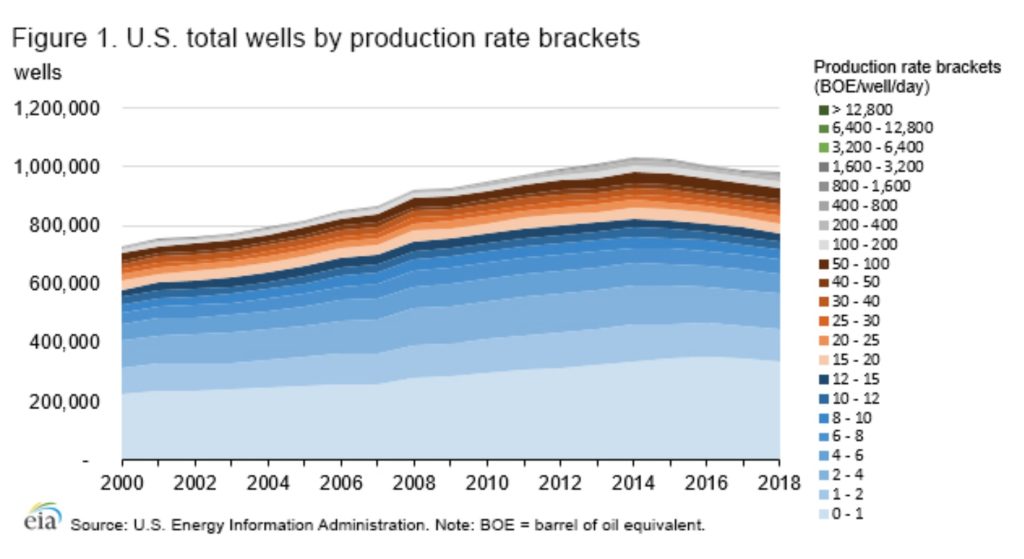

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and trade wars 5. Briefs 1. Energy prices and production Oil prices rose for the fourth consecutive weekly gain last week, steadying at three-month highs. At the close Friday, Brent was at $68.15 and WTI at 62.72 after the EIA reported an inventory draw of 5.5 million barrels for the week ending December 20 in the last weekly petroleum status report for 2019. Gasoline inventories were up by 2 million barrels in the week to December 20, compared with a build of 2.5 million barrels for the previous week. Distillate fuel inventories declined by 200,000 barrels. Oil prices are now 30 percent higher than they were at the start of the year, and investors are more bullish than they have been in months. In the years ahead, 2019 could go down in the history books as a pivotal year in the energy transition. It was the year in which the hype around US shale finally burst, as debt-driven production growth finally lost its luster. Coal has fared even worse. Climate change became increasingly top-of-mind for the energy sector as well, even as governments continue their futile efforts to deal with carbon emissions. Oil and gas companies have paid lip service to climate action but are mostly just trying to stave off the backlash as they continue to search for new reserves. The big change has been the shift in the capital markets as investors are beginning to sour on fossil fuel stocks as they eye the clean energy transition that is currently underway. Big banks are starting to make a shift, although to date it is very little. Goldman Sachs recently announced a policy shift, ruling out new financing for coal and Arctic oil. That makes it one of the more progressive banks in the US, even as it keeps the spigots open for most other types of fossil fuel extraction. As Bloomberg points out, “the steps Goldman and other big banks are taking can also be seen as minuscule compared with the $1.9 trillion in financing they’re estimated to have extended to the fossil-fuel industry in the three years following the 2015 signing of the Paris climate accords.” America’s top shale field, the Permian Basin, is becoming increasingly gassy as drilling there slows down. This undercuts profits for producers at a time when investors are demanding better returns. Natural gas has long been a nuisance in the Permian, where a massive amount of gas that comes with the oil weighs on prices. Crude producers sometimes have to pay to get it hauled away or burn it off. Now the problem is intensifying as wells age and fewer new wells are drilled. A new EIA report shows US oil production reached 12.04 million b/d and US natural gas gross withdrawals reached 108.56 billion cf/d in December 2018. The number of producing wells in the US increased from 729,000 in 2000 to a high of 1,035,000 wells in 2014, then declined to 982,000 wells in 2018 because of lower oil prices. The increase in the share of horizontal wells during the past decade rose from 3 percent to 14 percent between 2008–2018. Most US oil and natural gas production come from wells that produce between 100 barrels of oil equivalent per day and 3,200 boe/d. The share of US oil and natural gas wells producing less than 15 boe/d has remained surprisingly steady at about 80 percent from 2000 through 2018. |

There are many factors to watch that could affect oil markets next year. Independent energy analyst David Blackmon has summed up some predictions and concerns for Forbes.

1. US shale oil production will continue to grow but at a slower pace.

US shale growth is slowing down, but all analysts and organizations still expect oil supply from the US to continue to rise in 2020.

2. The US Rig count will remain stable.

However, the US oil and gas rig count declined by more than 250 units this year. The linkage between the number of working rigs and production levels is becoming weaker as the use of rigs becomes more efficient.

3. US oil and LNG exports will continue to rise.

Exports are expected to grow with the increase in infrastructure inn 2020, especially pipeline capacity to the Gulf Coast.

4. Oil and gas prices will remain range-bound in 2020.

Rising production from non-OPEC nations not part of the OPEC+ deal, driven by the US, Brazil, and Norway, is expected to keep a lid on oil prices, while OPEC+ cuts and an expected pick-up in global economic and oil demand growth could keep a floor under prices.

5. Sudden supply outages will have smaller impact on oil prices.

Due to the growing non-OPEC supply, unexpected and short-lived outages are likely to have a smaller impact on oil prices than they would have on markets five or ten years ago.

6. Bankruptcies in the US shale patch are set to grow.

7. US oil and gas mergers & acquisitions are poised to rise.

8. How oil demand growth will fareas the U.S.-China trade dispute de-escalates.

9. How OPEC+ cooperation will proceed after March 2020.

What will OPEC and its Russia-led non-OPEC partners will do after March 2020, when the current agreement for deeper cuts expires? Moscow has already said that it might consider ending their oil output curtailment deal next year in order to preserve market share and implement projects.

10. Supply outages in restive regions

Developments in Libya and Iraq, however. could suddenly tighten the market more than anyone had expected.

2. Geopolitical instability

Baghdad has continued to reduce its oil production as it moves closer to compliance with an OPEC agreement designed to bolster global oil prices. The federal government and the autonomous Kurdistan Regional Government produced a combined 4.71 million b/d in October and 4.69 million in November, according to an analysis based on data collected from each of the country’s producing fields.

In the meantime, Iraq’s domestic troubles continue to grow worse. In addition to not having a prime minister, Iraqi President Salih refused on Thursday to designate the nominee of an Iran-backed parliamentary bloc for prime minister. The Bina bloc, led by Iran-backed militia leader Hadi al-Amiri, had nominated Basra Governor al-Edani to be the next prime minister following weeks of political deadlock. President Salih said that appointing Edani would not placate protesters demanding an independent prime minister with no party affiliation. Salih said that because the constitution does not give him the right to reject nominees for the premiership, he was ready to quit.

The President’s resignation would only complicate the deadlock, as lawmakers must first choose a replacement for him, and that person must then nominate a premier. According to the constitution, the speaker of parliament will first resume the presidency on an interim basis. Mass protests have gripped Iraq since Oct. 1, and the mostly young protesters are demanding an overhaul of a system they see as profoundly corrupt and as keeping most Iraqis in poverty. More than 450 people have been killed. Over the weekend, protesters forced the shutdown of the 82,000 b/d Nassiriya oil field.

Hundreds and perhaps thousands of ISIS fighters have made their way into the sparsely populated territory spanning the disputed border with Kurdistan, which is off-limits to Kurdish and Iraqi security forces. The region has attracted the largest concentration of ISIS fighters since the last village held by the caliphate in eastern Syria was overrun last March.

On Tuesday, there was a suspected Islamic State group attack on a vulnerable well of the Khabbaz oil field, 15 miles southwest of Kirkuk. This attack is the latest in a series of increasingly frequent and successful operations by the ISIS group on oil-rich areas in northern Iraq, where they have taken advantage of a security vacuum during the protests further south.

Iranian proxy militias are thought to be smuggling crude from western Iraq to Syria, picking up a lucrative business left behind by the Islamic State. The groups, allegedly linked to the Iranian Revolutionary Guard Corps, may have gained access to a handful of oil fields and refineries in Iraq and Syria, using the fuel and proceeds from sales to the local population to fund their activities. “Every week tankers are entering from Iraq loaded with oil — between 30-40,” said a source who lives along the main supply road in Syria.

Turkey will send troops to Libya at the request of the Tripoli government as soon as next month, President Erdogan said on Thursday, thus putting the North African country’s conflict at the center of broader regional confrontations. Libya’s internationally recognized Government of National Accord in Tripoli has been struggling to fend off General Khalifa Haftar’s forces, which have been supported by Russia, Egypt, the United Arab Emirates, and Jordan.

An official in Tripoli confirmed a formal request had been made for Turkish military support in the air, on the ground and at sea. In the deepening proxy war, Turkey aims to send its Navy to protect Tripoli, while its troops train and coordinate Tripoli’s forces according to a senior Turkish official. Turkey recently signed a maritime deal with Libya that serves the energy interests of both countries and aims to salvage billions of dollars of business contracts thrown into limbo by the conflict.

The Libyan government had initially resisted the idea of a Turkish troop deployment but eventually accepted it as Haftar’s forces continue to advance on Tripoli, a Libyan official said. With Egypt and the United Arab Emirates aiding Haftar, Turkey’s deeper involvement in Tripoli could complicate international efforts to end the turmoil that has gripped the country since the overthrow of strongman Moammar Qaddafi in 2011.

The eastern-based Libyan National Army force said earlier last week it had monitored a Boeing 747 that had flown from Istanbul to Libya carrying military equipment. LNA spokesman Ahmed Mismari warned other carriers against transporting weapons using civilian planes, adding that “the army will down and strike any plane” that carries weapons.

3. Climate change

This year is likely to go down in the books as the warmest year on record in Alaska. Anchorage hit 90 degrees for the first time. The city also measured its highest humidity. Arctic permafrost and sea ice are melting at alarming rates. The North Slope’s landscape is changing before the inhabitants’ eyes. But to round out 2019, the weather will take an auspiciously timed abrupt turn — switching gears from record highs to extreme cold. The frigid blast may linger for seven to 10 days before easing by the first weekend of the new year.

The melting of the polar ice cap is disrupting the polar jet stream, which usually contains the frigid arctic air well to the north. The shift in the jet stream is resulting in abnormally low temperatures in parts of the northern hemisphere despite the slow warming of the planet.

The brush fires in Australia were the top climate-related story last week now that the UN climate change conference has adjourned for another year. Australian authorities say they are focused on protecting water supply plants, pumping stations, pipes, and other infrastructure from the brushfires surrounding Sydney, the country’s largest city. Firefighters battling the blazes for weeks received a reprieve of slightly cooler, damper conditions over Christmas, but the respite is not expected to last long. Temperatures in New South Wales state are forecast to head back towards 104-degree F. this week. Fires are approaching the Warragamba Dam, which provides water to about 80 percent of Sydney’s 5 million residents.

In the US, a bipartisan group of Northeastern and Mid-Atlantic states has released a draft plan to curb emissions from gasoline and diesel over the next decade and beyond. More than a year in the making, the program released this month marks a crucial step in an ambitious effort to cut the emissions from vehicles. Backers of the plan, which could launch as early as two years from now, cited health and economic analyses showing broad benefits — even beyond preventing the burning of fossil fuels that would release millions of metric tons of carbon dioxide into the atmosphere.

4. The global economy and trade wars

Gold prices rose and an index of global equity markets hit an all-time high last week as a year-end rally on Wall Street increased optimism over a U.S.-China trade agreement. Oil rose to three-month highs, buoyed by a report showing lower US crude inventories, hopes the pending Sino-US trade deal will soon be signed, and efforts by OPEC to curb crude supply.

US unemployment continues to fall, and wages are starting to climb in the wake of labor shortages. US consumer purchases had a banner year as on-line shopping set a record. The Chinese cabinet approved a plan to lower tariffs for all trading partners on more than 859 types of products to below the rates that most-favored nations enjoy.

The only dark spot on the horizon for the US economy is the report that US durable goods orders fell in November – mainly because of a decline in orders for military equipment, which fell 35 percent. However, through eleven months this year, durable goods orders were up 0.7 percent from the same period in 2018. The Dallas office of the Federal Reserve is worried about the outlook next year for shale oil in its region.

With Brexit coming soon, strikes in France, and Germany’s growth slowing, the outlook for the European economy is uncertain.

The prospects for China and its insatiable demand for oil are the great unknown. China’s top five oil suppliers — Saudi Arabia, Russia, Iraq, Brazil, and Oman — each delivered record high volumes of crude to China in November, propelling the crude import volume to a new high of 11.18 million b/d. Much of this crude is going to oil products exports and does not reflect domestic demand.

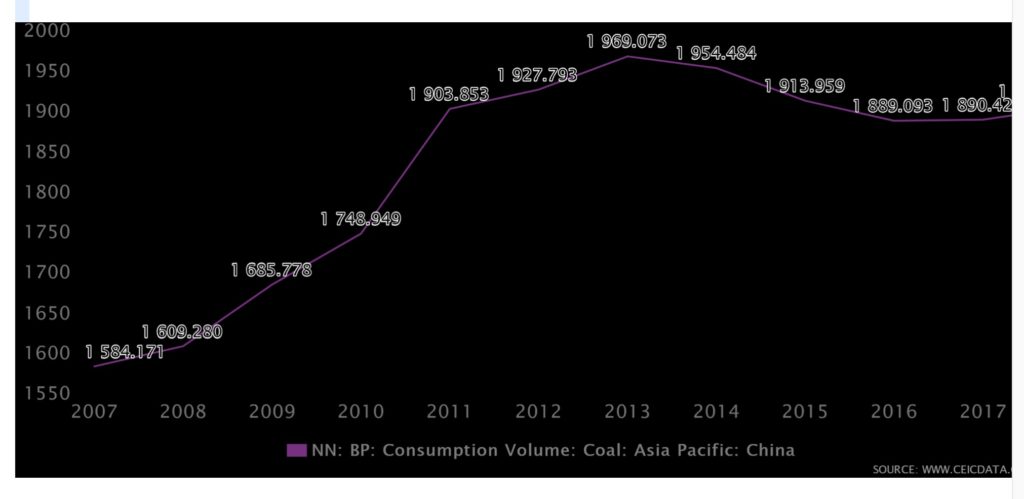

China’s coal consumption is back near peak levels after rebounding over the past three years. This increase comes despite China’s pledges to make steep cuts in what is the country’s most common and polluting source of energy. The country is building more coal-fired plant capacity than the rest of the world combined.

Profits at China’s industrial firms grew at the fastest pace in eight months in November, but weakness in domestic demand remains a risk for company earnings next year. China’s industrial sector has faced persistent pressure in the past year, with manufacturers battling sluggish demand and the trade dispute with the US. However, recent factory activity surveys have pointed to a modest recovery in the manufacturing sector, following Beijing’s accelerated stimulus measures to steady growth.

China’s state planner announced last week it had approved a high-speed railway project worth $10.34 billion in the northeastern provinces of Liaoning and Jilin. It also approved two railway projects linking cities in Inner Mongolia and Ningxia regions, and the NDRC approved an airport project in southern Jiangxi province. The problem, however, with Beijing’s reliance on public works projects in times of financial difficulties, is that the bills soon become due.

For decades, local governments in China borrowed heavily to build urban infrastructure growth. Now, they are under pressure to pay the bill, adding another financial worry to the Chinese policymakers’ list. Independent economists estimate that China’s municipalities have racked up more than $6 trillion in debt—including debts authorities don’t acknowledge on their books. It has become nearly impossible for local governments to tap riskier lending channels. Beijing’s efforts to rein in overall debt has meant new restrictions on informal lending.

Corporate defaults in China surged to a record high of $18 billion in 2019, raising new questions over how policymakers in Beijing will manage mounting financial distress among large private and state-owned companies.

5. The Briefs (date of the article in the Peak Oil News is in parentheses)

Nord Stream 2 holdup: Switzerland-based Allseas — which has been integral to laying the controversial Nord Stream 2 gas pipeline from Russia to Germany — has suspended pipelaying activity after President Donald Trump signed new sanctions into law. The move by Allseas will undoubtedly mean further delays to the completion of the 55 Bcm/year pipeline, which had been initially scheduled to start operations at the end of 2019. (12/23)

Russia can finish the construction of the Nord Stream 2 gas pipeline to Germany within a couple of months, Russian Energy Minister Alexander Novak said last week. That undercuts sanctions imposed by President Trump last week on the pipeline designed by Moscow to bypass Ukraine. (12/26)

In France, shortages of oil products have started mounting as strikes at most French refineries entered their fourth week resulting in increased imports of diesel and gasoil. (12/28)

Saudis Arabia and Kuwait are nearing the end to their spat over their shared oil field called the Neutral Zone. The deal could still fall through at the last minute, and the two countries, which reached a preliminary agreement in October, are unlikely to restart production immediately. The return would be gradual and would be offset by output reductions in other oil fields to comply with cuts agreed upon with other producers. (12/24)

Oman: With a fiscal breakeven oil price of $87.55 per barrel of Brent in 2020 and 80 percent of its revenues still coming directly or indirectly from the hydrocarbons sector, Oman is looking at all options to raise money for critical projects related to its preferred source of hydrocarbons income, the high value-added petrochemicals sector. (12/25)

India will surpass China to become the world’s largest energy growth driver by 2030, India’s Oil Minister Dharmendra Pradhan said at a conference on Friday. He said India is on its way to become the world’s largest energy consumer while noting that India plans to use a combination of conventional fuel and sustainable fuels to create a “balanced energy mix.” (12/23)

Japanese refiners may have little option but to increase the ratio of lighter crude oil it purchases in 2020 as the global supply of heavy crude is expected to remain tight, industry officials and market sources in Tokyo said. Market participants have been voicing their concerns over the tight, heavy crude supply triggered by US sanctions on Iran and Venezuela, and the industry’s woes deepened after additional supply cuts, to take effect in January, were announced by OPEC and non-OPEC producers. (12/24)

Suriname: Apache Corp. and French Total have struck a deal to explore for oil offshore Suriname jointly. Each will have 50 percent in the venture, with Apache leading as operator of the first three exploration wells and then transferring the operatorship to the French supermajor. Apache had been conducting exploration work off the Suriname coast on its own, but results have been unsatisfactory. With a partner, it would now receive much-needed financial help, including $5 billion in cash carry for its first $7.5 billion of capital for appraisal and development of Block 58. (12/24)

Brazil’s crude oil production in November topped 3 million b/d for the first time, the National Petroleum Agency reported, adding that total oil and gas production rose to 3.95 million barrels of oil equivalent daily – also a record-breaking figure. The strong output result came on the back of the ongoing ramp-up of production at eight new floating production, storage, and offloading facilities. (12/25)

Argentina is suffering from growing pains as it seeks to become a significant oil and natural gas player. Argentina has the world’s second-largest shale gas resources and the fourth in shale oil. It is one of only four countries to put shale into mass-scale production along with Canada, China, and the US. Vaca Muerta has surged from zero output in 2012-13 to more than 100,000 b/d of oil and 35 million cubic m/d of gas at the end of 2019, with still less than 10 percent of the play in full-scale development. (12/27)

The final weekly US oil rig count for 2019 decreased by 8 to 680, down by 207 for the year, according to Baker Hughes. The gas rig count stayed flat at 125, down from 198 one year ago. The combined count declined by 278 to 805—a decrease of nearly 26 percent. The Permian basin, with 405 rigs, has over half the active rigs in the US. Despite the decline in the oil rig count, production has grown from 11.7 million b/d at the beginning of the year to 12.8 million last week, according to preliminary EIA data. (12/28)

GOM record: 2020 is expected to be another record year for the region with average production above 1.9 million b/d. Despite a massive downturn in investment in the US Federal Gulf of Mexico (GOM), industry experts are anticipating that 2020 will be yet another record year. This would be an additional 100,000 barrels a day above 2019 production. (12/27)

Natural gas bans: The year 2020 could reveal whether a smattering of municipal bans on new natural gas hookups for buildings becomes a more widespread movement tied to de-carbonization efforts around the country. Partly at stake for the natural gas sector is maintaining its share in the residential-commercial market. The res-comm sector makes up about 26 percent of US gas demand, according to S&P Global Platts Analytics.

US coal-fired power generation totaled 66.9 TWh in October, EIA data showed Monday, a year-on-year decrease of 23.6 percent, the largest such decline since March 2016. (12/24)

Japan’s nuclear problem: Japan’s government is considering releasing tainted water from the Fukushima nuclear power plant destroyed by a tsunami’s waves, according to Prime Minister Shinzo Abe’s cabinet and the Tokyo Electric Power Company — the operator of the Fukushima Daiichi plant, where a triple meltdown led to the worst nuclear crisis since Chernobyl. The government must decide what to do with more than one million tons of contaminated water stored in about 1000 giant tanks on the plant site. (12/23)

The American love affair with driving is cooling in ways that are changing how cities look and feel. Over the past three years, the average number of miles driven per person has hovered around 9,800 miles a year, roughly 2 percent fewer than at the 2004 peak. Driving is down in states with urban centers like California and New York and some rural states such as Wyoming and Vermont. Among the reasons for the national decline are migration to dense urban areas; young adults’ preference to live close to their jobs or to use alternate modes of transportation; more online working, shopping and streaming; and a growing population of retirees who don’t commute to jobs anymore. (12/25)

Volkswagen said on Friday that it would reach a key target in the production of electric autos earlier than previously anticipated. VW will have produced one million electric vehicles by the end of 2023, two years ahead of schedule. (12/27)

EV buses: Hartsfield-Jackson Atlanta International Airport has added two BYD battery-electric buses. The vehicles carry 22 passengers and luggage; the vehicles they replaced only carried 14 passengers. Atlanta is one of three airports—with Kansas and Los Angeles—to purchase BYD buses. (12/24)

In China, US electric vehicle maker Tesla will begin delivering Model 3 vehicles built at its Shanghai factory on Monday; a company representative told Reuters. Construction of its first plant outside the United States began in January, and production started in October. It aims to produce 250,000 vehicles a year after the production of the Model Y is added in the initial phase. (12/27)

US electric vehicle maker Tesla and a group of China banks have agreed on a new $1.4 billion, five-year loan facility for the automaker’s Shanghai car plant, three sources familiar with the matter said, part of which will be used to roll over an existing loan. (12/23)

The government of New Delhi, India’s capital city, on Monday approved an electric vehicle policy aimed at combating air pollution that is projected to lower demand for transportation fuels, both oil and gas, in the coming years if implemented successfully. The Delhi Electric Vehicle Policy 2019 comes shortly after the city was engulfed by heavy pollution that shut schools and affected everyday life and at a time when India’s car sales have been falling due to a slowing economy. (12/24)

The Government of Sweden has launched a study to offer proposals on how to implement a ban on sales of new gasoline and diesel cars, and the timeline for the phase-out of fossil fuels. The final report is to be presented by 1 February 2021. (12/26)

Turkey unveiled its first entirely domestically produced car on Friday, saying it aimed to eventually produce up to 175,000 a year of the electric vehicle in a project expected to cost $3.7 billion over 13 years. The project has been a long-time goal of President Tayyip Erdogan and his ruling AK Party as a demonstration of the country’s growing economic power. Turkey already exports to Europe cars made domestically by firms such as Ford, Fiat Chrysler, Renault, Toyota, and Hyundai. (12/28)

Seven Danish companies were awarded funding of $5 million for the H2RES project. The partners will build a 2MW electrolysis plant with appurtenant hydrogen storage. The plant will use electricity from offshore wind turbines to produce renewable hydrogen for buses, trucks, and potentially taxis. (12/24)

New methods of testing and simulating air quality should be considered to help policymakers have a more accurate understanding of how emissions affect air pollution levels, new research suggests. (12/26)

China’s exports of rare earth magnets to the United States fell 21.2 percent month-on-month, customs data showed on Wednesday, as improving trade relations between the two countries reduced demand for stockpiling. (12/25)